tag > Crypto

-

Bitcoin mining and green energy

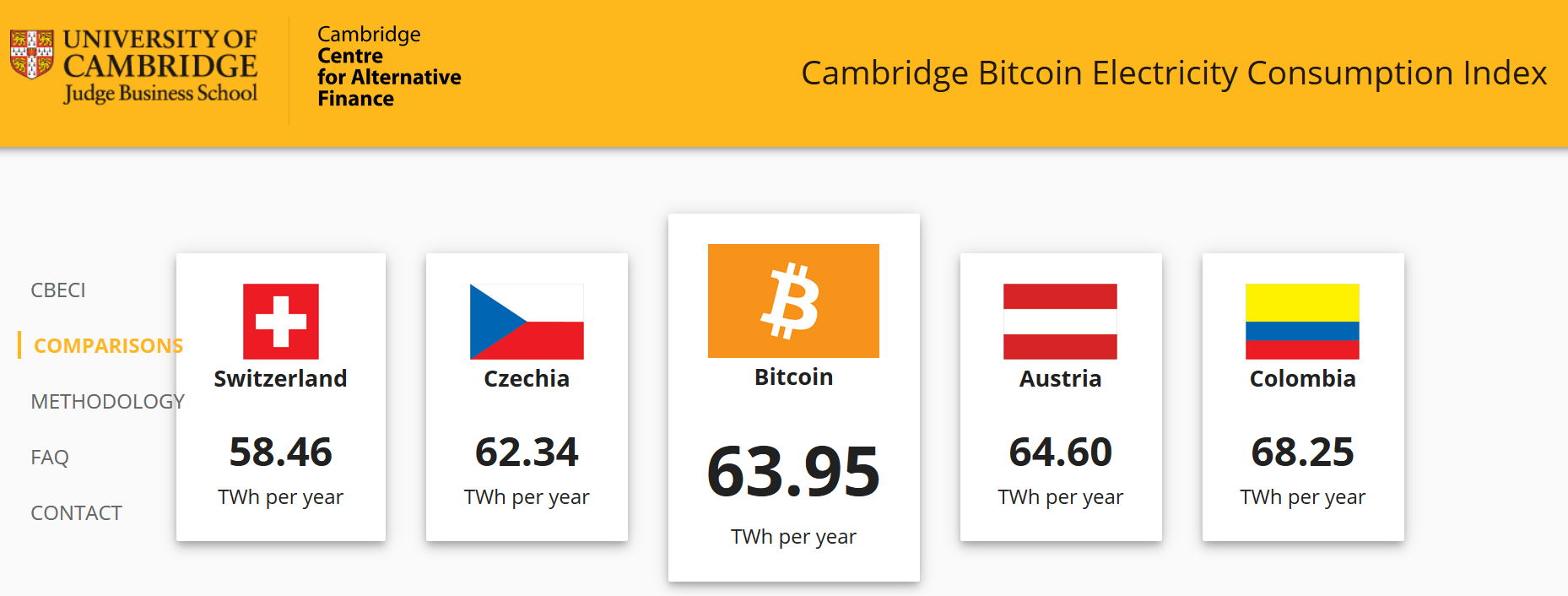

bitcoin’s BIG PROBLEM is that it uses a country’s worth of electricity to run the most inefficient payment network in human history. people don’t seem to know this! and i tell them, and they get angry. because a bunch of nerds killing each other for e-pennies is one thing, but that much CO2 is quite another. you could say “it’s their money, they can spend it how they like”, and that’s how things work, sure. but it’s still a massive externality, and this is a big problem.

-

William F. Friedman (1891 - 1969)

#Comment: To put "knowledge is power" on your gravestone is surely an effective and comedic way to illustrate the severe limits of both...

-

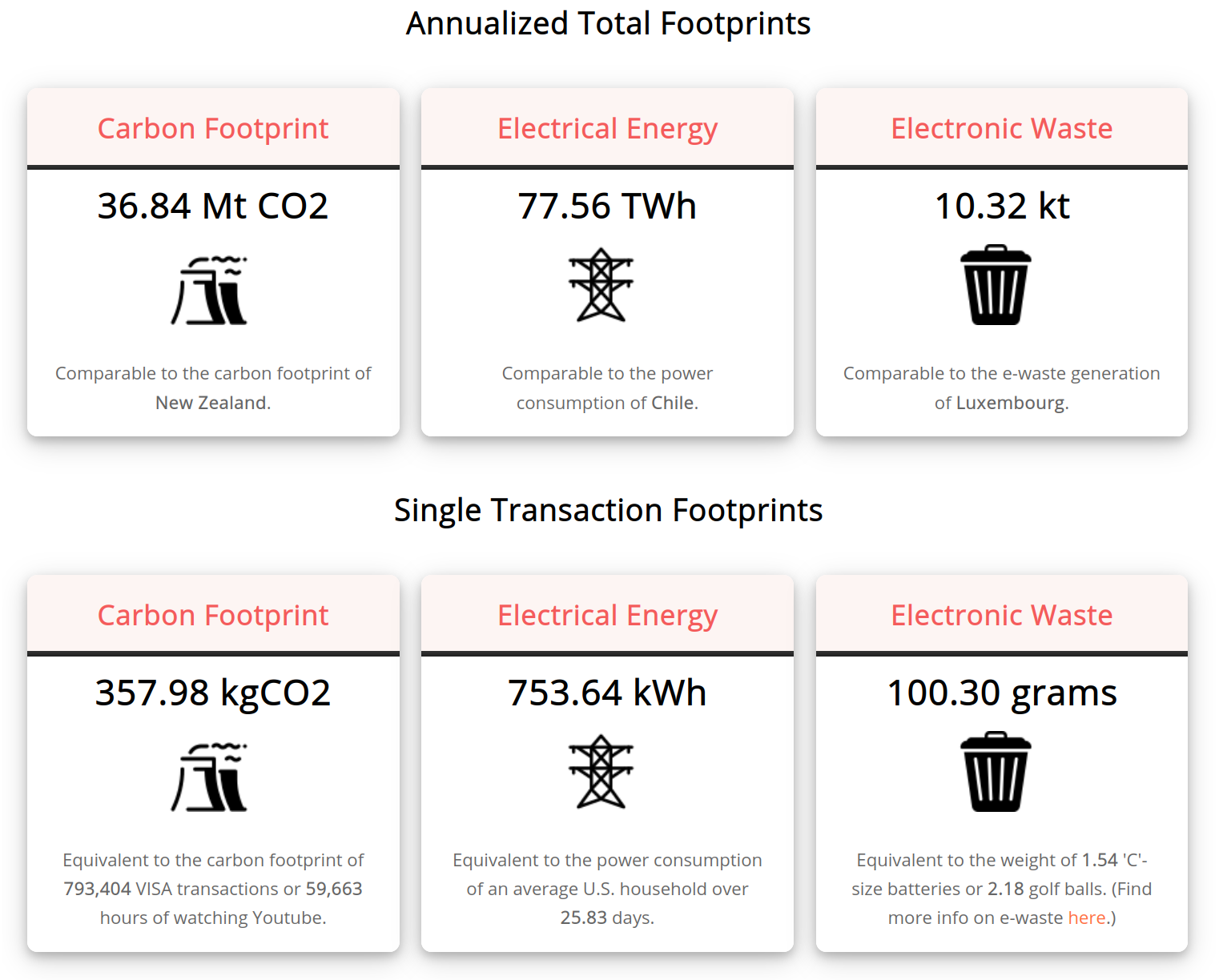

Single bitcoin transaction resource need/emissions (via)

- 360 kg CO2

- 750 kWh electricity

- 100 grams electronic waste

Clearest example of that digital and sustainability transformation have to be co-designed.

-

Press TV, the Iranian equivalent of the BBC, announcing that Iran will use bitcoin as part of its import settlement system. It will export bitcoins and import things barred to it from the U.S.

"Can Iran and the US re-engage after the election?" - Webinar with Asia Times columnist Pepe Escobar and renowned Iran expert Mohammad Marandi (October 28 2020)

-

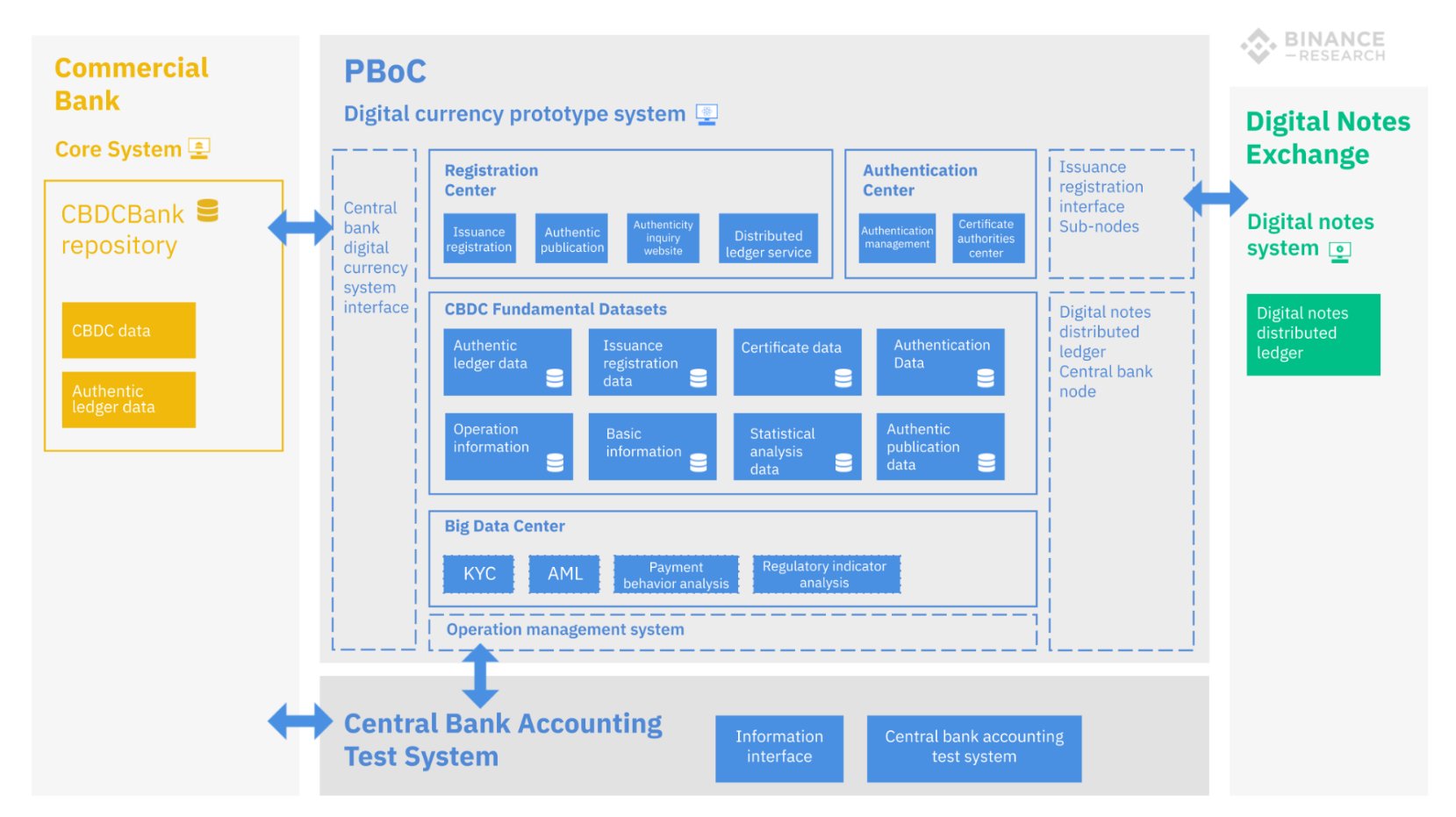

Proposed Chinese Law Outlaws All Yuan-Pegged Tokens – Except for Its CBDC

A proposed Chinese law would ban stablecoins – yuan-pegged tokens – except for the central bank’s digital currency, popularly known as the digital yuan. The People’s Bank of China (PBoC) aims to provide greater legal clarity to the regulation of its national virtual currency.

-

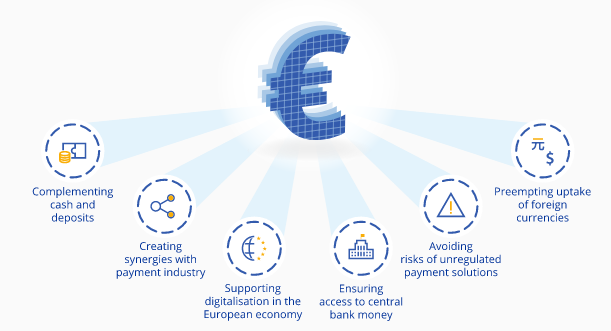

European Central Bank - Report on a digital euro

This report examines the issuance of a central bank digital currency (CBDC) – the digital euro – from the perspective of the Eurosystem. Such a digital euro can be understood as central bank money offered in digital form for use by citizens and businesses for their retail payments. It would complement the current offering of cash and wholesale central bank deposits.

-

China sets trial run for digital yuan in top city hubs

Shanghai, Beijing, Guangzhou and Hong Kong added to pilot project amid US tensions

-

China’s biggest banks are testing the digital yuan ‘on a large scale’

Selected employees at China’s largest banks are trialing the country’s much-anticipated digital currency “on a large scale” (our translation), Caijing reported on Wednesday.

-

Coronavirus Fuels P2P Connectivity: Crypto-Driven Meshnet Gives Rural Towns Internet

While the coronavirus wreaks havoc on the economy across the U.S., a number of the 1,737 residents from Clatskanie, Oregon can’t obtain an internet service provider (ISP). The situation has motivated the town to adopt a decentralized meshnet ISP called Althea and the network’s users are paid in cryptocurrency for relaying.

-

China’s Digital Currency Could Challenge Bitcoin and Even the Dollar (Bloomberg)

Now the Chinese government has begun a pilot program for an official digital version of its currency—with the likelihood of a bigger test at the Beijing Winter Olympics in 2022. Some observers think the virtual yuan could bolster the government’s power over the country’s financial system and one day maybe even shift the global balance of economic influence.

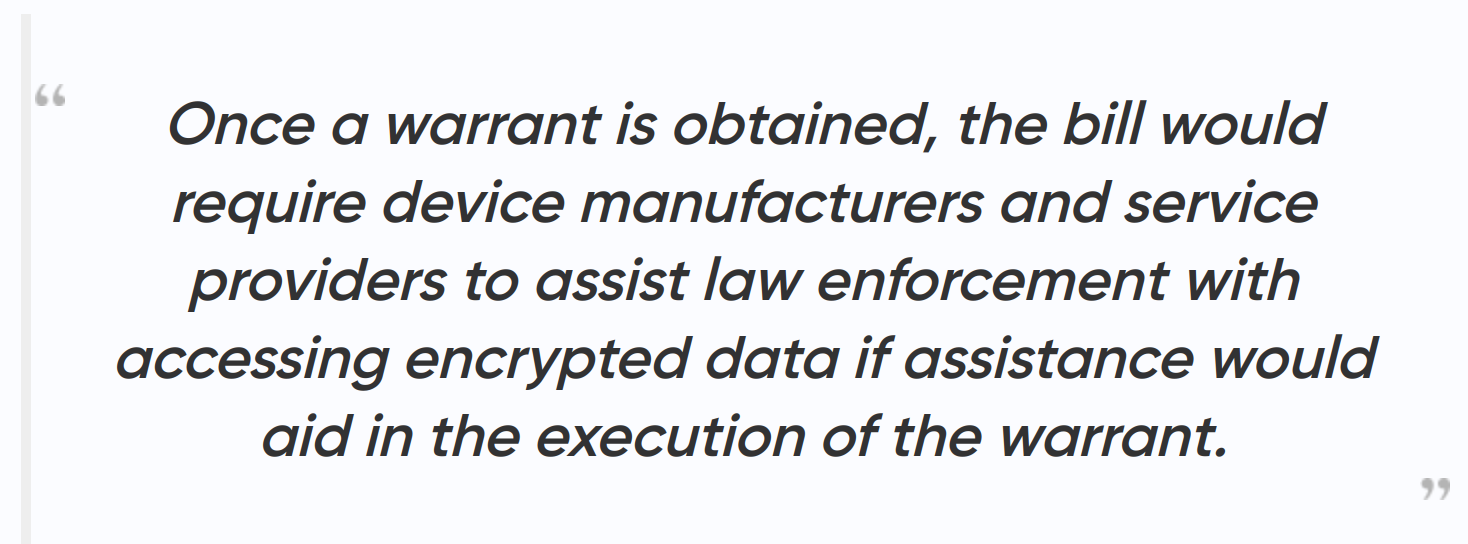

US Senators Introduce 'Lawful Access to Encrypted Data Act' — With Backdoor Mandate

US lawmakers have introduced the Lawful Access to Encrypted Data Act to ensure law enforcement can access encrypted information. This bill is “a full-frontal nuclear assault on encryption in the United States,” one expert says. It requires manufacturers of encrypted devices and operating systems to have the ability to decrypt data upon request, creating a backdoor requirement.

-

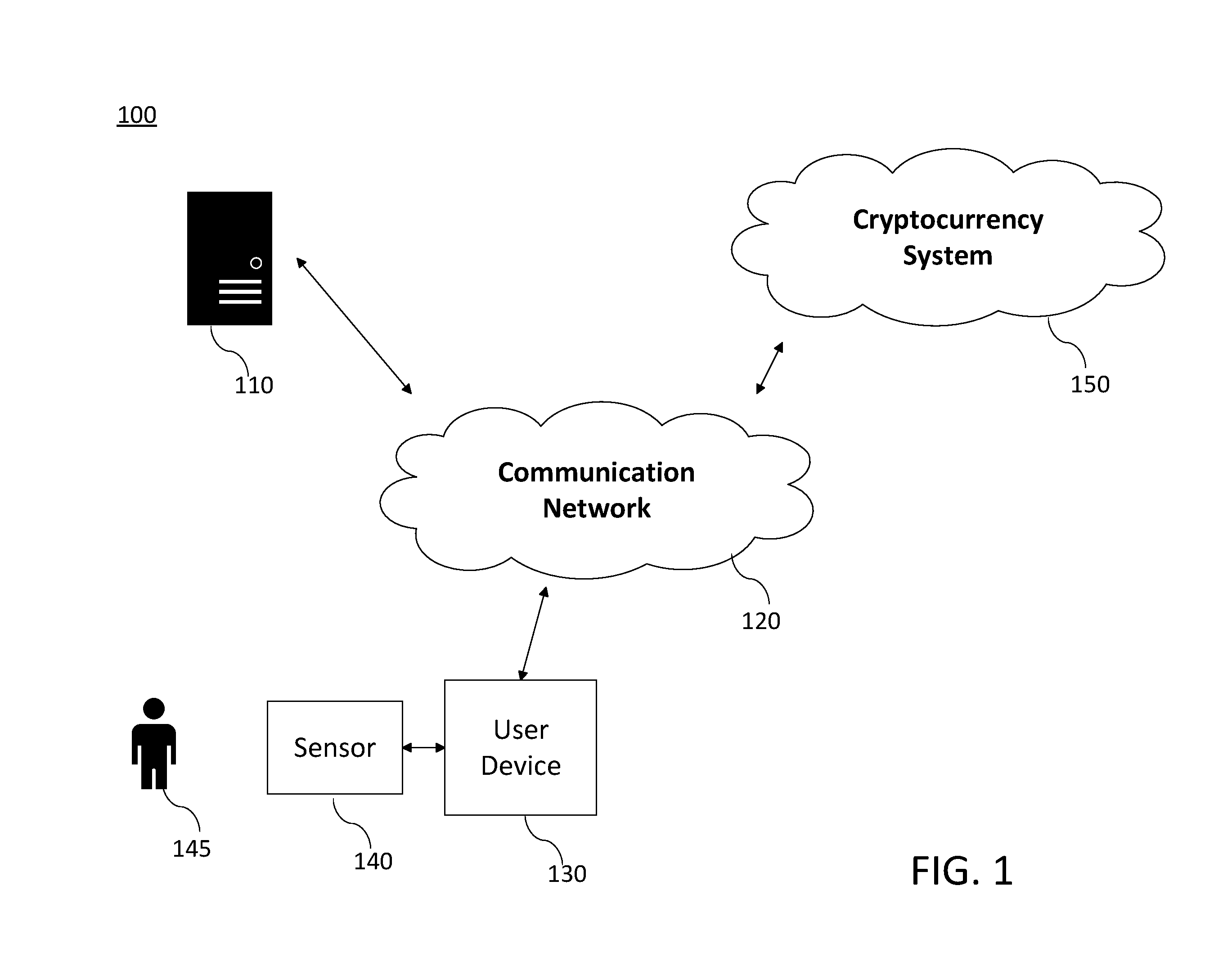

Microsoft Patents New Cryptocurrency System Using Body Activity Data

Microsoft has patented a cryptocurrency mining system that leverages human activities, including brain waves and body heat, when performing online tasks such as using search engines, chatbots, and reading ads. “A user can solve the computationally difficult problem unconsciously,” the patent reads.

#Technology #Health #Biology #Military #Crypto #Economics #Cryptocracy

-

Central Bank Digital Currencies (CBDC) News

Could Central Bank Digital Currencies Ever Replace Fiat Money? (Beincrypto)

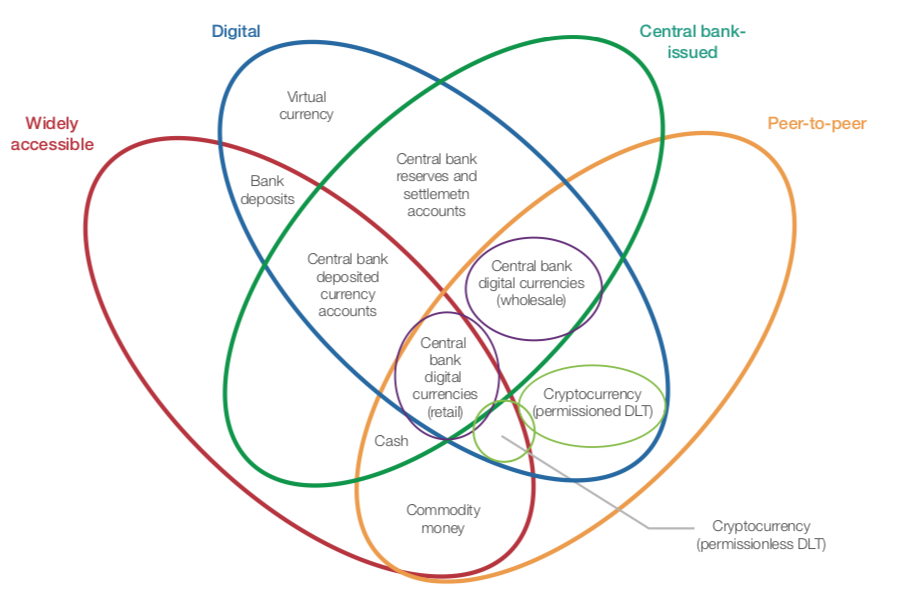

Cryptocurrencies are defying the age-old monopoly of central banks on issuing currency. A central-bank digital currency is backed by a reserve bank and can be used as a means of payment and unit of account. Central banks have been waking up to the idea of CBDC now more than ever.

Digital Pound Could Present ‘Challenges’ for UK, Says Mark Carney (Coindesk)

The outgoing governor of the Bank of England (BoE) has highlighted the potential risks to monetary governance if a central bank digital currency were to be launched in the U.K.

Carney sees big challenges as BoE eyes 'digital banknotes' (Reuters)

LONDON (Reuters) - The Bank of England must tread carefully to avoid financial stability dangers if it creates a digital equivalent to its existing banknotes, Governor Mark Carney said on Thursday.

Mark Carney concerned about financial stability risks of introducing digital currency (thelogic)

The outgoing Bank of England governor said a government-backed digital coin would to be "very carefully designed" if it is introduced.

What China’s Cyber-Cash Advantage Means for the Global Economy (insead)

The rise of cryptocurrency could threaten the dominance of the US dollar and cost the United States trillions in increased debt financing charges.

China's central bank is one step closer to issuing its digital currency - report (The Block)

The People’s Bank of China is said to have moved one step closer to issuing digital yuan. A Global Times report on Tuesday, citing “industry insiders,” said the central bank appears to have completed the development of digital currency’s basic function. The PBoC is now reportedly drafting relevant laws to circulate its digital currency

Central Bank Digital Currency ‘Incredibly Rich Area’ Says IMF (bitcoinist)

Tao Zhang, Deputy Managing Director of the International Monetary Fund (IMF) has made a strong argument for the development of Central Bank Digital Currency (CBDCs). He asserts that as a new asset class they hold tremendous promise, notably for the developing world.

IMF Weighs the Pros and Cons of a Central Bank Digital Currency (cointelegraph)

In a recent keynote speech to the London School of Economics, International Monetary Fund (IMF) Deputy Managing Director, Tao Zhang, briefed the positives and negatives of a central bank digital currency (CBDC). Zhang pointed toward greater efficiency and lower costs associated with a CBDC. “In some countries, the cost of managing cash can be very high on account of geography, and access to the payments system may not be available to the unbanked, rural, or poorer population,” he said in the Feb. 28 speech, which hit the web on March 19.

Deputy Managing Director Tao Zhang’s Keynote Address on Central Bank Digital Currency (IMF)

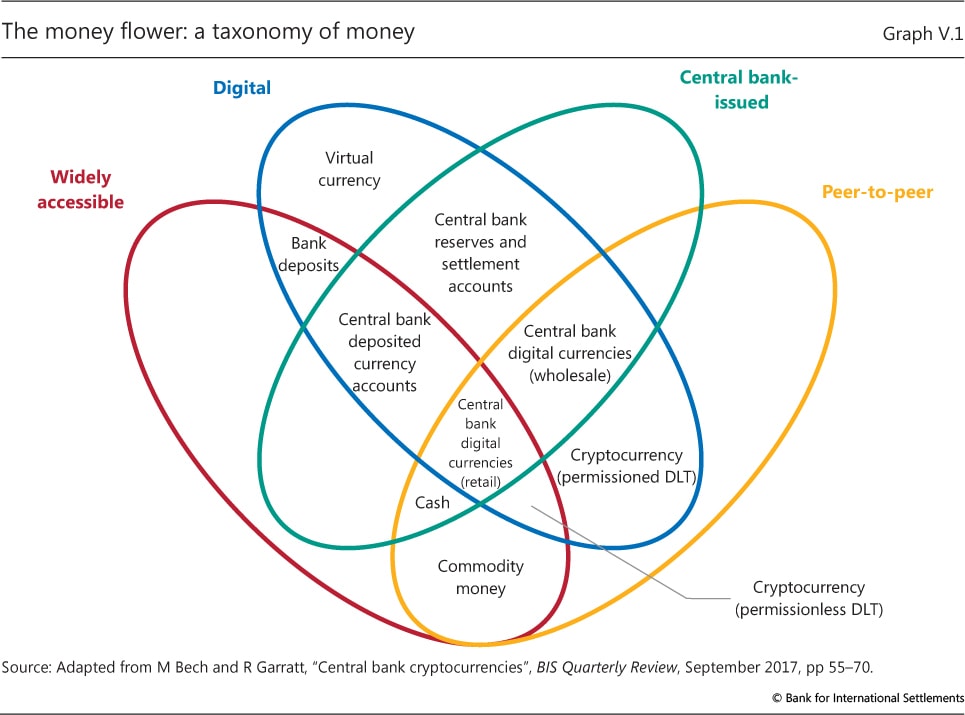

This afternoon, we’re going to take up a topic that everybody seems to be talking about these days – namely, central bank digital currency (or “CBDC” for short). This is a “widely accessible, digital form of fiat money that can be legal tender,” and a recent BIS survey of central banks shows that 80 percent were exploring CBDC.

G7 Working Group on Stablecoins - Investigating the impact of global stablecoins (BIS)

Stablecoins have many of the features of cryptoassets but seek to stabilise the price of the “coin” by linking its value to that of a pool of assets. Therefore, stablecoins might be more capable of serving as a means of payment and store of value, and they could potentially contribute to the development of global payment arrangements that are faster, cheaper and more inclusive than present arrangements. That said, stablecoins are just one of many initiatives that seek to address existing challenges in the payment system and, being a nascent technology, they are largely untested.

4 Reasons Central Banks Should Launch Retail Digital Currencies (Coindesk)

Financial stability is about preventing the financial system from becoming unstable and thus causing financial distress for consumers. Unlike cash and reserves, a retail CBDC will allow a central bank to become the lender of last resort for households and small businesses rather than for billionaires and banks. In a financial crisis, this will allow the central bank to bail out consumers instead of corporations, which in turn will reduce the incentives for mega corporations to borrow too much. That, in turn, will reduce aggregate national debt and improve financial stability.

A central bank will issue a consumer-ready digital currency within five years (omfif)

73% of central bank survey respondents would require retail CBDCs to be available under all circumstances and for all types of payments where cash is currently used.

Coronavirus: SF businesses decline cash, fearing it could spread the virus (sfchronicle)

More and more businesses are turning away from cash, fearing that the virus could be sitting on banknotes and coins, as it changes hands from person to person in everyday transactions. “Looking at the situation with COVID-19 getting worse, we decided to switch,” said Eileen Rinaldo, owner of Ritual Coffee. “Cash is notoriously covered with germs, and it’s a matter of eliminating that point of contact.”

-

New Coronavirus Stimulus Bill Introduces Digital Dollar And Digital Dollar Wallets (Forbes)

As the markets continue to drop and the U.S. looks to Congress for agreement on a massive stimulus package to save the economy from impacts of the coronavirus pandemic, the newest offer by House Democrats includes a very forward-looking kind of stimulus: the creation of a ‘digital dollar’ and the establishment of ‘digital dollar wallets.’ In what will send shock waves through the cryptocurrency and blockchain industry, particularly for those following central bank digital currencies around the world, this signals the U.S. is serious in establishing infrastructure for a central bank digital currency.

-

Russia Will Ban the Issuing and Selling of Cryptocurrencies (forbes.com)

A senior Russian official says an upcoming digital assets bill will ban the issuing and selling of cryptocurrencies. Forbes reports: "We believe there are big risks of legalizing the operations with the cryptocurrencies, from the standpoint of financial stability, money laundering prevention and consumer protection," Russia's central bank head of legal, Alexey Guznov, told Russia news agency Interfax this week in comments translated to English via Google. "We are opposed to the fact that there are institutions that organize the release of cryptocurrency and facilitate its circulation," Guznov said, adding the coming bill "directly formulates a ban on the issue, as well as on the organization of circulation of cryptocurrency, and introduces liability for violation of this ban...."

. However, Guznov admitted that Russia would not be able to completely ban bitcoin and other cryptocurrencies. "Nobody is going to ban owning cryptocurrencies," Guznov said, adding people will not be punished for owning crypto "if they made their deal in a jurisdiction that does not prohibit that."

-

China Intensifies Pursuit of 'De-Dollarization' With Digital Currency (2020, Newsmax)

Earlier this week, we covered the Federal Reserve's pursuit of a central bank digital currency (CBDC), based on the blockchain and dubbed "Fedcoin." It turns out that China is also pursuing its own version of a CBDC, and while the consequences of such a move for Americans would be very different than those of a Fedcoin, they have the potential to be even more dire. What's more, Beijing could be even closer to implementation than the Fed is.

Kung Hei Fat Choi: The Story of China’s Digital Yuan Project (2020, Medium)

It was on Thursday, July 11th 2019 that the former Peoples Bank of China governor Zhou Xiaochuan told an event in Beijing that Facebook’s Libra project was a ‘new risk’ that should motivate the government to ‘make good preparations and make the Chinese yuan a stronger currency’. This ‘new risk’ of Facebook’s Libra cryptocurrency appears to have acted as validation to the ongoing tinkering of a Chinese organisation tasked to investigate digital currencies.

-

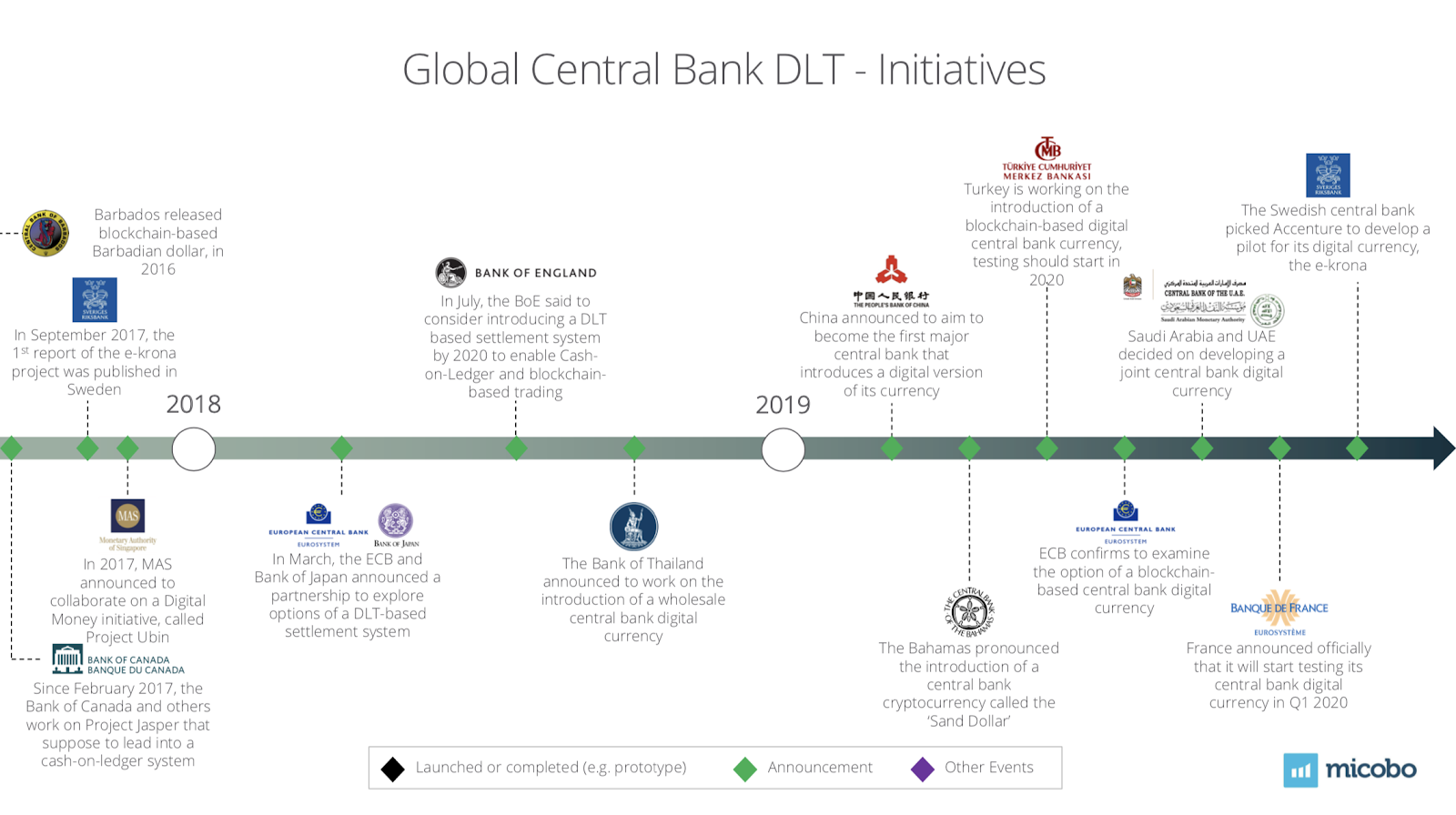

12 Countries Are Now Considering Central Bank Digital Currencies (Qz)

As money gets swept up by tech innovation, government authorities are taking a closer look at old fashioned notes and coins. More than a dozen countries are either researching, piloting, or, like China, have ongoing work in place for central bank digital currencies, according to a Bank for International Settlements report published today. "Central banks around the world are investigating a rich set of prototypes," the BIS wrote...

-

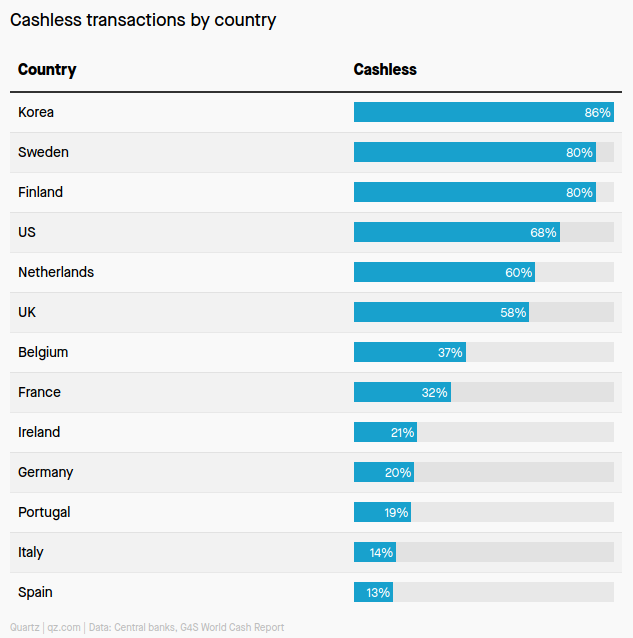

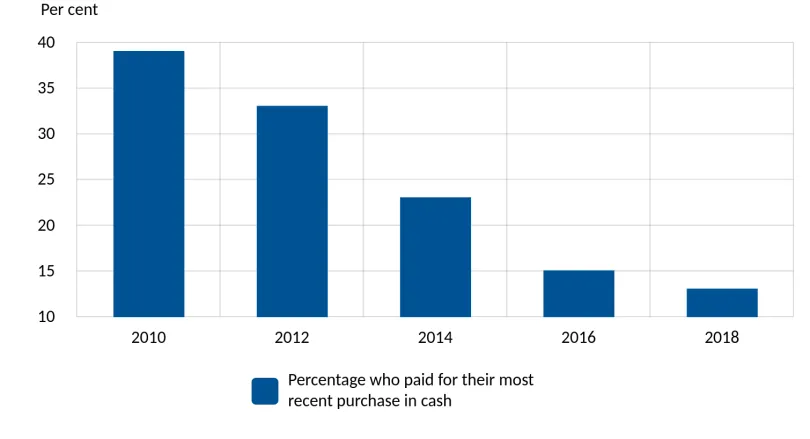

Sweden Starts Testing World's First Central Bank Digital Currency

Cash development in Sweden -

“I don’t think Facebook Libra has a chance in its current form, because central banks will not accept the basket of currencies underpinning it. The project, in this form, has thus failed.” - Ueli Maurer, Switzerland’s finance minister & President

-

Basel Committee calls for 'prudential' rules for crypto as they pose risks to banks

Image source:"Central bank cryptocurrencies" (BIS) The Bank for International Settlements, has published a discussion paper, saying that the growth of cryptocurrencies and related services could pose risks to financial stability and banks, and therefore, a “conservative prudential” treatment to cryptocurrency exposures should be applied.

“If banks are authorized, and decide, to acquire crypto-assets or provide related services, the Committee is of the view that they should apply a conservative prudential treatment to such exposures, especially for high-risk crypto-assets,” it said.

Related: They’ve Got a Secret - by Michael Hirsh (NYTimes, 2013).

Related: Comment by Carroll Quigley about the BIS.