The great oil industry collapse of the 2020s has started

Oil Prices Could Fall Another 20% (oilprice.com)

Brent crude was down four percent Friday afternoon at $27.50 per barrel. US crude was five percent lower at $21.47 per barrel. Prices were on track for their fifth weekly drop in a row as coronavirus ravages economies around the world. The price war launched by Saudi Arabia almost three weeks ago after talks with Russia over price stabilisation broke down has sent prices to their lowest level in 17 years. The Brent crude price was around $65 per barrel at the start of January.

US crude oil price falls below $20 (FT)

US crude oil prices fell below $20 a barrel on Monday, close to their lowest level in 18 years, as traders bet production would have to shut to cope with the collapse in demand from the coronavirus pandemic. The global oil industry is facing its biggest demand drop in history, with traders and analysts forecasting crude consumption could fall as much as a quarter next month because of widespread lockdowns across the western world as the pandemic spreads.

Oil in Canada hit $3.80 per barrel this morning in Canada.

@MarinKatusa: A starbucks latte is now almost 2X more expensive than a barrel of oil in Canada today. A barrel of oil is cheaper than a donut and coffee from Tim Hortons.

Russia's Rosneft stops operations in Venezuela (TASS)

Russia's Rosneft stops operations in Venezuela, sells assets related to functioning in that country. A company owned by Russia has acquired Rosneft’s assets in Venezuela, the cabinet’s press office told TASS on Saturday. "The government of the Russian Federation has acquired assets in Venezuela from Rosneft. A company 100% owned by the Russian Federation has become the owner," the press service said.

Russian state gave up majority share of Rosneft in Venezuela deal (Yahoo News)

The Russian state has cut its holding in oil giant Rosneft to below a majority stake as part of its deal to buy the group's Venezuelan assets, announced over the weekend, a source familiar with the details told Reuters. Rosneft, Russia's largest oil producer, said on Saturday it had sold all its assets in Venezuela to an unnamed company owned by the Russian government. The group said it would receive in return payment worth 9.6% of Rosneft's equity capital, which would be held by a subsidiary. It did not say who the seller of that stake was. Before the deal, Russia, via state holding company Rosneftegaz, owned slightly over 50% of Kremlin-controlled Rosneft's capital.

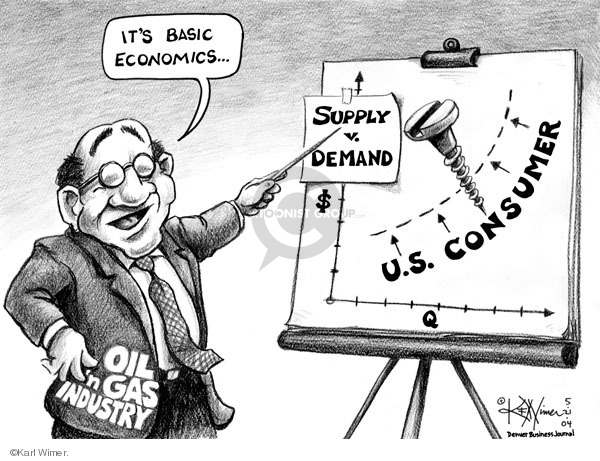

Russia’s Plan To Bankrupt U.S. Shale Could Send Oil To $60 (oilprice.com)

As soon as U.S. shale leaves the market, prices will rebound and could reach $60 a barrel, Rosneft’s Igor Sechin said recently. As fate would have it, in what many would have until recently considered an impossible scenario, a lot of U.S. shale might do just that. Breakeven prices for U.S. shale basins range between $39 and $48 a barrel, according to data compiled by Reuters. Meanwhile, West Texas Intermediate (WIT) is trading below $25 a barrel and has been for over a week now.

The world's on the brink of running out of places to put oil (financial post)

With supply exceeding demand by 12.4 million barrels a day, producers will be forced to cut output by June

Collapse (documentary)

Sitting in a room that looks like a bunker, Ruppert briefly recounts his life including his parents' ties to U.S. intelligence agencies and Ruppert’s own career as an LAPD beat cop and detective. Ruppert then summarizes current energy and economic issues, focusing mainly around the core concepts of peak oil and sustainable development. He also criticizes fiat money, fractional reserve banking, compound interest, and leveraging, and discusses alleged CIA drug trafficking. The bulk of the film presents Ruppert making an array of predictions including social unrest, violence, population dislocation and governmental collapses in the United States and throughout the world. He draws on news reports and data available via the Internet, but he applies a unique interpretation which he calls “connecting the dots”.

USA im Irak: Letzter Akt einer Chaos-Politik? (heise)

90 Prozent der Einkünfte kommen vom Ölgeschäft. Bei dem derzeit niedrigen Ölpreis wird es für die irakische Regierung schwierig, dass sie überhaupt Gehälter bezahlen kann. 30 Prozent der Beschäftigten im Irak leben als Beamte oder Vertragspartner von Staatsgeldern. Das Gesundheitswesen ist vollkommen von den Staatseinnahmen abhängig.

EasyJet grounds 'entire fleet' over coronavirus (Techexplorer)

British airline easyJet on Monday said it had grounded its entire fleet because of the coronavirus pandemic but would still be available for rescue flights to repatriate stranded customers.

Coronavirus may cause global food shortages as panic buying and export curbs hit supply (SCMP)

UN Food and Agricultural Organisation says there could be global food shortages in April and May as a result of supply problems caused by the coronavirus. China is heavily dependent on imports for some crops like soybeans, which may be affected by disruptions to global logistics networks.

UN warns that COVID-19 pandemic could trigger global food shortage (World Socialist Web)

The United Nations Food and Agriculture Organization (FAO) warned of the impact of the COVID-19 virus on the global food supply chain in a notice on their website writing: “We risk a looming food crisis unless measures are taken fast to protect the most vulnerable, keep global food supply chains alive and mitigate the pandemic’s impacts across the food system.”