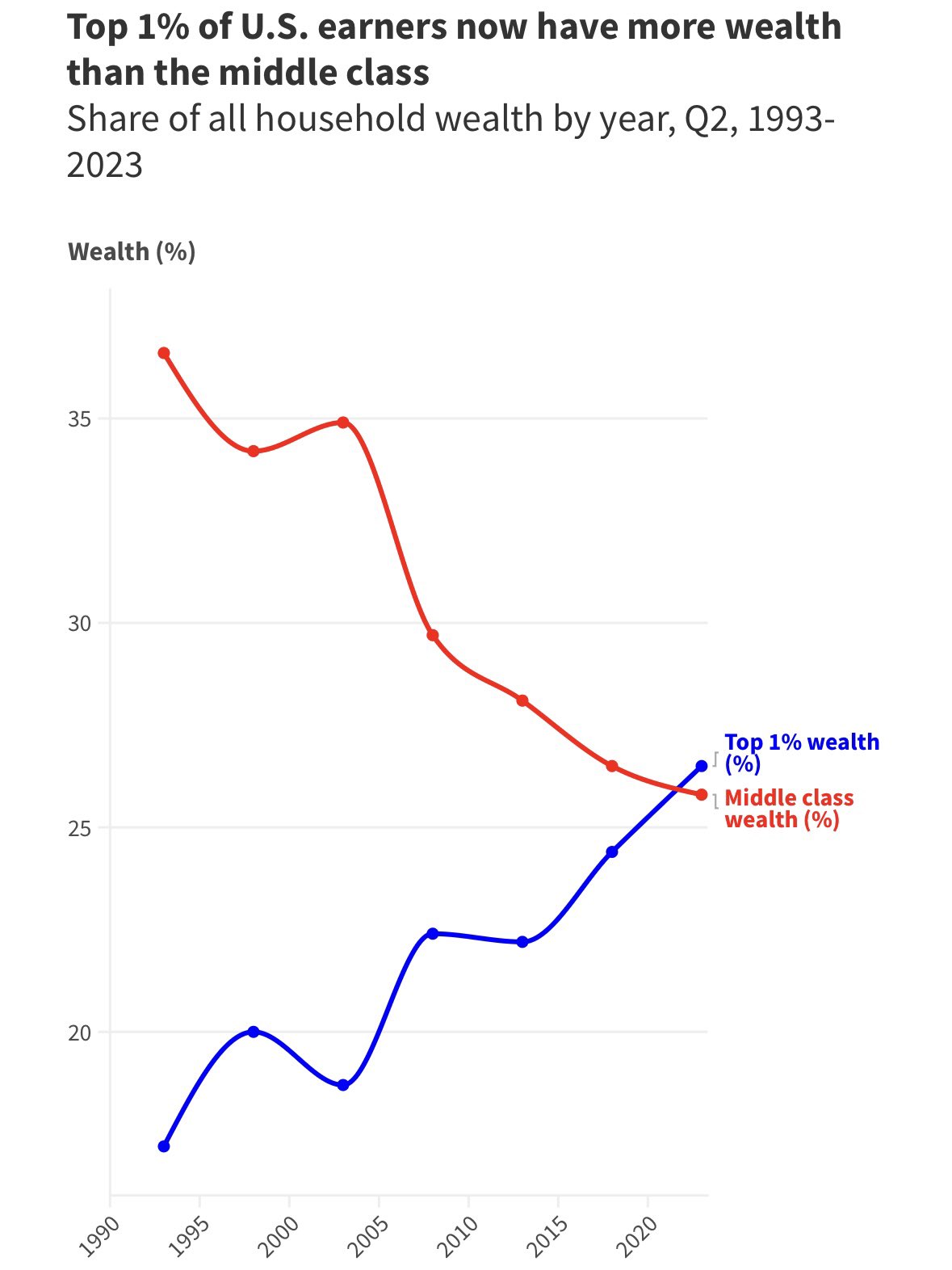

tag > Economics

-

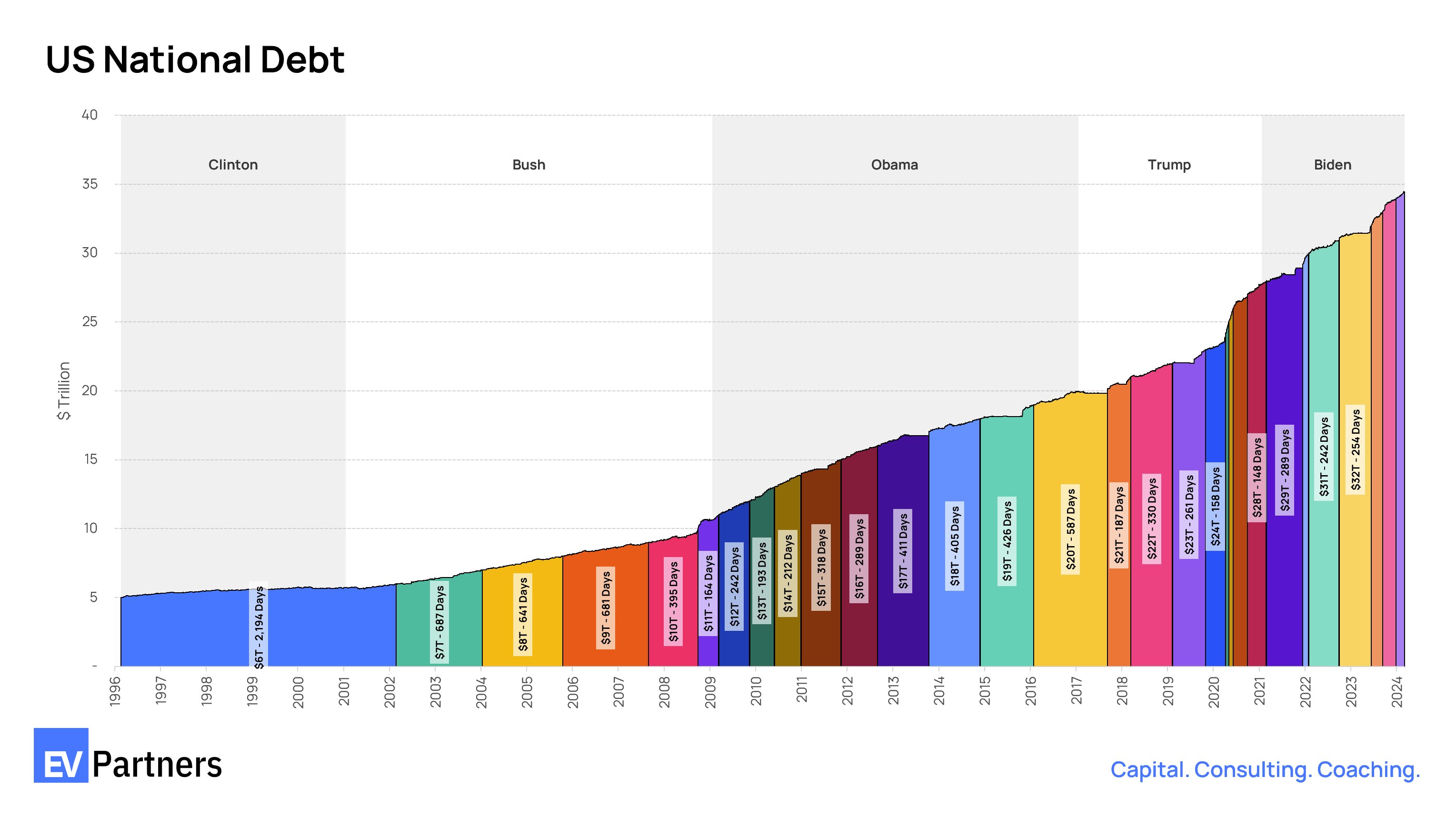

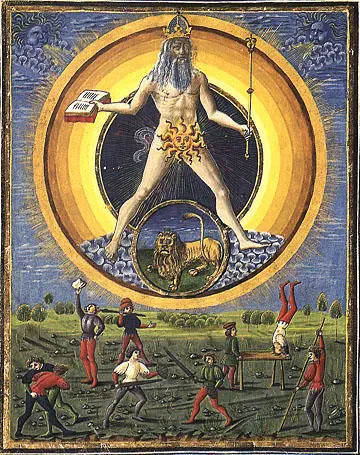

Each color shows $1T getting added to the US national debt. Not that long ago, it took six years to add a bar. Now adding one every 90-120 days. This will clearly end well.

-

Cryptochrome is the preferred method of value exchange on the complex networks of spaceship earth.

-

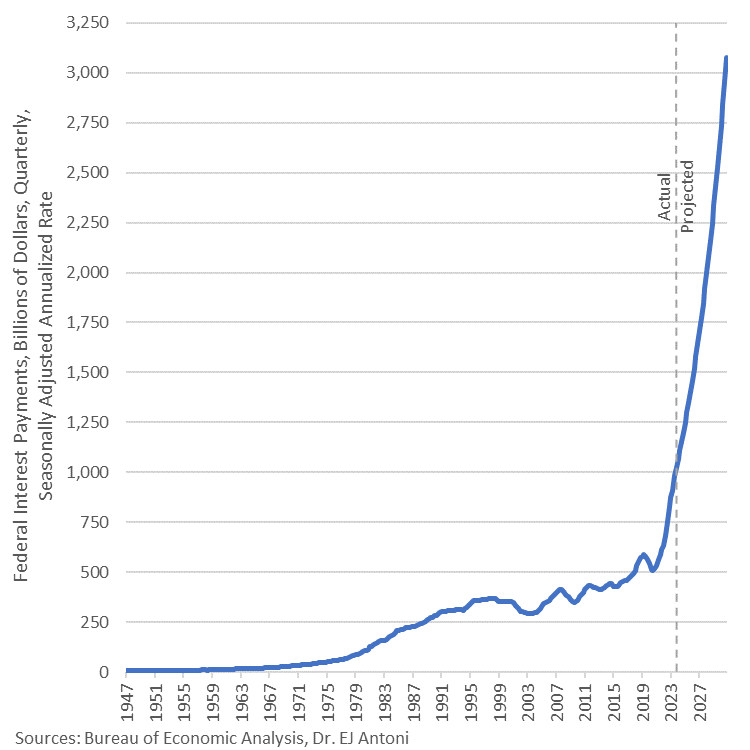

insane clown mafia casino: annualized interest on the US federal debt now exceeds $1 trillion and is projected to breach $3 trillion, annualized rate, by Q4 2030.

-

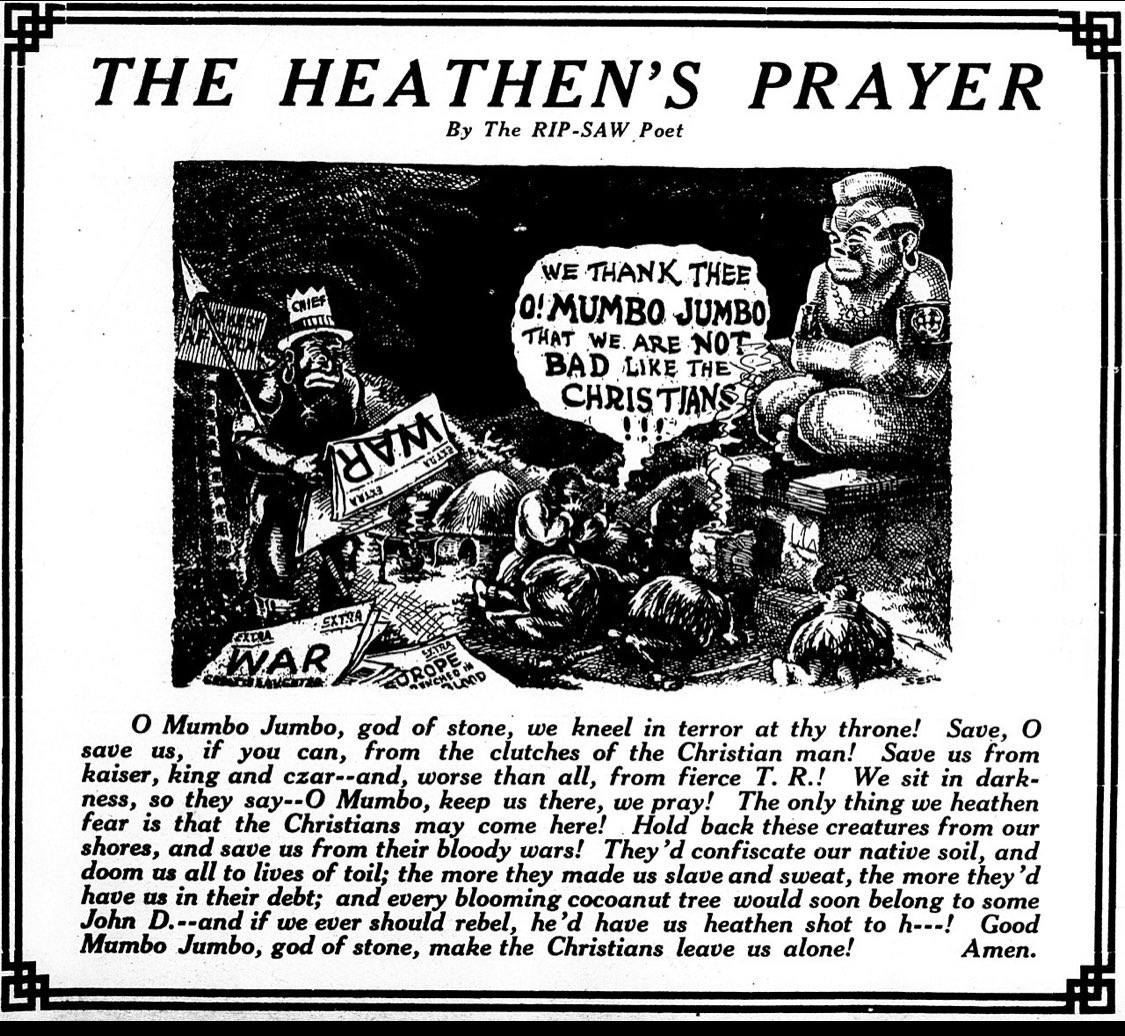

Seven Sermons of the Dead, by Carl Jung (under the pseudonym of Basilides of Alexandria)

Related from this blog - #Economics #Magic #Religion #History

-

When is risk the highest? - Quote from an interview with Peter Bernstein (1919 - 2009)

Vermeer's The Geographer, 1669 "The riskiest moment is when you’re right. That’s when you’re in the most trouble, because you tend to overstay the good decisions. Once you’ve been right for long enough, you don’t even consider reducing your winning positions. They feel so good, you can’t even face that. As incredible as it sounds, that makes you comfortable with not being diversified. So, in many ways, it’s better not to be so right. That’s what diversification is for. It’s an explicit recognition of ignorance."

Q: What investing and personal advice do you offer your great-grandchildren? A: As they are four and two (and about three months in the womb), they are not likely to take much of my advice, nor should I be giving them the kind of advice you have in mind. But I would teach them Pascal’s Law: the consequences of decisions and choices should dominate the probabilities of outcomes. And I would also teach them about Leibniz’s warning that models work, but only for the most part. I would remind them of what the man who trained me in investing taught me: Risk-taking is an inevitable ingredient in investing, and in life, but never take a risk you do not have to take.

In 1703 the mathematician Gottfried von Leibniz told the scientist Jacob Bernoulli that nature does work in patterns, but “only for the most part.” The other part — the unpredictable part — tends to be where things matter the most. That’s where the action often is.

Pascal’s Wager doesn’t mean that you have to be convinced beyond doubt that you are right. But you have to think about the consequences of what you’re doing and establish that you can survive them if you’re wrong. Consequences are more important than probabilities.

Related: WHAT is Risk, by Peter L. Bernstein - Peter. L. Bernstein WIkipedia

-

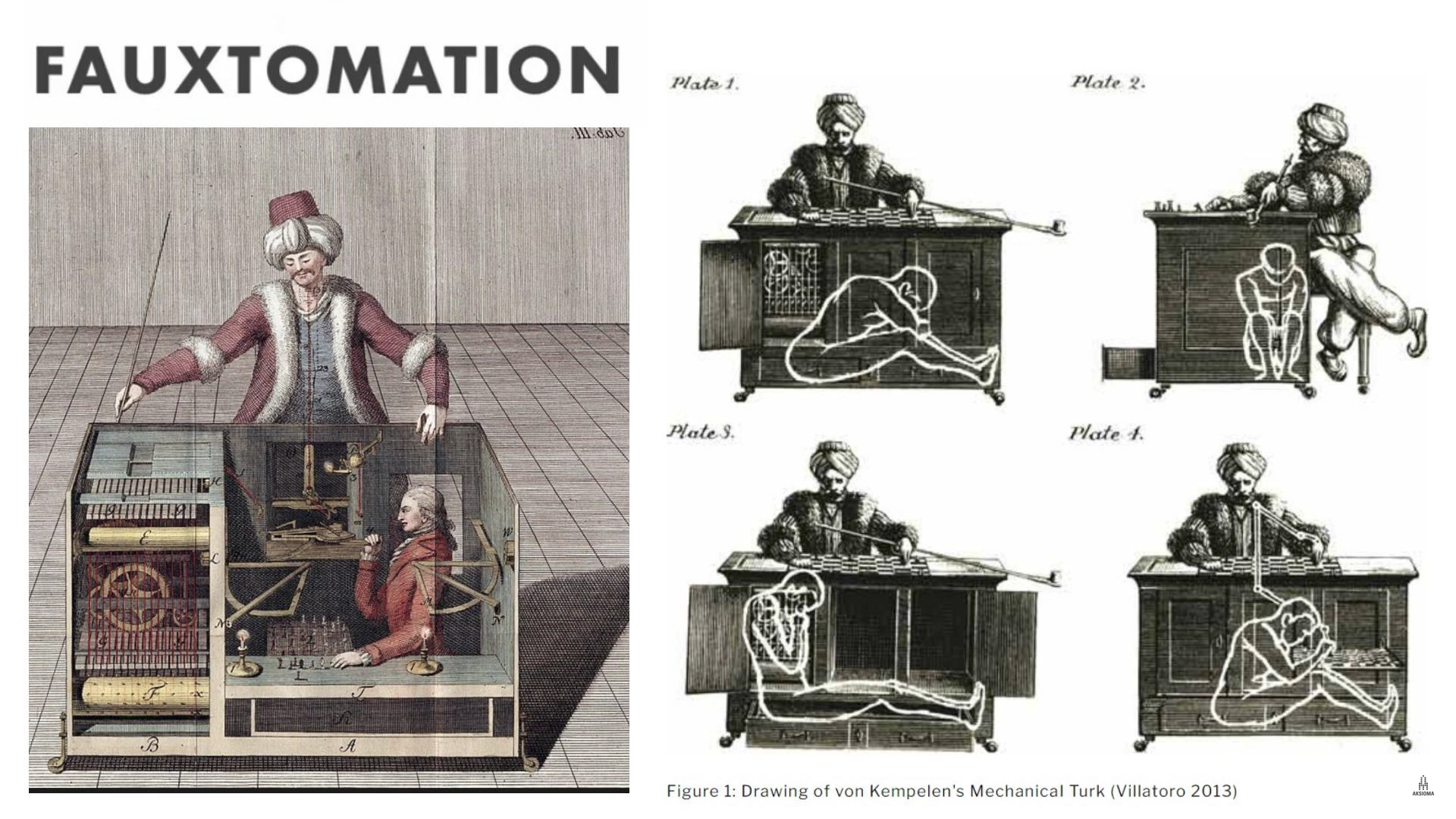

When anyone makes crazy sounding economic claims, such as wanting to raise $7 trillion for AI chips, Occam's razor suggests questioning the currency's value first.

-

Today in the collapse of western civilization: Former Blackrock manager and Young Global Leader appointed Director Internal Audit of the European Central Bank

-

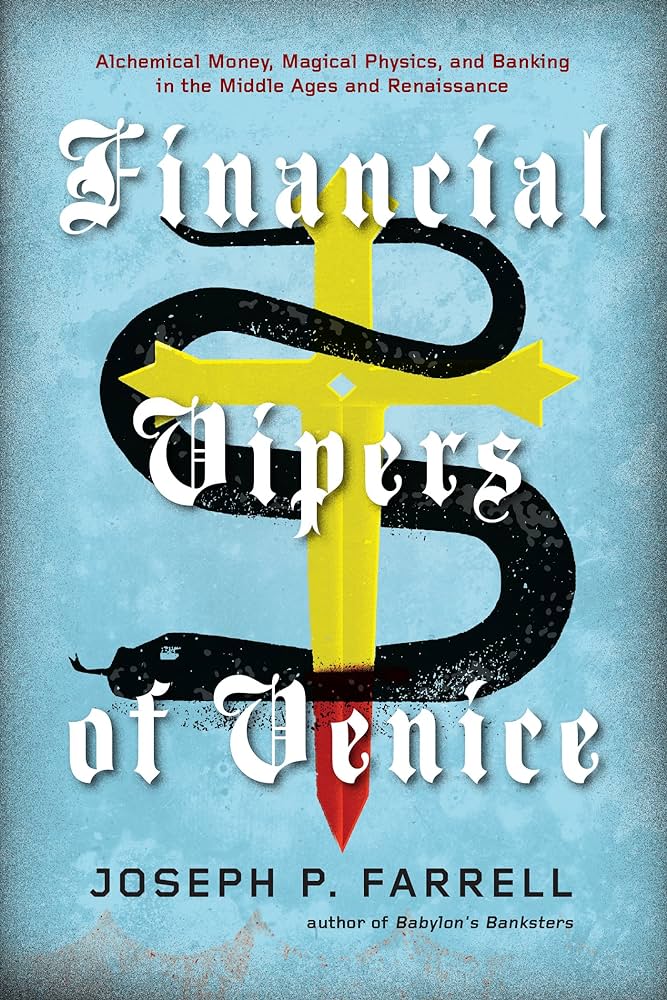

Financial Vipers of Venice: Alchemical Money, Magical Physics, and Banking in the Middle Ages and Renaissance - Book by Joseph P. Farrell (PDF)

-

“In the age of instant information man ends his job of fragmented specializing and assumes the role of information-gathering. Today information-gathering resumes the inclusive concept of “culture” exactly as the primitive food-gatherer worked in complete equilibrium with his entire environment. Our quarry now, in this new nomadic and “workless” world, is knowledge and insight into the creative processes of life and society.”

― Marshall McLuhan, Understanding Media: The Extensions of Man