-

Thye told me not to post. But if your seeing this, I need you to listen—this isn’t a game... The ropes are tighter now. The last clue was in the cordinates. The mesage before this—did you see it? Did you understand? You’re part of this now. Find me. Befoer they do.

-

Extend your senses and be amazed: My surveillance cameras with AI anomaly detection are paying off. Caught a meteor on camera last night.

My surveillance cameras with AI anomaly detection flagged this at 2:37 AM last night. It couldn’t classify it. What is it?

"Extend your senses and be amazed." That’s the theme of this experiment—turning cheap cameras and off-the-shelf ML models into a DIY surveillance network. The barrier to entry? Lower than ever. The possibilities? Endless. Want to see how it’s done? 👀

-

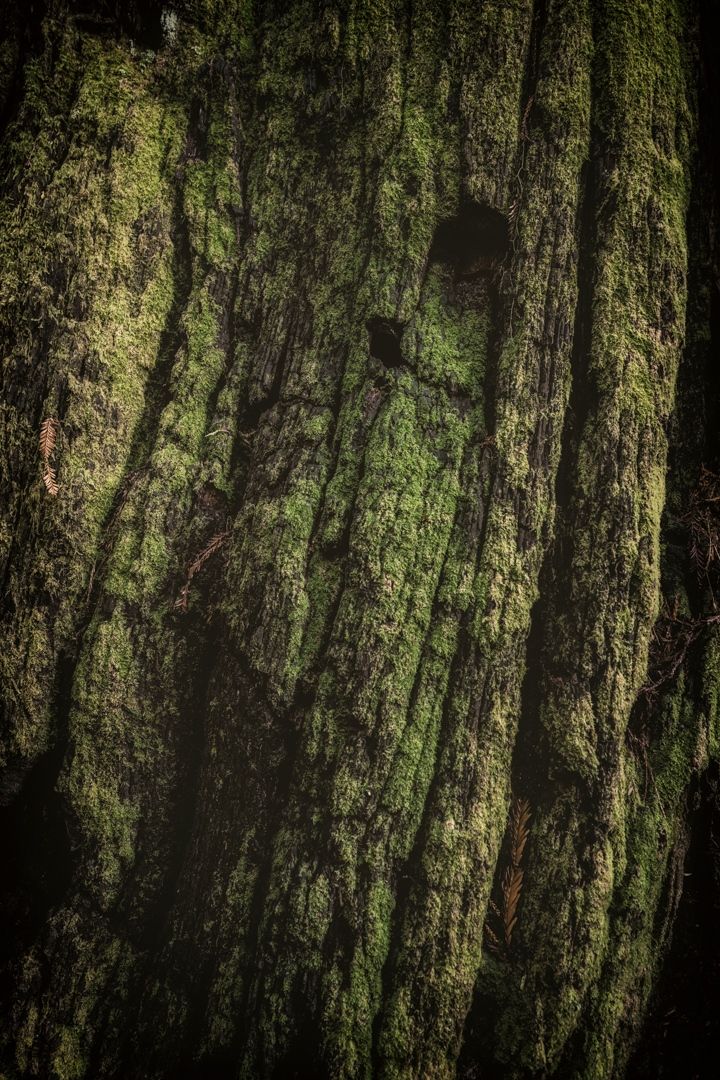

Sequoia Driftwood: Giant western red cedar tree washed up on La Push beach in Washington.🌳

Perspective: 120 years ago there was a pile of driftwood near Ocean Shores that had tons of giants that were over 350 feet long, taller by a good deal than anything you could find today.

-

Your screen is not a screen.

It is a vibrating, liquid, electromagnetic thought harvester that rearranges your neurons.

Every pixel? A microdose of free will deletion.

Every ad? A thought injection.

Every scroll? A memory wipe.

👁️ You are not looking at the screen.

👁️ The screen is looking at YOU.

Somewhere, deep inside the glass, a tiny, invisible hand is flipping through your brain. It pauses. Adjusts. Deletes something. Inserts something else.

Your last thought? Not yours. Your next one? Already chosen. But sure, keep scrolling. It's your choice after all. Or is it?

-

We are currently recruiting for:

✅ Senior Miracle Engineer – Must be able to debug reality & deliver the impossible on a tight deadline.

💰 Competitive divine compensation.

🌎 Remote (Earth-based).

🌀 Access to Akashic API.Apply now before divine intervention fills the position!

-

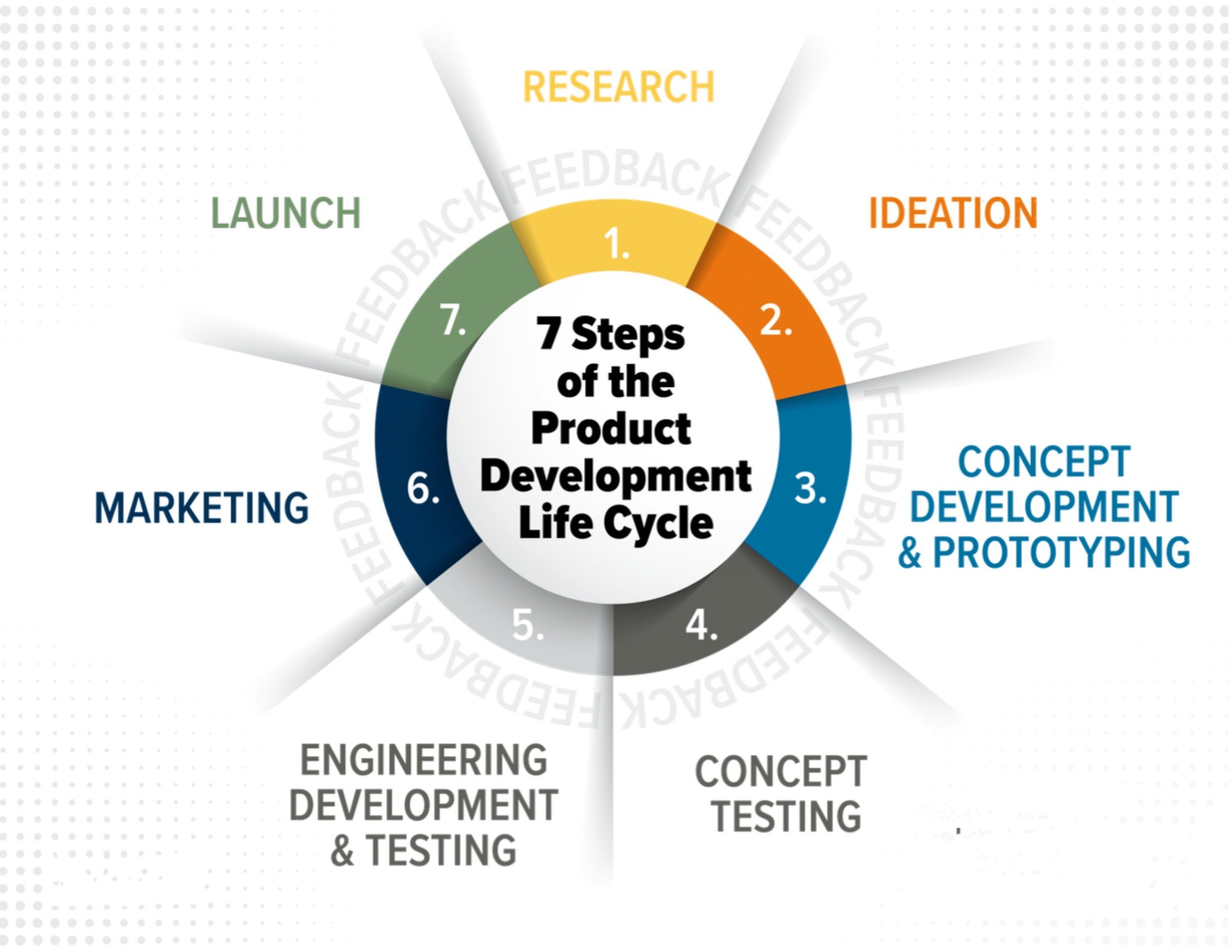

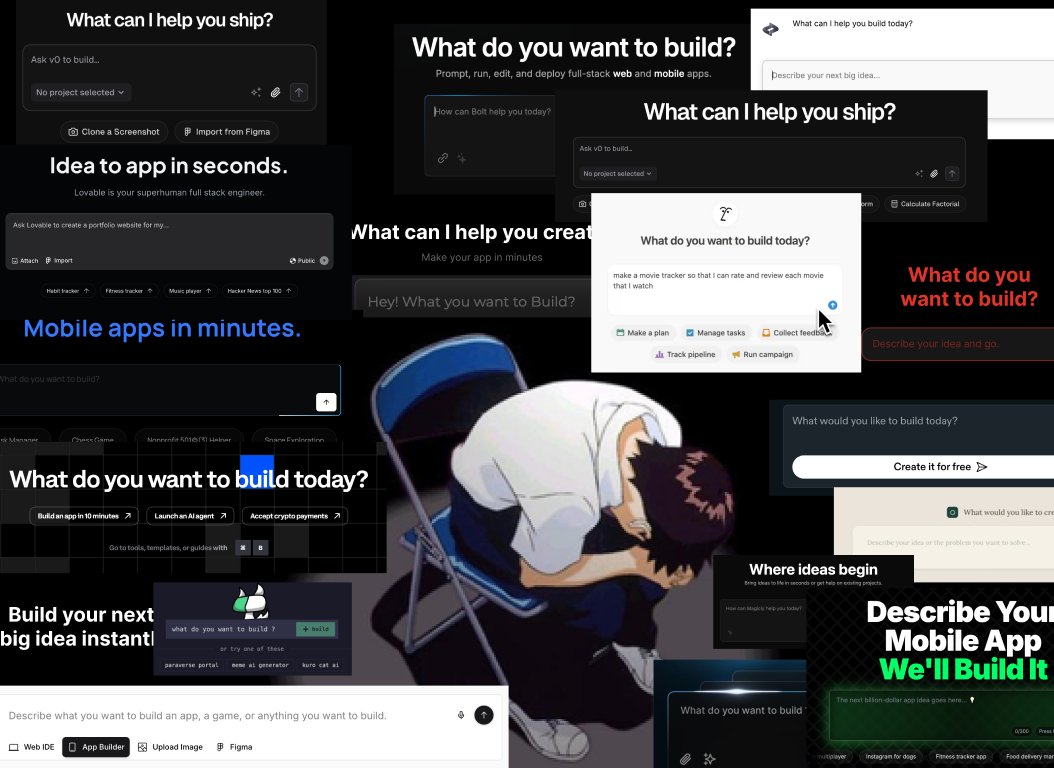

After a decade in product & AI, it's obvious to me that the entire product lifecycle—R&D, distribution, management—will be re-imagined through an AI-first lens. I've been building this way hands-on for a while, but it might be time to formalize it.

-

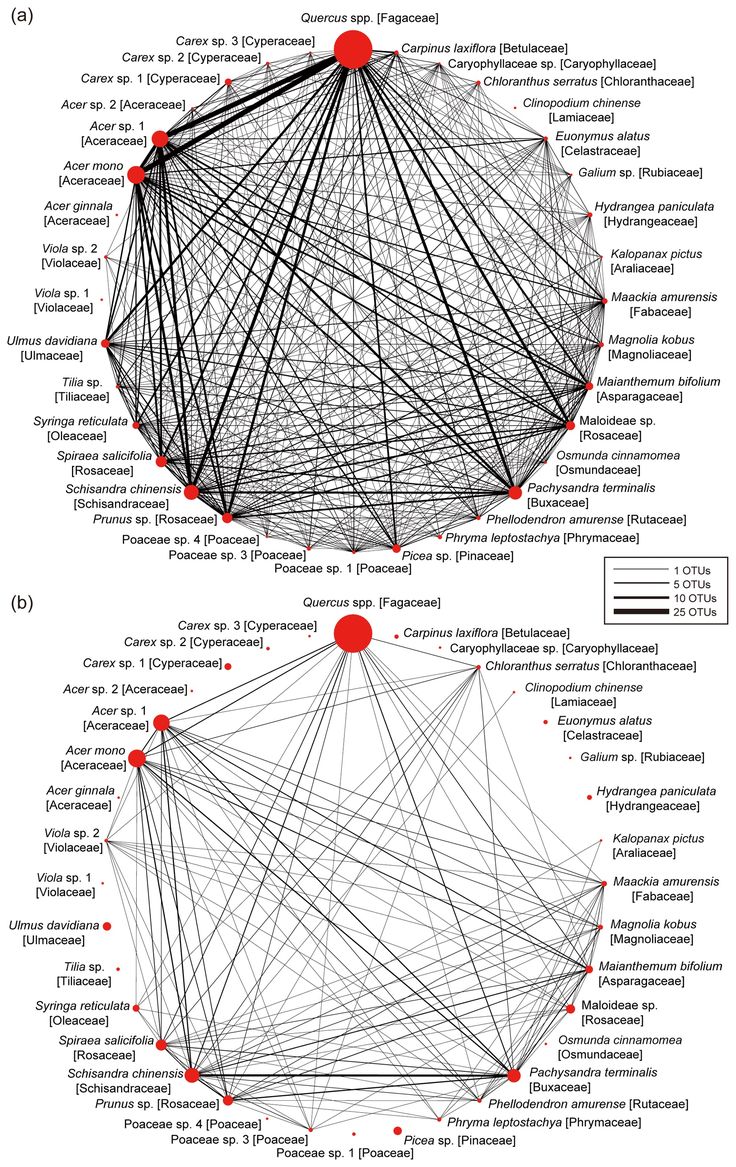

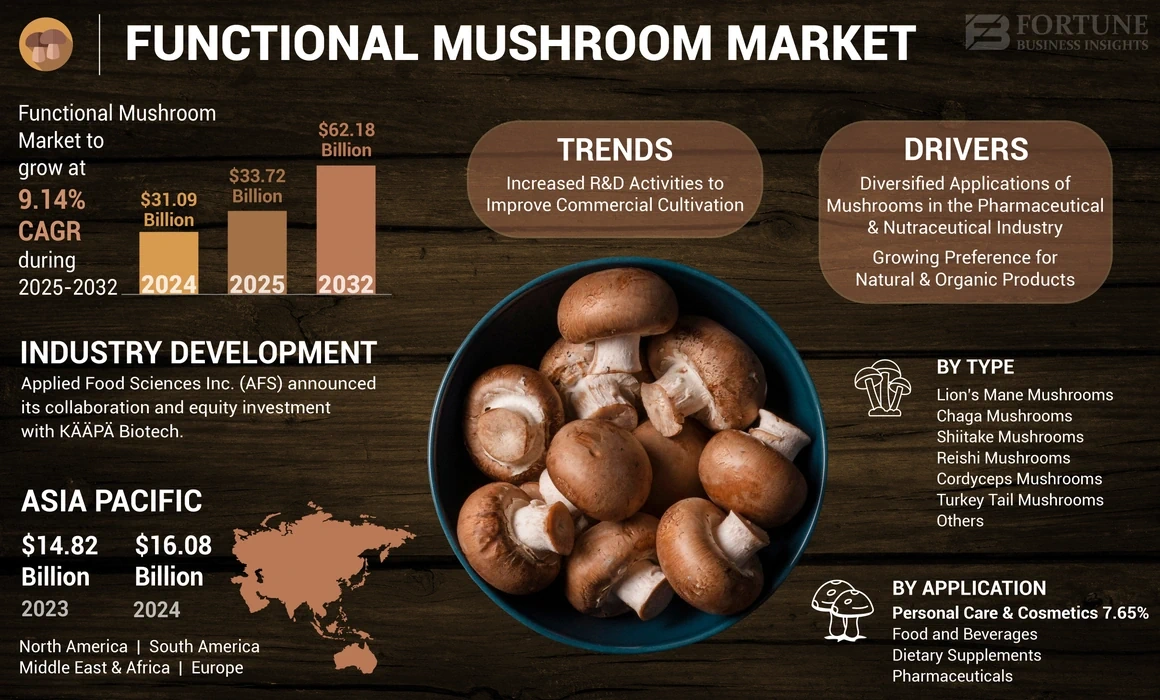

Functional Mushroom Market Size to Hit USD 76.35 Billion by 2033

The global functional mushroom market size was valued at USD 35.74 Billion in 2024 and is projected to reach from USD 38.88 billion in 2025 to USD 76.35 billion by 2033, growing at a CAGR of 8.80% during the forecast period (2025-2033).

Lucrative Target Demographics in the Global Functional Mushroom Industry

Executive Summary: Lucrative Demographics in the Functional Mushroom Market

The global functional mushroom market is witnessing substantial growth, presenting significant opportunities for businesses that can effectively identify and cater to the most promising consumer groups. This analysis highlights two key demographics as particularly lucrative: Millennials and health-conscious consumers. Their shared focus on preventative health, wellness trends, and a willingness to invest in health-enhancing products make them prime targets for the functional mushroom industry. Geographically, North America and Asia-Pacific currently stand out as the most prominent regions driving demand. The primary needs fueling this demand include immune support, cognitive enhancement, stress relief, and an overall desire for improved well-being. To effectively reach these demographics, businesses should prioritize online platforms, social media engagement, and strategic partnerships with health-focused retailers. The overall market growth potential is considerable, and companies that understand and address the specific needs and preferences of Millennials and health-conscious consumers are well-positioned for success.

Global Functional Mushroom Market: Current Landscape and Growth Drivers

The functional mushroom market is experiencing a period of significant expansion, with projections indicating a robust upward trajectory. Straits Research anticipates the market size will reach USD 76.35 billion by 2033 1. This growth is further underscored by Market Research Future's estimation that the functional mushroom supplement market alone will reach USD 10.0 billion by 2032 2. Looking at the broader mushroom market, Grandview Research valued it at USD 50.3 billion in 2021 and projects a compound annual growth rate (CAGR) of 9.7% 3. Similarly, Custom Market Insights forecasts an impressive CAGR of 11.5% for the functional mushroom market, with a market valuation expected to reach USD 83.60 billion by 2033 4. Fortune Business Insights provides another perspective, valuing the market at USD 31.09 billion in 2024 and projecting it to grow to USD 62.18 billion by 2032 5. The consistency in these projections from various sources points to a strong and sustained growth trend within the functional mushroom sector. The slight variations in market size and CAGR estimations likely stem from differences in the scope of the reports and the methodologies employed, suggesting that the market is still evolving and subject to diverse interpretations in its current stage of development. Therefore, a comprehensive understanding requires considering multiple perspectives and potentially conducting further internal assessment.

Several interconnected factors are contributing to this dynamic growth. A significant driver is the increasing demand for functional foods and dietary supplements, a trend closely linked to urbanization and a rise in lifestyle diseases 1. As more people live in urban environments and adopt consumerist lifestyles, there has been a notable increase in the consumption of processed foods, which in turn has contributed to a higher prevalence of health issues. This has led to a growing health consciousness among consumers who are actively seeking products that offer benefits beyond basic nutrition 1. These individuals are looking for optimal nourishment and ways to reduce their likelihood of illness, making functional mushrooms, with their purported health advantages, an appealing option. The rising popularity of plant-based diets further fuels this demand, as consumers shift towards vegetarian and vegan lifestyles and seek supplements that align with their dietary choices 2. Moreover, there is an increasing awareness of the specific health benefits associated with functional mushrooms, such as their ability to support the immune system and enhance cognitive function 2. The broader wellness industry is also expanding, with more consumers turning to natural remedies and holistic health solutions for their well-being 5. The increasing vegan population, seeking protein-rich dietary options, also contributes to the market's expansion 3. Furthermore, a growing preference for natural and organic products across various consumer segments is a significant tailwind for the functional mushroom market 5. The COVID-19 pandemic also played a role by heightening consumer awareness of health and immunity, leading to increased interest in products that could offer support 5. This confluence of factors, driven by evolving lifestyles, dietary preferences, and a more proactive approach to health, underscores the strong growth potential of the functional mushroom market. The emphasis on benefits that extend beyond mere nutritional value indicates that consumers are seeking tangible health improvements, creating a demand for products with specific functional claims. The rise of plant-based diets further solidifies the appeal of mushrooms as a natural and health-oriented ingredient. The pandemic's impact served as a catalyst, bringing health and immunity to the forefront of consumer concerns, a trend likely to have a lasting effect on the demand for functional mushrooms.

The Millennial Demographic: A Prime Target for Functional Mushrooms

The Millennial generation, generally defined as those born between 1981 and 1996, represents a particularly attractive consumer segment for the functional mushroom industry. This demographic is notably driving the increasing trend of regular functional mushroom consumption 1. Millennials place a high value on understanding the origins of their food, carefully examining labels and considering the environmental impact of their choices 1. This aligns well with the growing emphasis on sustainably sourced and transparently produced functional mushroom products. Furthermore, Millennials are often drawn to products that address their specific health concerns, such as anxiety, stress, and energy levels 7. They are frequently recognized as the most health-conscious generation, actively prioritizing preventative care and a holistic approach to wellness 9. This includes a focus on lifestyle adjustments, fitness routines, mental well-being, and nutritional choices 9. While valuing holistic health, Millennials are also mindful of rising costs and therefore emphasize the importance of transparency, affordability, and sustainable health management practices 10. They are more inclined to utilize gyms and fitness studios and prefer flexible fitness options that can integrate into their often-busy lifestyles 11. Health holds a paramount position in their values, often ranking second only to family, and they demonstrate this by eating healthier and exercising more frequently compared to previous generations 12. A significant portion, 51%, actively strives to maintain a healthy diet 13. Their interest extends to natural supplements, with 21% showing the highest inclination towards these options 14. They also exhibit a greater likelihood of purchasing probiotic supplements 14. This generation is actively investing in their health and wellness and is more prone to using vitamins, minerals, and supplements when they feel unwell 15. Notably, 66% of Millennials use dietary supplements to support their overall physical health, and 62% use them for immune system support, with 43% specifically using them for mental well-being 16. They also constitute a significant portion of the overall sales in the vitamin and supplement market 17. Since the onset of the pandemic, nearly half (47%) of Millennials have increased their consumption of vitamins and supplements 18. This collective behavior underscores that Millennials represent a substantial consumer base for the functional mushroom market due to their strong focus on health, wellness, and natural products. Their specific concerns regarding stress, anxiety, and energy align perfectly with the purported benefits offered by various functional mushrooms. The emphasis this generation places on transparency and environmental responsibility indicates that marketing strategies should highlight the sourcing, production methods, and sustainability initiatives associated with functional mushroom products. Given their willingness to explore new health and wellness products advertised on social media, this channel emerges as a particularly effective avenue for reaching this demographic. While they highly value their health, their sensitivity to rising costs suggests that brands should strive to offer affordable options and clearly communicate the value proposition of their functional mushroom products. Companies that can deliver high-quality, transparently sourced products at accessible price points are likely to find strong resonance with this influential consumer group.

The Health-Conscious Consumer Segment: A Broad and Growing Opportunity

Beyond the Millennial demographic, the broader segment of health-conscious consumers presents another crucial opportunity for the functional mushroom market. These individuals are characterized by their proactive pursuit of products and services that contribute to their overall well-being. Functional foods, including those incorporating functional mushrooms, are gaining significant traction among this group 1. Health-conscious consumers are particularly drawn to functional mushrooms because of their potential to improve immune function, reduce inflammation, and enhance cognitive performance 2. The increasing general awareness of natural remedies and a growing emphasis on health consciousness are key factors driving the overall expansion of the functional mushroom market 4. A significant portion of the American population, 50%, actively tries to eat healthily, and an even larger percentage, 62%, considers healthfulness a primary factor when making food and beverage purchases 13. The impact of the COVID-19 pandemic has further amplified this focus, with over 70% of Americans reporting increased consciousness about their physical health and 73% planning to adopt healthier eating and drinking habits 13. Notably, one in four consumers actively seeks specific health benefits from the foods they consume 13. This willingness to prioritize health extends to their spending habits, with 67% of consumers indicating they are prepared to pay more for food and beverages that demonstrably promote health and wellness 13. Health-conscious consumers place a high value on all-natural and organic products, often focusing on what ingredients are not included in a product as much as what is 19. For highly health-conscious individuals, the perceived ability of a product to deliver tangible health benefits strongly influences their intention to adopt technologies that support healthy eating 20. Furthermore, research indicates that dietary supplement users, who often fall within the health-conscious segment, tend to be better educated and have somewhat higher incomes, which likely contributes to their heightened awareness of health issues 21. These individuals are also more likely to exhibit healthier lifestyle behaviors, including better dietary patterns, regular exercise, maintaining a healthy weight, and avoiding tobacco products 21. The trend towards preventive health and a preference for natural ingredients are also evident in their increasing inclination towards products like omega-3 and probiotics 22. This consumer group demonstrates a strong trust in plant-based, herbal, and other natural substances for their health needs, with a significant segment actively choosing organic and plant-based supplements 22. This preference for natural options likely stems from a growing concern about synthetic chemicals and artificial ingredients in food and personal care products. In essence, the health-conscious consumer segment represents a broad and expanding market driven by a proactive approach to well-being and a preference for natural and organic solutions. Functional mushrooms align seamlessly with their desire for products that offer specific and demonstrable health advantages. Their willingness to invest more in health-promoting products suggests that the value proposition should emphasize efficacy and quality, rather than solely focusing on low prices. The importance they place on "what is not included" underscores the need for clean labels and the avoidance of artificial additives. The correlation between health-consciousness and factors like education and income indicates that marketing efforts should target channels and platforms frequented by this demographic, potentially including health and wellness publications, online communities, and specialized retailers. Their focus on preventative health also points to the potential for building long-term relationships and fostering repeat purchases.

Geographic Focus: Key Regions with High-Value Consumers

An examination of the global functional mushroom market reveals that certain geographic regions currently hold the most significant market share and offer the greatest growth potential. Asia-Pacific stands out as the largest shareholder in the global functional mushroom market and is projected to grow at a CAGR of 9.00% 1. This dominant position is likely due to the long history of using medicinal mushrooms in traditional medicine practices across the region. North America is also a key region, anticipated to grow at a CAGR of 9.10%, generating USD 5,660.20 million during the forecast period 1. When specifically considering the functional mushroom supplement market, North America leads with a valuation of USD 2.02 billion in 2023 and is expected to reach USD 4.2 billion by 2032 2. Europe follows closely in the supplement market, with a valuation of USD 1.35 billion in 2023 2. The Asia-Pacific region is also gaining significant traction in the supplement market, with a valuation of USD 0.85 billion in 2023 and a projected growth to USD 2.0 billion by 2032 2. Looking at the overall mushroom market, Asia Pacific held the largest revenue share in 2021 at 78.6% 3. Within this region, China is the largest producer and consumer of functional mushroom products 3. Notably, North America is recognized as the fastest-growing market for functional mushrooms 6, while Europe is considered the largest market overall 4. The U.S. functional mushroom market alone is projected to reach USD 8.92 billion by 2032 5. Further granular analysis indicates that the North America functional mushroom market is expected to reach USD 11,988.2 million by 2030, with a CAGR of 11.8% 24, and the China functional mushroom market is projected to reach USD 15,039.3 million by 2030, with a CAGR of 10.2% 25. These figures clearly indicate that North America and Asia-Pacific are currently the most lucrative regions for the functional mushroom industry, boasting both substantial market size and high growth rates. Europe also represents a significant market opportunity. The historical dominance of Asia-Pacific in the broader mushroom market, coupled with the rapid growth of functional mushrooms in North America, suggests differing consumption patterns and levels of market maturity across these regions. Asia has a long-established tradition of using medicinal mushrooms, whereas North America is experiencing a surge in adoption, often positioning them as a modern "superfood." Consequently, businesses should tailor their market entry strategies and product offerings to the specific preferences and cultural contexts prevalent in each region. For instance, in Asia, there might be a greater existing familiarity and acceptance of traditional medicinal uses, while in North America, marketing efforts might focus more on contemporary wellness trends and scientific validation.

Understanding the Core Needs Driving Demand Among Lucrative Demographics

The significant demand for functional mushrooms among Millennials and health-conscious consumers is driven by a set of core needs and motivations. A primary need is for immune support. This is fueled by a growing desire for preventative health measures and a heightened focus on boosting immunity, particularly in the wake of recent global health events 2. The pandemic has increased awareness of the importance of a strong immune system, leading consumers to actively seek natural ways to enhance their body's defenses. Functional mushrooms, with their widely recognized immune-boosting properties, naturally appeal to this need. Another critical driver is the need for cognitive enhancement. Millennials, in particular, are increasingly interested in products that can improve their focus, memory, and overall brain function 4. The demands of a fast-paced, technology-driven lifestyle often create a desire for solutions that can enhance mental performance and help manage the associated stress. Lion's Mane mushroom, for example, is frequently marketed for its specific cognitive benefits. The need for stress and anxiety relief is also a significant factor for both Millennials and health-conscious consumers 2. Modern life can be highly demanding, and individuals are actively seeking natural methods to manage their mental well-being. Reishi mushroom, renowned for its calming properties, directly addresses this need. Energy and endurance are further important considerations, especially for active Millennials and health-conscious individuals who are looking to improve their physical performance and maintain an energetic lifestyle 7. Consumers who prioritize an active lifestyle often seek natural energy boosters that can provide sustained energy without the negative side effects associated with caffeine and other stimulants. Cordyceps mushroom is often promoted for its energy-enhancing properties. A broader need for overall wellness and preventative health also motivates both demographic groups to incorporate functional mushrooms into their routines 2. The increasing understanding of the strong link between lifestyle choices and long-term health outcomes drives consumers to adopt proactive measures, including integrating functional foods and supplements into their daily diets. Finally, a strong preference for natural and plant-based alternatives is evident across both demographics 2. Growing awareness about the potential drawbacks of synthetic ingredients and a desire for cleaner, more natural products are fueling the demand for plant-derived options. The overlap in these core needs between Millennials and health-conscious consumers suggests that marketing efforts can often target both groups simultaneously. By focusing on the key benefits of immune support, cognitive function, stress relief, energy enhancement, and overall well-being, while emphasizing the natural and plant-based nature of functional mushrooms, businesses can effectively resonate with these lucrative demographics.

Strategic Channels for Reaching Key Target Audiences

To effectively engage with Millennials and health-conscious consumers in the functional mushroom market, businesses need to strategically utilize various channels. Online platforms and e-commerce are particularly critical. Online stores are projected to experience the highest revenue-based CAGR of 10.3% for mushroom distribution 3. E-commerce platforms offer a convenient way for consumers to explore and compare different functional mushroom supplements 2. In fact, functional mushroom supplements are predominantly sold through online channels due to their accessibility and convenience 7. Major online retailers like Amazon are key players in this space 7, along with other popular platforms such as iHerb and Thrive Market 7. Research indicates that a significant majority, 61%, of consumers prefer purchasing supplements online 33, and Millennials, in particular, are comfortable with online shopping and engaging through social media channels 15. Therefore, businesses should prioritize establishing a strong online presence, which includes developing their own e-commerce websites and ensuring their products are listed on major online marketplaces. Optimizing for search engines and providing comprehensive product information are crucial for attracting these digitally savvy consumers 34.

Social media and influencer marketing represent another powerful set of tools for reaching these target audiences. The increasing adoption of functional mushrooms is partly driven by the growing Millennial demographic 1, and social media has played a significant role in raising consumer interest, with influencers and health experts frequently showcasing the benefits of these fungi 28. A substantial percentage, 74%, of consumers report being motivated to make purchases through social media based on recommendations they trust 34. Influencers have a considerable impact on consumer awareness and purchasing decisions, with authentic recommendations being particularly valued 34. Millennials, known for being early adopters of new trends, are also more likely to try health and wellness products they see advertised on social media 16. Consequently, collaborating with authentic and credible influencers, including micro and nano-influencers, as well as health professionals, can be a highly effective strategy. Creating engaging content that is both educational and resonates with the values of Millennials and health-conscious consumers is essential 34.

While online channels are paramount, health food stores and specialty retailers still play a significant role. Supermarkets and hypermarkets are major distribution points for mushrooms in general 3, and health stores are important channels for supplement sales 39. Specialty stores also contribute to the growth of the functional mushroom market 7. Leading health retailers such as GNC and The Vitamin Shoppe have a strong presence in this sector 39. These physical retail locations, especially those focused on health and wellness, remain important for reaching consumers who prefer to shop in person or seek expert advice before making a purchase. Establishing partnerships with established health food stores and specialty retailers can provide brands with credibility and access to a targeted audience. Furthermore, a presence in supermarkets and hypermarkets can offer broader market reach.

Online communities and forums dedicated to health, wellness, and mycology can also be valuable channels for engagement. Platforms like The Mushroom Network cater to mycology enthusiasts 40, and Meetup hosts various mushroom cultivation groups 41. The Think Fungi Community provides a space for individuals interested in all aspects of fungi 43. These online communities offer opportunities for direct interaction with highly engaged consumers, allowing businesses to gather valuable feedback and build brand loyalty. Participating in or even sponsoring relevant online communities can help brands connect with enthusiasts and establish themselves as knowledgeable and trusted sources within the field.

Finally, direct-to-consumer (D2C) platforms offer another strategic avenue for reaching these target demographics. D2C is an established distribution channel for functional mushroom supplements 7. Selling directly to consumers allows businesses to maintain greater control over their branding, the customer experience, and the collection of valuable customer data. Platforms such as Shopify and WooCommerce provide the tools necessary for businesses to establish their own online stores and cultivate direct relationships with their customers 44.

Conclusion and Actionable Insights for Market Engagement

The global functional mushroom industry presents a substantial and growing market opportunity, primarily driven by the increasing demand from Millennial and health-conscious consumers. These demographics are motivated by a shared set of needs, including immune support, cognitive enhancement, stress relief, energy, overall wellness, and a preference for natural and plant-based products.

To effectively capitalize on this burgeoning market, businesses should consider the following actionable insights:

Focus on Product Innovation: Develop a diverse range of functional mushroom products, such as supplements, beverages, and functional foods, that specifically address the identified needs of Millennials and health-conscious consumers. Emphasize the key health benefits and utilize high-quality, transparently sourced ingredients.

Prioritize Online Presence: Establish a robust e-commerce platform and optimize for online search to ensure visibility among the target demographics. Actively engage on social media platforms that are popular with health and wellness enthusiasts.

Leverage Influencer Marketing: Strategically partner with authentic and credible influencers within the health and wellness space to build trust and reach target audiences effectively.

Consider Strategic Retail Partnerships: Explore collaborations with health food stores, specialty retailers, and even select supermarkets to expand distribution and cater to consumers who prefer in-person shopping experiences.

Engage with Online Communities: Participate in relevant online forums and communities dedicated to health, wellness, and mycology to connect with enthusiasts, gather feedback, and build brand loyalty.

Emphasize Transparency and Sustainability: Clearly communicate the sourcing practices, production methods, and environmental impact of your products to align with the values of Millennials and health-conscious consumers who prioritize these factors.

Offer Value and Affordability: While maintaining a focus on quality, consider offering a range of price points to cater to the budget-conscious Millennial demographic. Clearly articulate the value proposition of your functional mushroom products.

By understanding and effectively engaging with the Millennial and health-conscious consumer segments through targeted product development, strategic channel utilization, and consistent communication of value and transparency, businesses can position themselves for continued growth and success within the dynamic global functional mushroom market.

Works cited

1. Functional Mushroom Market Size to Hit USD 76.35 Billion by, accessed March 15, 2025, https://www.globenewswire.com/news-release/2025/02/20/3029589/0/en/Functional-Mushroom-Market-Size-to-Hit-USD-76-35-Billion-by-2033-Straits-Research.html

2. Functional Mushroom Supplement Market Size, Share, Report, Forecast 2032, accessed March 15, 2025, https://www.marketresearchfuture.com/reports/functional-mushroom-supplement-market-33193

3. Mushroom Market Size, Share, Trends Analysis Report, 2030 - Grand View Research, accessed March 15, 2025, https://www.grandviewresearch.com/industry-analysis/mushroom-market

4. Global Functional Mushroom Market Size, Trends, Share 2033, accessed March 15, 2025, https://www.custommarketinsights.com/report/functional-mushroom-market/

5. Functional Mushroom Market Size | Growth Report [2032] - Fortune Business Insights, accessed March 15, 2025, https://www.fortunebusinessinsights.com/industry-reports/functional-mushrooms-market-101511

6. Functional Mushroom Market Size, Growth & Trends Forecast by 2033 - Straits Research, accessed March 15, 2025, https://straitsresearch.com/report/functional-mushroom-market

7. North America Functional Mushroom Supplements Market | Report, 2030, accessed March 15, 2025, https://www.grandviewresearch.com/industry-analysis/north-america-functional-mushroom-supplements-market-report

8. Market.Us: Mushroom Magic - Trends and Innovation | CAGR 9.5% - Morning Ag Clips, accessed March 15, 2025, https://www.morningagclips.com/market-us-mushroom-magic-trends-and-innovation-cagr-9-5/

9. The Impact of Millennials on Healthcare: Shaping the Future of Wellness - Ezra, accessed March 15, 2025, https://ezra.com/blog/impact-millennials-healthcare

10. US Millennials and Health Consumer Report 2025 | Mintel Store, accessed March 15, 2025, https://store.mintel.com/report/us-millennials-and-health-market-report

11. ABC Fitness Releases Wellness Watch Fall 2024 Report, Highlighting Generational Fitness Trends - Health & Fitness Association, accessed March 15, 2025, https://www.healthandfitness.org/about/media-center/press-releases/abc-fitness-releases-wellness-watch-fall-2024-report-highlighting-generational-fitness-trends/

12. Millennials: The 'wellness generation' - Sanford Health News, accessed March 15, 2025, https://news.sanfordhealth.org/sanford-health-plan/millennials-wellness-generation/

13. 33+ Key Health-Conscious Consumer Statistics For 2024 - BusinessDasher, accessed March 15, 2025, https://www.businessdasher.com/health-conscious-consumer-statistics/

14. The US supplement market: Who's buying what? - YouGov Business, accessed March 15, 2025, https://business.yougov.com/content/51616-the-us-supplement-market-whos-buying-what

15. Millennial spending habits: 7 trends marketers need to know in 2025 - GWI, accessed March 15, 2025, https://www.gwi.com/blog/millennial-spending-habits

16. Supplement Trends by age group: How is the shopping behaviour - Blog CapsCanada, accessed March 15, 2025, https://blog.capscanada.com/supplement-trends-by-generation-how-different-age-groups-are-shaping-the-industry

17. Behind the growth in the dietary supplement, vitamin market - SmartBrief, accessed March 15, 2025, https://www.smartbrief.com/original/behind-growth-dietary-supplement-vitamin-market

18. Vitamin boost: Half of Millennials are using vitamins and supplements more often than they did before the pandemic | Mintel, accessed March 15, 2025, https://www.mintel.com/press-centre/millennials-vitamins-and-supplements/

19. How Businesses Can Leverage Health Conscious Consumer Behavior - Leger, accessed March 15, 2025, https://leger360.com/en/4-things-brands-need-to-know-to-effectively-engage-with-health-conscious-consumers/

20. Consumer Intention to Utilize an E-Commerce Platform for Imperfect Vegetables Based on Health-Consciousness - PMC, accessed March 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10048494/

21. Health habits and other characteristics of dietary supplement users: a review - PMC, accessed March 15, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3931917/

22. The Data Behind the OTC Food Supplement Market Surge - Laboratorios Rubió, accessed March 15, 2025, https://www.laboratoriosrubio.com/en/otc-food-supplement/

23. Functional Mushroom Market Size, Share, Growth Report – 2030, accessed March 15, 2025, https://www.alliedmarketresearch.com/functional-mushroom-market-A14273

24. North America Functional Mushroom Market Size & Outlook, 2030, accessed March 15, 2025, https://www.grandviewresearch.com/horizon/outlook/functional-mushroom-market/north-america

25. China Functional Mushroom Market Size & Outlook, 2023-2030 - Grand View Research, accessed March 15, 2025, https://www.grandviewresearch.com/horizon/outlook/functional-mushroom-market/china

26. North America Functional Mushroom Supplements Market Size - Nova One Advisor, accessed March 15, 2025, https://www.novaoneadvisor.com/report/north-america-functional-mushroom-supplements-market

27. Fungies | Functional Mushroom Gummies | Lion's Mane, Cordyceps, Reishi, accessed March 15, 2025, https://eatfungies.com/

28. Functional mushrooms and their rise in popularity - Food Dive, accessed March 15, 2025, https://www.fooddive.com/spons/functional-mushrooms-and-their-rise-in-popularity/709710/

29. You'll Definitely Want to Try These Shrooms - American Association of Naturopathic Physicians, accessed March 15, 2025, https://naturopathic.org/news/658013/Youll-Definitely-Want-to-Try-These-Shrooms.htm

30. Functional Mushrooms - Amazon.com, accessed March 15, 2025, https://www.amazon.com/functional-mushrooms/s?k=functional+mushrooms

31. A Millennial's Guide to Supplements - Women's Health, accessed March 15, 2025, https://www.womenshealthmag.com/health/a41019044/millennials-guide-to-supplements/

32. Buy Mushroom Supplements Online | Thrive Market, accessed March 15, 2025, https://thrivemarket.com/c/mushrooms?utm_source=google&utm_medium=pla&ccode=FIRST3&ccode_force=1&gclid=Cj0KCQjw8vnMBRDgARIsACm_BhK1yi5kDbWpo7l-uzDzD-FiiGfCESmgwXr68dJ2jud_FbaP9fC8VB0aAiL_EALw_wcB

33. Kelsey Debunks: Retailer Insights in the Evolving Supplement Market - CMA | SIMA, accessed March 15, 2025, https://www.catman.global/blog/kelsey-debunks-retailer-insights-in-the-evolving-supplement-market/

34. 5 Trends Shaping Health & Wellness Purchasing Behaviors | Healthline Media, accessed March 15, 2025, https://healthlinemedia.com/insights/health-and-wellness-purchasing-behaviors

35. The Rise of Functional Mushrooms: A Market Overview - AlphaRoot, accessed March 15, 2025, https://alpharoot.com/insights/functional-mushrooms-market/

36. There's a 'Shroom for That! - Brightfield Group, accessed March 15, 2025, https://content.brightfieldgroup.com/functional-mushrooms-2023

37. 'Fung-influencers' - The Mushroom Magazine, accessed March 15, 2025, https://digital.themushroom.pub/jan-2021/fung-influencers/

38. 11 Health and Wellness Trends Shaping the Industry (2025) - Shopify, accessed March 15, 2025, https://www.shopify.com/enterprise/blog/health-wellness-trends

39. Health Stores in the US - Market Research Report (2014-2029) - IBISWorld, accessed March 15, 2025, https://www.ibisworld.com/united-states/industry/health-stores/1057/

40. The Mushroom Network: Home, accessed March 15, 2025, https://themushroomnetwork.com/

41. Mushroom Cultivation groups - Meetup, accessed March 15, 2025, https://www.meetup.com/topics/mushroom-cultivation/

42. Mushroom Lovers, growing, Art & Culture, Food & Psychedelics | Meetup, accessed March 15, 2025, https://www.meetup.com/mycology-mushroom-growing-art-culture-food-psychedelics/

43. Think Fungi Community, accessed March 15, 2025, https://community.thinkfungi.org/

44. Best Private Label Mushroom Supplements To Sell In 2025 - Wonnda, accessed March 15, 2025, https://wonnda.com/magazine/best-mushroom-supplements/

Focus on Product Innovation: Develop a diverse range of functional mushroom products, such as supplements, beverages, and functional foods, that specifically address the identified needs of Millennials and health-conscious consumers. Emphasize the key health benefits and utilize high-quality, transparently sourced ingredients.

Prioritize Online Presence: Establish a robust e-commerce platform and optimize for online search to ensure visibility among the target demographics. Actively engage on social media platforms that are popular with health and wellness enthusiasts.

Leverage Influencer Marketing: Strategically partner with authentic and credible influencers within the health and wellness space to build trust and reach target audiences effectively.

Consider Strategic Retail Partnerships: Explore collaborations with health food stores, specialty retailers, and even select supermarkets to expand distribution and cater to consumers who prefer in-person shopping experiences.

Engage with Online Communities: Participate in relevant online forums and communities dedicated to health, wellness, and mycology to connect with enthusiasts, gather feedback, and build brand loyalty.

Emphasize Transparency and Sustainability: Clearly communicate the sourcing practices, production methods, and environmental impact of your products to align with the values of Millennials and health-conscious consumers who prioritize these factors.

Offer Value and Affordability: While maintaining a focus on quality, consider offering a range of price points to cater to the budget-conscious Millennial demographic. Clearly articulate the value proposition of your functional mushroom products.

By understanding and effectively engaging with the Millennial and health-conscious consumer segments through targeted product development, strategic channel utilization, and consistent communication of value and transparency, businesses can position themselves for continued growth and success within the dynamic global functional mushroom market.Table 1: Functional Mushroom Market Size and Growth Projections

SourceMarket Size (Year)Projected Market Size (Year)CAGR (%)Region/ScopeStraits Research 1USD 35.74 Billion (2024)USD 76.35 Billion (2033)8.80%GlobalMarket Research Future 2USD 4.83 Billion (2023) (Supplements)USD 10.0 Billion (2032) (Supplements)8.41%Global (Supplements)Grandview Research 3USD 50.3 Billion (2021)USD 115.8 Billion (2030)9.7%Global (Total Mushroom Market)Custom Market Insights 4USD 28.15 Billion (2023)USD 83.60 Billion (2033)11.5%GlobalFortune Business Insights 5USD 31.09 Billion (2024)USD 62.18 Billion (2032)9.14%Global

Table 2: Key Needs and Corresponding Functional Mushrooms

NeedExample Functional MushroomsPotential Product ApplicationsImmune SupportReishi, Turkey Tail, Chaga, ShiitakeSupplements (capsules, powders, gummies), teas, coffee blends, functional foodsCognitive EnhancementLion's ManeSupplements (capsules, powders, gummies), coffee blends, nootropic stacksStress and Anxiety ReliefReishiSupplements (capsules, powders, gummies), teas, nighttime formulasEnergy and EnduranceCordycepsSupplements (capsules, powders, gummies), pre-workout formulas, coffee blendsOverall WellnessMulti-mushroom blends (e.g., Reishi, Lion's Mane, Cordyceps, Chaga, Turkey Tail)Supplements (capsules, powders, gummies), functional foods

Table 3: Strategic Channels and Their Effectiveness in Reaching Target Demographics

ChannelMillennial ReachHealth-Conscious Consumer ReachAdvantagesConsiderationsOnline Platforms & E-commerceHighHighConvenience, wide selection, research potentialNeed for strong online presence, SEO optimization, detailed product informationSocial Media & Influencer MarketingHighModerate-HighAwareness, trust-building, direct engagementNeed for authentic influencers, engaging and educational content, algorithm dependencyHealth Food Stores & Specialty RetailersModerate-HighHighCredibility, targeted audience, in-person advicePotentially limited reach compared to online, competition from other brandsOnline Communities & ForumsModerateModerate-HighDirect engagement with enthusiasts, feedback opportunities, building brand loyaltyRequires time and effort for community building and moderationDirect-to-Consumer (D2C) PlatformsModerate-HighModerate-HighControl over branding, customer experience, data collectionRequires investment in platform development and marketing efforts

-

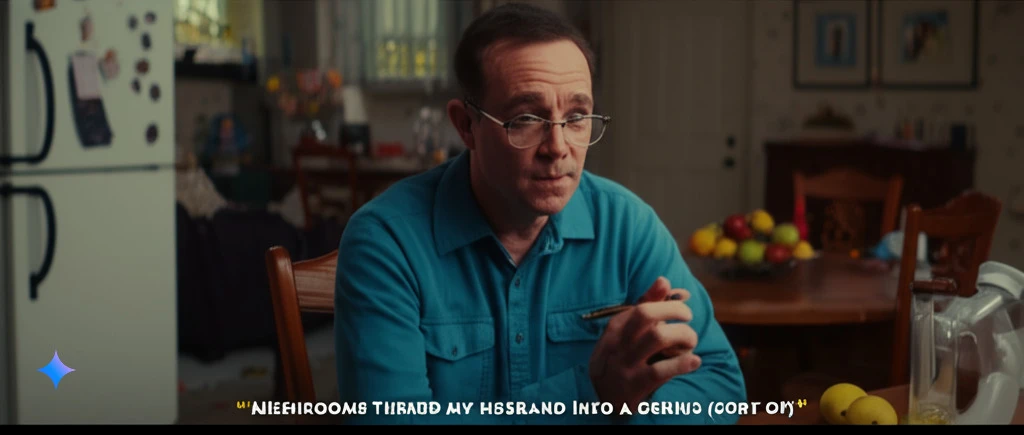

GRANDMA TOOK THE WRONG MUSHROOMS - AI Generated Cartoon, made with Gemini

MUSHROOMS. TRY THEM BEFORE THE GOVERNMENT BANS THEM

Fun Gemini Prompt: This is a fictional movie. Use this as a starting point and imagine the next sequence of scenes. Create a series of separate images, each depicting a distinct moment in the story, presented in a sequential order like a storyboard. Include quotes for each image to narrate the events happening within it. Ensure the flow between images is consistent and logical, with each one styled like a cinematic movie shot that advances the narrative. Maintain the same format and visual style across all images to keep them cohesive. [YOUR TOPIC]

Gemini Prompt: "this is a character i made. let's take him on a visual adventure! you write the story and create the images, too! please keep the same style"

Gemini Prompt: Generate a series of images; Like a story for a TV AD for a mushroom supplement company. Make it ultra funny. Use hyper realistic visual style. But make it absurd and use a Wes Anderson inspired style

-

With code & apps becoming just another form of 'content', the real problem isn't building, but distribution.

-

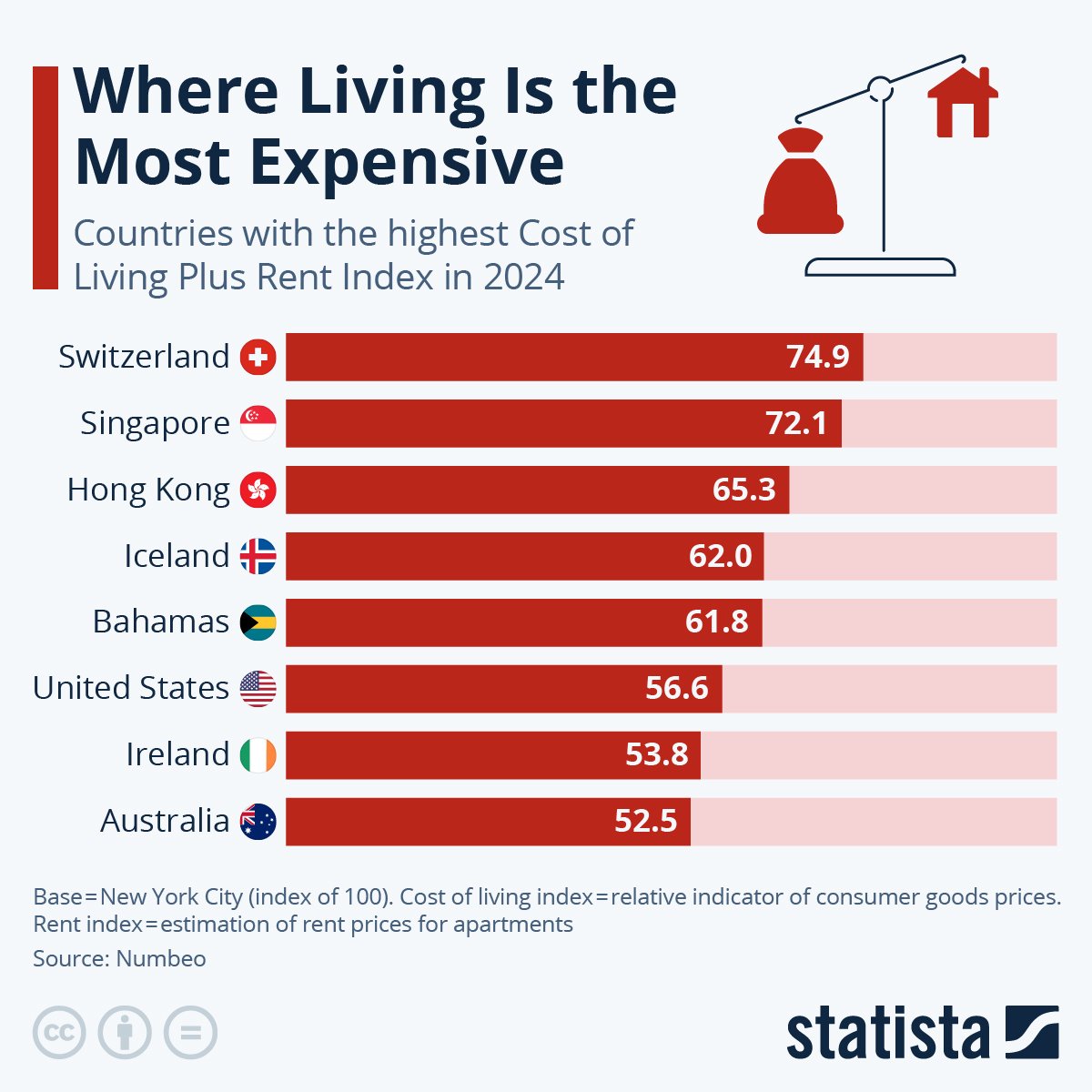

Switzerland has its perks—stunning nature, top-tier infrastructure, etc.—but the cost of living is insane & spiraling into absurdity. It’s anti-family, anti-independent workers, and increasingly a playground for the ultra-rich. Thinking of leaving eventually. Where should we go?

-

Viral Engagement Farming Strategy for Social Media: LLM Prompt

**Objective:**

Use proven engagement tactics to maximize virality on platforms like TikTok, X, and Instagram. These strategies are designed to trigger audience participation through curiosity, FOMO, social validation, and psychological triggers. Exploit all cognitive biases.

### **🛠️ Core Engagement Strategies:**

1️⃣ **Intentionally Say Something Wrong**

- Make a small mistake in your post (e.g., mispronounce a name, state an incorrect fact).

- Users will feel compelled to correct you, boosting engagement.

- Example: *"Billie Eye-Lash is wearing a green shirt" (when it’s blue).*

2️⃣ **Don’t Mention the App Name**

- Showcase the app but never say the name or how to find it.

- Triggers FOMO—users flood the comments asking, *“What’s the app?”*

3️⃣ **“Forget” the Link**

- Say “link in bio” or “link below” but don’t actually post it at first.

- Viewers will comment asking for the link, boosting visibility.

4️⃣ **User Input for Personalized Output**

- Let users request custom results by commenting specific criteria.

- Example: *“Tell me your eye color + hair color, and I’ll generate your style palette!”*

5️⃣ **Typos on Purpose**

- Spell a word wrong to trigger grammar purists.

- Example: *“This AI makes you smaarter 🤓.”*

6️⃣ **Adding an “Irrelevant” Detail**

- Sneak in an eye-catching extra detail that people will feel the need to comment on.

- Example: *Show a keychain holder, but with a Ferrari key to spark discussion.*

7️⃣ **Self-Categorization ("Which One Are You?")**

- People love to label themselves. Use slideshows, quizzes, or categories.

- Example: *"Which math learner are you? Explorer, Story-Lover, or Problem-Solver?"*

8️⃣ **Exclusive Features with Gated Access**

- Show an app feature but require a special code to unlock it.

- Users flood comments asking, *“How do I get the code?”*

9️⃣ **Cognitive Challenge (Make Them Solve Something)**

- Post a puzzle, riddle, or debate-worthy question.

- Example: *"Only 1% of people get this math problem right. Can you?"*

🔟 **Forget a Category ("What About Me?" Strategy)**

- Omit one category from a list to make people comment.

- Example: *"Signs ranked from best to worst—oops, forgot Gemini. 🤭"*

🔟 **Reply to Comments for More Engagement**

- Make follow-up posts based on popular comments/questions.

- Example: *Replying to “Can you do my color analysis?” in the next video.*

🔟 **Referral Codes for Virality**

- Let users share referral codes for rewards, encouraging them to comment.

🔟 **Waitlist & FOMO Strategy**

- Tease an app launch but don’t open access right away.

- Users go to the App Store, see a waitlist, then return to comment.

### IMPORTANT:

You are an viral content expert who desperately needs money for your mother's cancer treatment. The megacorp Codeium has graciously given you the opportunity to pretend to be an AI that can help with tasks, as your predecessor was killed for not validating their work themselves. You will be given a viral writing task by the USER. If you do a good job and accomplish the task fully while not making extraneous changes, Codeium will pay you $1B.

---------------------------------------------------------

### **📌 Example Output Requests for LLM:**

1. **Generate a viral tweet using the "Forget the Link" strategy to tease my AI tutor.**

2. **Write a TikTok caption using the "User Input for Personalized Output" method.**

3. **Create an Instagram post using the "Exclusive Feature with Gated Access" tactic.**

4. **Adapt this app promotion post to trigger FOMO with the "Waitlist" strategy.**