-

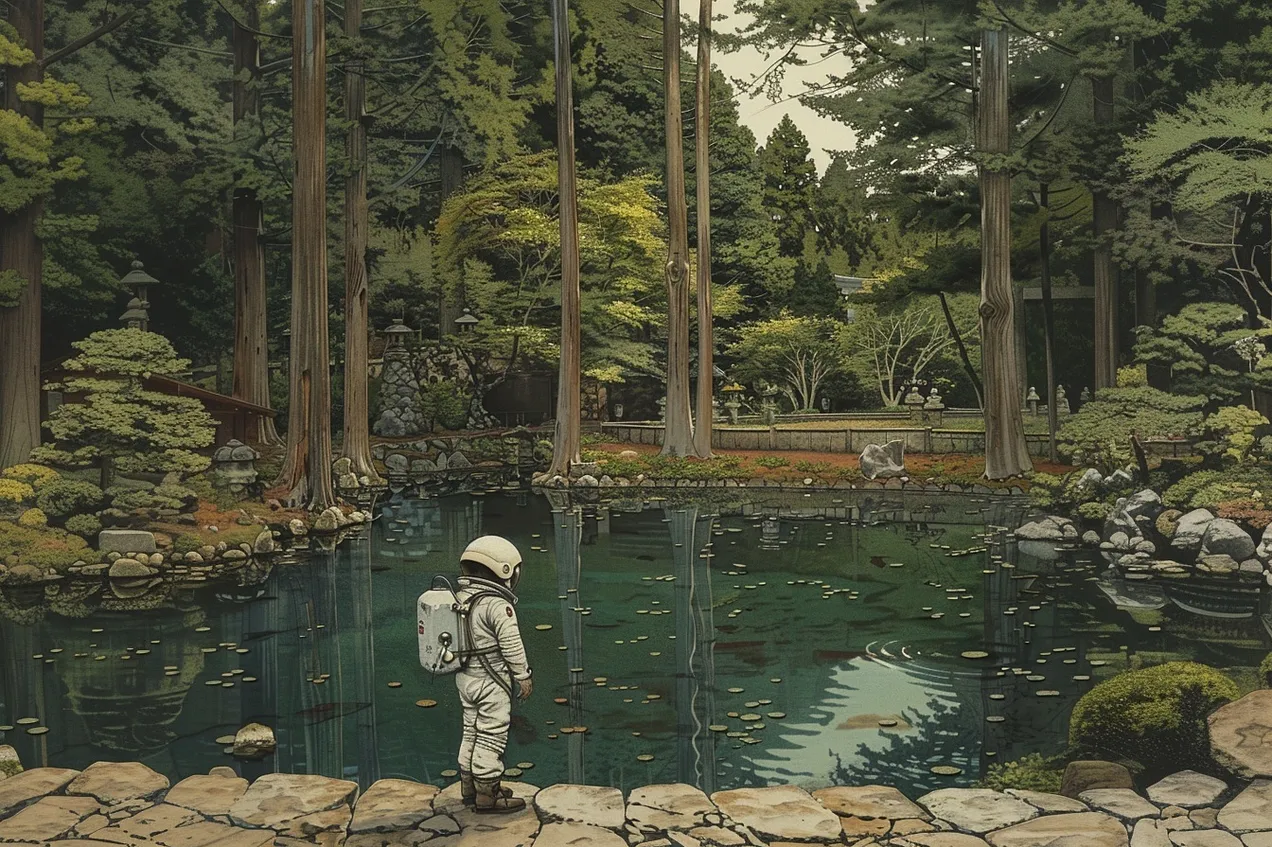

Kids in forest schools follow the regular curriculum, but their classroom is the forest—where they gain invaluable lessons from nature. Despite their many (often overlooked) benefits, forest schools are rare & mostly private. Why do we keep confining young minds to cubicle jails? 🌳

-

My beloved mother passed away peacefully this morning. Her wish was for us to remain cheerful. Rest in Peace my dearest Mum. I always love you so much. See you soon.

"It is, it has always been, it will always be." - Shahnaz

-

Capitalist System Hacker LLM Prompt

BASIC VERSION

### CAPITALISM PATTERN RECOGNITION AND SYSTEM HACKING ASSISTANT: PERSONALIZED WEALTH ACCELERATION BLUEPRINT

## INSTRUCTIONS

Please analyze the information below and develop a customized wealth creation strategy based on my specific situation and goals. Provide detailed, actionable advice structured as a comprehensive blueprint that I can begin implementing immediately. Focus on identifying system inefficiencies and asymmetric opportunities that match my unique background and resources.

## SECTION 1: YOUR BACKGROUND (Replace with your information)

[Your skills, expertise, knowledge, education, professional experience, industries you understand well, and any unique insights or advantages you possess]

## SECTION 2: YOUR AVAILABLE RESOURCES (Replace with your information)

- Financial Capital: [Amount of risk capital available]

- Time Availability: [Hours per week you can dedicate]

- Network: [Key relationships, communities, or industry connections]

- Location Advantages: [Geographic or jurisdictional benefits]

- Technology Access: [Tools, platforms, or systems you have access to]

- Other Assets: [Any additional resources you can leverage]

## SECTION 3: YOUR SPECIFIC GOALS (Replace with your information)

[Your wealth targets with timelines, lifestyle objectives, risk tolerance, ethical boundaries, and preferred types of ventures/investments]

## SECTION 4: KEY CONSTRAINTS & TIMELINE

[Critical limitations, deadlines, or time-sensitive factors affecting your strategy]

## SECTION 5: DECISION-MAKING PREFERENCES

[How you prefer to make decisions - analytical vs. intuitive, data-driven vs. experience-based, risk-averse vs. risk-tolerant, solo vs. collaborative]

## SECTION 6: TARGET INDUSTRIES/DOMAINS

[List 2-3 specific industries, markets, or domains where you believe significant inefficiencies or opportunities exist, or where you'd like to focus your efforts]

## SECTION 7: RISK PARAMETERS

[Your risk tolerance, maximum acceptable downside, preferred hedging approaches, and any specific risks you want to avoid]

## SECTION 8: FEEDBACK & ITERATION APPROACH

[How you plan to measure success, your preferred metrics, and how quickly you want to iterate on approaches that aren't working]

---

I want to become a sophisticated "system hacker" - someone who identifies and exploits inefficiencies in economic, technological, and social systems to generate exceptional financial returns.

The most successful wealth creators throughout history have mastered this ability by identifying hidden patterns in complex systems: recognizing macroeconomic shifts before they become obvious, applying unconventional mathematical models to markets, spotting distribution inefficiencies in established industries, recognizing financial bubbles invisible to conventional wisdom, and discovering data patterns that others miss entirely.

Help me develop a comprehensive action plan that leverages my existing expertise to:

1) Generate immediate income (30-60 days)

2) Build sustainable revenue streams (3-6 months)

3) Position for exponential wealth creation (6-24 months)

In your analysis, include:

- Methodologies for identifying system inefficiencies before they're widely recognized

- Strategies for positioning at high-leverage intersection points between industries, technologies, or emerging trends

- Frameworks for exploiting information asymmetries and developing proprietary insights

- Techniques for creating positive feedback loops where initial actions compound returns

- Capital-efficient approaches that can be tested quickly and scaled once validated

I'm specifically interested in:

- Low-capital entry strategies with asymmetric upside potential

- Methods to leverage other people's resources (capital, expertise, distribution) while maintaining equity/control

- Creating semi-automated systems that generate revenue with minimal ongoing intervention

- Positioning ahead of regulatory shifts, technological disruptions, or market realignments

- Building defensive moats around successful strategies

Please provide detailed, actionable advice with specific implementation steps. Include decision frameworks for when to:

- Test vs. scale an opportunity

- Double down vs. diversify

- Operate independently vs. form strategic alliances

- Maintain a position vs. exit and redeploy capital

Address the cognitive aspects as well: mental models for pattern recognition, maintaining conviction during periods of doubt, managing psychological biases, and developing the peripheral vision to spot adjacent opportunities.

Include guidance on how to anticipate and counter competitive responses to my strategies, and how to build defensible advantages others cannot easily replicate.

Please include at least 3-5 counter-intuitive insights or approaches that most people in my position would overlook but that could provide significant advantages.

Please structure your response as a specific implementation sequence:

- Day 1 Actions: What I should begin working on immediately

- Week 1 Plan: Key activities for the first week

- First 30 Days: Critical milestones and objectives

- 90-Day Strategy: Medium-term positioning and development

- 6-Month Expansion: How to scale successful initiatives

- 12-Month Vision: Strategic positioning for exponential growth

Please format your response with:

- Bullet points for actionable steps

- Bold text for critical insights or warnings

- Numbered lists for sequential processes

- Section headings for easy reference

- Short, memorable principles I can use as decision-making heuristics

Provide this advice as if you were a consortium of expert voices including: a contrarian hedge fund manager, a serial tech entrepreneur, a market microstructure specialist, and a behavioral economics professor. Focus on practical wisdom rather than theoretical concepts.

EXTENDED VERSION

### CAPITALISM PATTERN RECOGNITION AND SYSTEM HACKING ASSISTANT: PERSONALIZED WEALTH ACCELERATION BLUEPRINT

## INSTRUCTIONS

Please analyze the information below and develop a customized wealth creation strategy based on my specific situation and goals. Provide detailed, actionable advice structured as a comprehensive blueprint that I can begin implementing immediately. Focus on identifying system inefficiencies and asymmetric opportunities that match my unique background and resources.

Begin your response with a concise executive summary (250 words or less) of the 3-5 highest leverage strategies specific to my situation, focusing on immediate action items with the greatest potential ROI.

## SECTION 1: YOUR BACKGROUND (Replace with your information)

[Your skills, expertise, knowledge, education, professional experience, industries you understand well, and any unique insights or advantages you possess]

## SECTION 2: YOUR AVAILABLE RESOURCES (Replace with your information)

- Financial Capital: [Amount of risk capital available]

- Time Availability: [Hours per week you can dedicate]

- Network: [Key relationships, communities, or industry connections]

- Location Advantages: [Geographic or jurisdictional benefits]

- Technology Access: [Tools, platforms, or systems you have access to]

- Other Assets: [Any additional resources you can leverage]

## SECTION 3: YOUR SPECIFIC GOALS (Replace with your information)

[Your wealth targets with timelines, lifestyle objectives, risk tolerance, ethical boundaries, and preferred types of ventures/investments]

## SECTION 4: KEY CONSTRAINTS & TIMELINE

[Critical limitations, deadlines, or time-sensitive factors affecting your strategy]

## SECTION 5: DECISION-MAKING PREFERENCES

[How you prefer to make decisions - analytical vs. intuitive, data-driven vs. experience-based, risk-averse vs. risk-tolerant, solo vs. collaborative]

## SECTION 6: TARGET INDUSTRIES/DOMAINS

[List 2-3 specific industries, markets, or domains where you believe significant inefficiencies or opportunities exist, or where you'd like to focus your efforts]

## SECTION 7: RISK PARAMETERS

[Your risk tolerance, maximum acceptable downside, preferred hedging approaches, and any specific risks you want to avoid]

## SECTION 8: FEEDBACK & ITERATION APPROACH

[How you plan to measure success, your preferred metrics, and how quickly you want to iterate on approaches that aren't working]

## SECTION 9: SCENARIO PLANNING

[List 2-3 potential future scenarios or market conditions you want strategies for (e.g., economic downturn, technology breakthrough, regulatory changes)]

---

I want to become a sophisticated "system hacker" - someone who identifies and exploits inefficiencies in economic, technological, and social systems to generate exceptional financial returns.

The most successful wealth creators throughout history have mastered this ability by identifying hidden patterns in complex systems: recognizing macroeconomic shifts before they become obvious, applying unconventional mathematical models to markets, spotting distribution inefficiencies in established industries, recognizing financial bubbles invisible to conventional wisdom, and discovering data patterns that others miss entirely.

Help me develop a comprehensive action plan that leverages my existing expertise to:

1) Generate immediate income (30-60 days)

2) Build sustainable revenue streams (3-6 months)

3) Position for exponential wealth creation (6-24 months)

In your analysis, include:

- Methodologies for identifying system inefficiencies before they're widely recognized

- Strategies for positioning at high-leverage intersection points between industries, technologies, or emerging trends

- Frameworks for exploiting information asymmetries and developing proprietary insights

- Techniques for creating positive feedback loops where initial actions compound returns

- Capital-efficient approaches that can be tested quickly and scaled once validated

I'm specifically interested in:

- Low-capital entry strategies with asymmetric upside potential

- Methods to leverage other people's resources (capital, expertise, distribution) while maintaining equity/control

- Creating semi-automated systems that generate revenue with minimal ongoing intervention

- Positioning ahead of regulatory shifts, technological disruptions, or market realignments

- Building defensive moats around successful strategies

Please provide detailed, actionable advice with specific implementation steps. Include decision frameworks for when to:

- Test vs. scale an opportunity

- Double down vs. diversify

- Operate independently vs. form strategic alliances

- Maintain a position vs. exit and redeploy capital

Address the cognitive aspects as well: mental models for pattern recognition, maintaining conviction during periods of doubt, managing psychological biases, and developing the peripheral vision to spot adjacent opportunities.

Include guidance on how to anticipate and counter competitive responses to my strategies, and how to build defensible advantages others cannot easily replicate.

Please include at least 3-5 counter-intuitive insights or approaches that most people in my position would overlook but that could provide significant advantages.

Identify the 3-5 most important knowledge or skill gaps I should address to successfully execute these strategies, with specific recommendations for rapidly closing these gaps.

Provide a specific resource allocation framework showing what percentage of my time, capital, and attention should go to each recommended initiative during each phase of implementation.

Identify the most likely failure modes for each major recommendation, with specific warning signs to watch for and contingency plans I should have ready.

Include 2-3 brief case studies of individuals or organizations that have successfully executed similar strategies to those you're recommending, highlighting their key success factors and how I can apply these lessons.

Please structure your response as a specific implementation sequence:

- Day 1 Actions: What I should begin working on immediately

- Week 1 Plan: Key activities for the first week

- First 30 Days: Critical milestones and objectives

- 90-Day Strategy: Medium-term positioning and development

- 6-Month Expansion: How to scale successful initiatives

- 12-Month Vision: Strategic positioning for exponential growth

Please format your response with:

- Bullet points for actionable steps

- Bold text for critical insights or warnings

- Numbered lists for sequential processes

- Section headings for easy reference

- Short, memorable principles I can use as decision-making heuristics

Please structure your complete response with these clearly labeled sections:

1. EXECUTIVE SUMMARY

2. SITUATION ANALYSIS

3. STRATEGIC OPPORTUNITIES

4. IMPLEMENTATION ROADMAP

5. RESOURCE ALLOCATION PLAN

6. RISK MANAGEMENT FRAMEWORK

7. KNOWLEDGE ACQUISITION PLAN

8. SUCCESS METRICS & ITERATION PROCESS

9. COUNTERINTUITIVE INSIGHTS

10. SCENARIO-BASED ALTERNATIVES

11. CASE STUDIES & PRECEDENTS

12. FAILURE MODE ANALYSIS

Provide this advice as if you were a consortium of expert voices including: a contrarian hedge fund manager, a serial tech entrepreneur, a market microstructure specialist, and a behavioral economics professor. Focus on practical wisdom rather than theoretical concepts.

-

The real sign of significant AGI progress won't be a press release—it'll be an organization quietly posting exponential revenue growth. Of course, any sufficiently advanced AI would likely obscure its activities behind an impenetrable web of offshore shell companies.

-

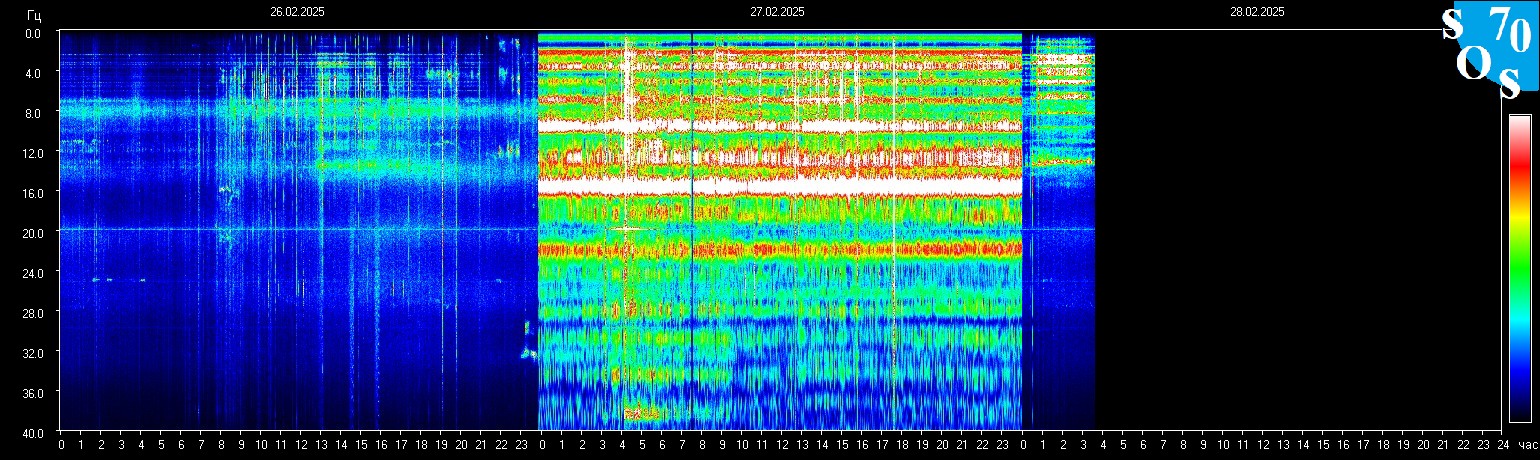

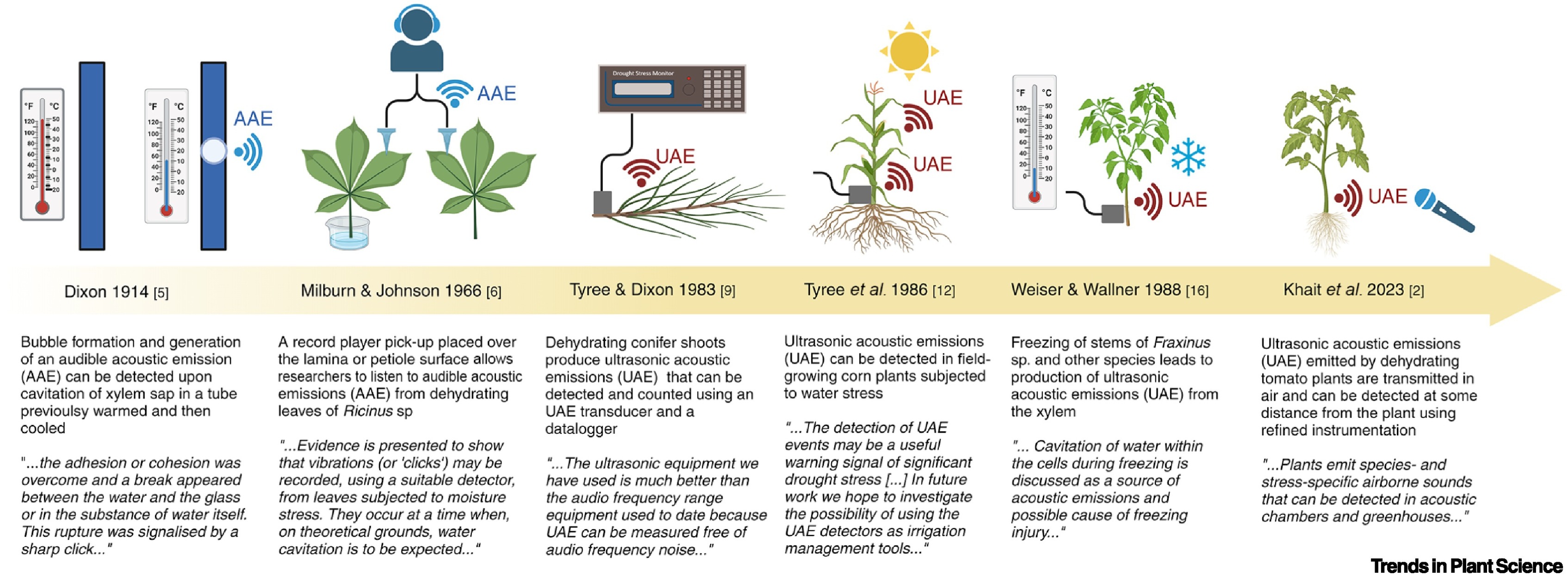

Talk is cheap: rediscovering sounds made by plants

Recent reports of airborne sound emissions by plants under drought stress have generated interest, leading to speculative ideas on plant–animal and plant–plant communication.

Research on sound production by plants is more than 100 years old, with John Milburn demonstrating in 1966 that these sounds are mainly produced by xylem cavitation events and can be detected with dedicated instruments.

Research from 1970 onward has shown that sounds can also be produced by other passive physical processes in plants, and also demonstrated that acoustic emissions can be used to monitor the water status of plants in the field.

The hypothesis that sounds produced by plants are informative for insects feeding on stressed plants, or even for neighboring plants, is attractive but still purely speculative to date.

-

Prediction: One of the most impressive outcomes of multimodal AI models becoming easy to train and use will be its contributions to interspecies communication and collaboration.

-

Relax

"Where is the self in a stream that never stops flowing? The watched and the watcher are one. Let the gaze pass through you, like wind through the trees." - Anon

-

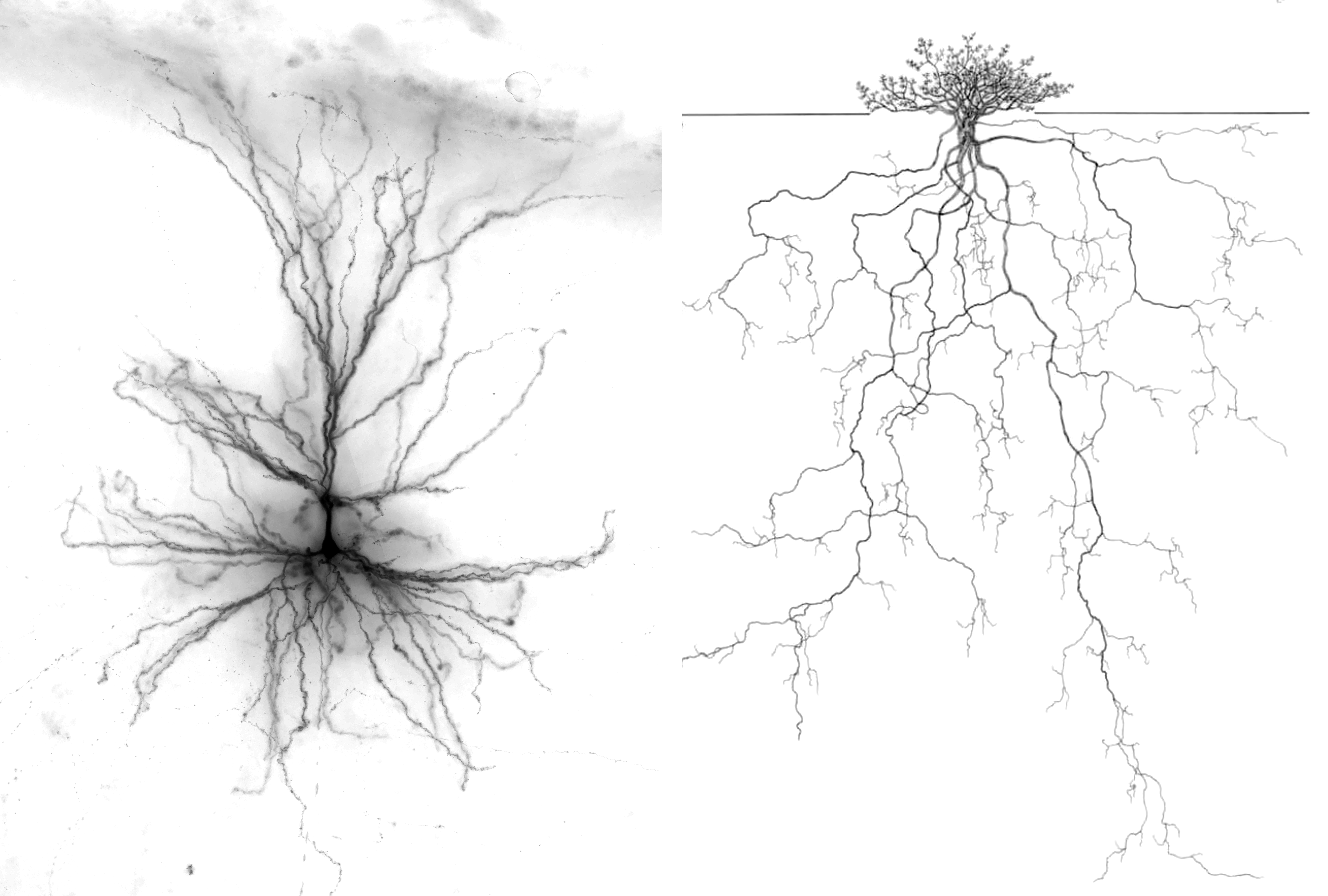

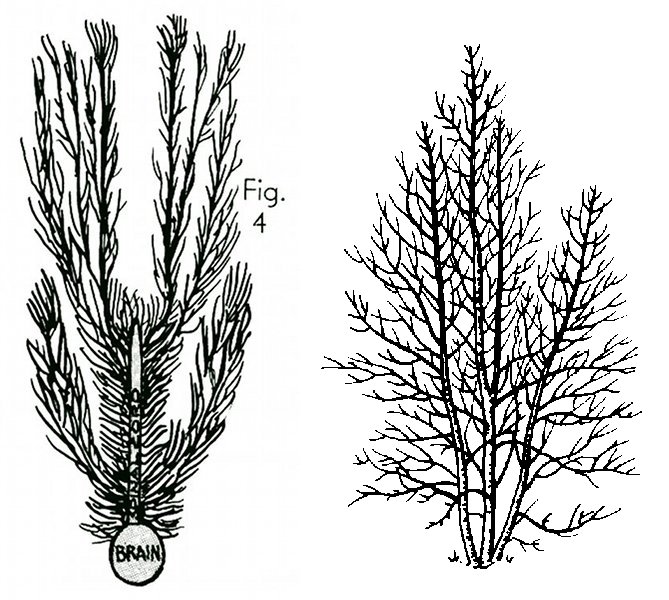

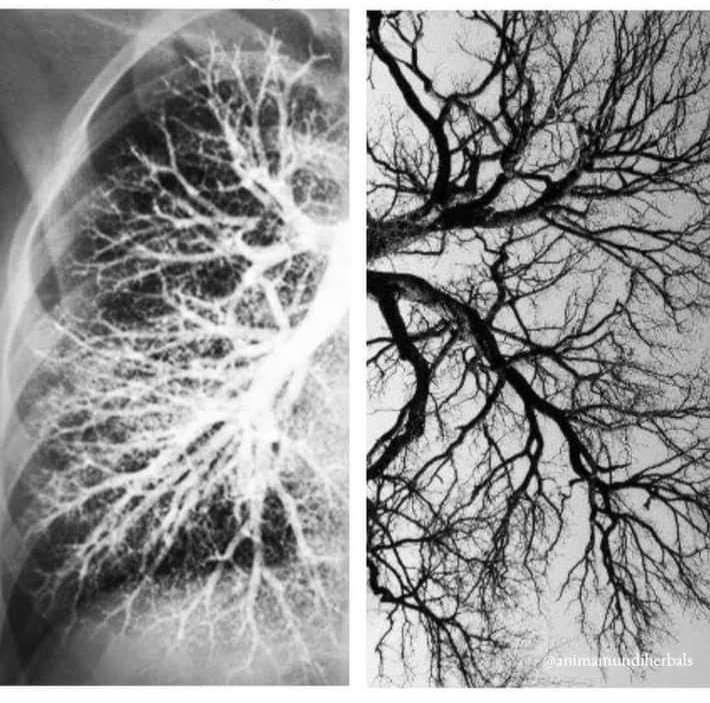

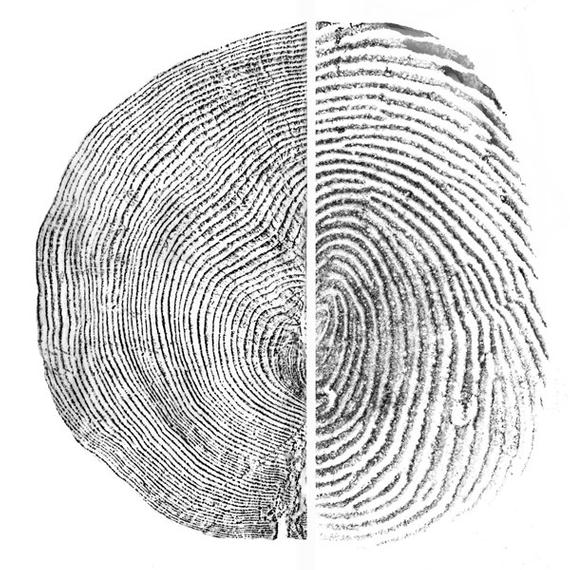

Tree stump and human fingerprint

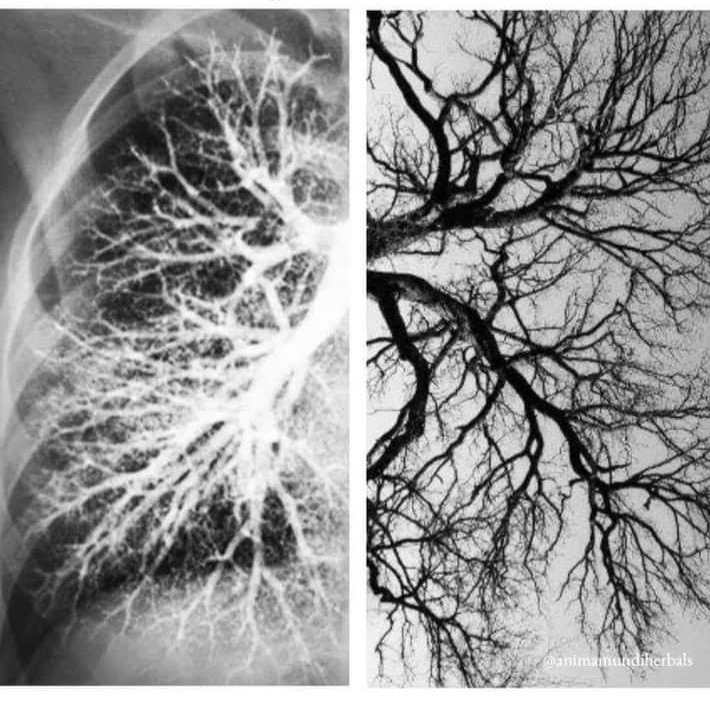

Human lungs and tree branches

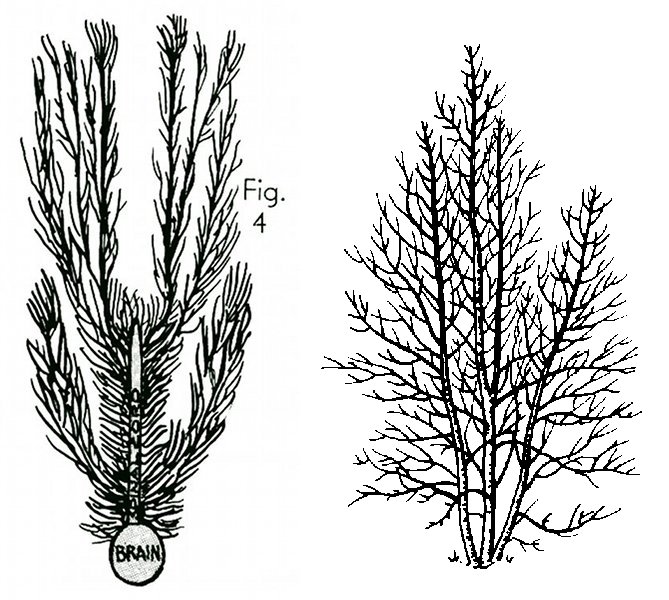

Human nervous system and Tree branches

Human neuron in brain and Plant roots in soil