tag > Economics

-

Jeff Bezos sold $3.4bn of Amazon stock just before Covid-19 collapse (Guardian)

Millions of people across the world have lost their jobs, and trillions of dollars have been wiped off the value of stock markets. But not everyone has lost out. Jeff Bezos, the world’s wealthiest person, is $5.5bn (£4.3bn) richer today than he was at the start of the year. His paper fortune, held mostly in Amazon shares, rose by $3.9bn on Thursday alone to $120bn – enough to buy 188,000 standard gold bars. Bezos, 56, benefited this week from the best three-day stock market rally since 1933 helping Amazon’s share price to recover almost all of its losses this month to trade at about $1,920, though that was slightly down on their peak of $2,170 in February. Bezos owns about 12% of Amazon’s shares.

-

Wann endet Fracking? (When does Fracking come to an end) (Telepolis, DE only)

Der Ölpreiskrieg zwischen Russland und Saudi-Arabien könnte das Ende der US-Fracking-Industrie einläuten. Die amerikanische Ölindustrie bereitet sich nicht nur wegen der Corona-Pandemie auf schwere Zeiten vor. Ab dem ersten April werden die seit drei Jahren geltenden Förderlimits der OPEC aufgehoben. Dann dürfen sämtliche Länder soviel produzieren, wie sie wollen. Der aktuelle Preis für ein Barrel Rohöl von 25 US-Dollar könnte unter 10 US-Dollar fallen. Das gilt allerdings als unwahrscheinlich. Für die Frackingindustrie ist selbst der aktuelle Preis viel zu niedrig, um am Leben bleiben zu können.

-

Amid pandemic, Pentagon urges ‘hyper-vigilance’ against foreign investment (defensenews)

The Pentagon’s top acquisition official is worried that adversary nations may use the economic downturn caused by the new coronavirus pandemic to buy out American-made technologies. During a Wednesday news conference, Ellen Lord warned that it “is critically important that we understand that during this crisis, the [defense-industrial base] is vulnerable to adversarial capital, so we need to ensure that companies can stay in business without losing their technology.” The Pentagon over the last several years has become increasingly vocal about concerns that foreign nations — primarily China — are investing in U.S. startup companies whose technologies could have national security applications. Those startups have been willing to accept Chinese funds in exchange for Beijing having ownership or access to certain technologies.

-

World's wind power capacity up by fifth after record year (Guardian)

The world’s wind power capacity grew by almost a fifth in 2019 after a year of record growth for offshore windfarms and a boom in onshore projects in the US and China. The Global Wind Energy Council found that wind power capacity grew by 60.4 gigawatts, or 19%, compared with 2018, in one of the strongest years on record for the global wind power industry.

Oil price may fall to $10 a barrel as world runs out of storage space (Guardian)

Facilities thought to be 75% full with Saudi Arabia due to ramp up output as demand falters amid coronavirus shutdowns

-

After series of cuts, India axes Bayer's GM cotton royalty (Reuters)

India has axed the royalties that local seed companies pay to German drugmaker Bayer AG for Monsanto’s genetically modified (GM) cotton, a government order said, after cutting them back since 2016.95% of cotton grown in India is by Monsanto; 75% debt of farmers is on account of input costs; over 3.2 lakh Farmer Suicides due to debt.

-

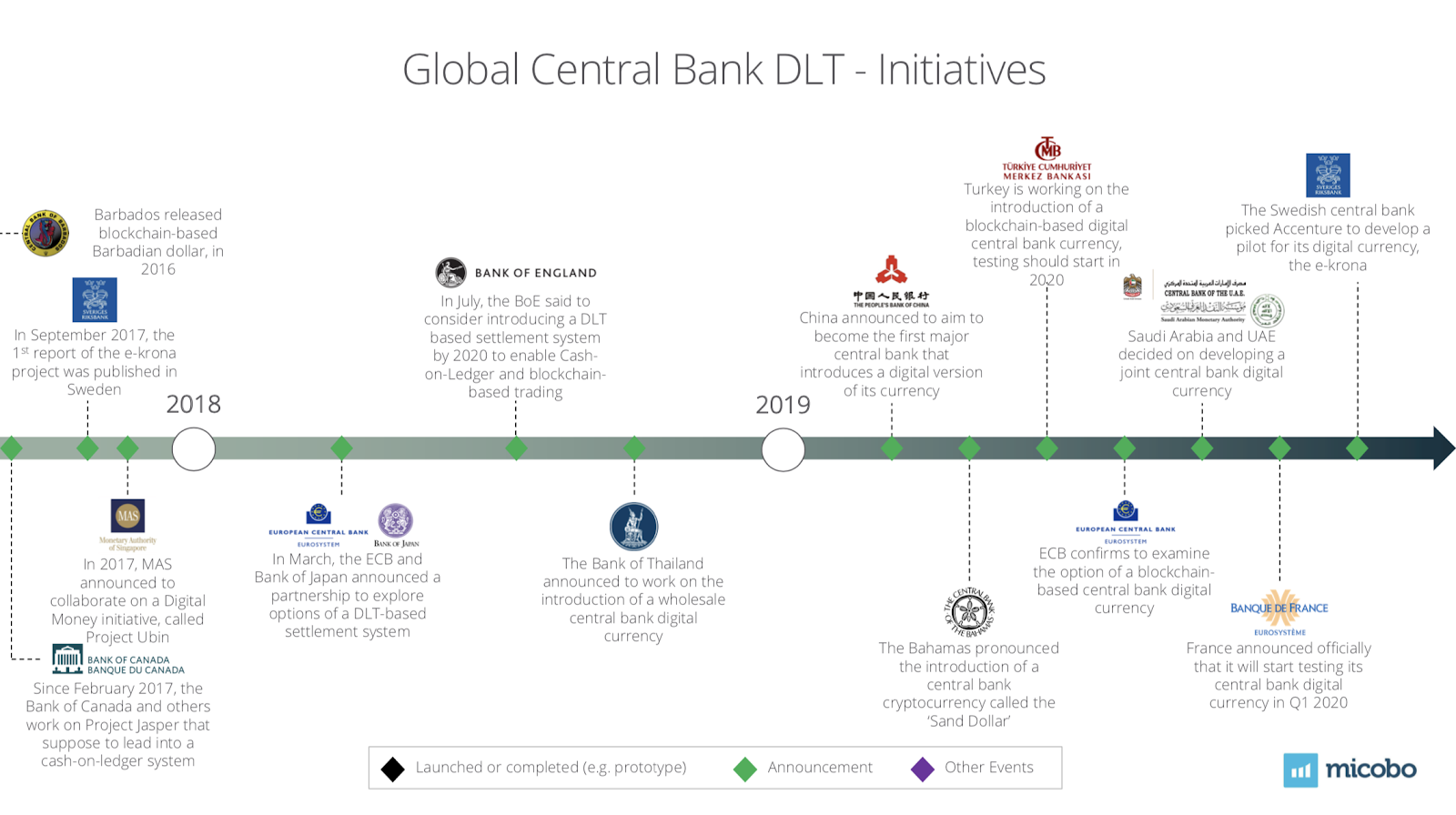

Central Bank Digital Currencies (CBDC) News

Could Central Bank Digital Currencies Ever Replace Fiat Money? (Beincrypto)

Cryptocurrencies are defying the age-old monopoly of central banks on issuing currency. A central-bank digital currency is backed by a reserve bank and can be used as a means of payment and unit of account. Central banks have been waking up to the idea of CBDC now more than ever.

Digital Pound Could Present ‘Challenges’ for UK, Says Mark Carney (Coindesk)

The outgoing governor of the Bank of England (BoE) has highlighted the potential risks to monetary governance if a central bank digital currency were to be launched in the U.K.

Carney sees big challenges as BoE eyes 'digital banknotes' (Reuters)

LONDON (Reuters) - The Bank of England must tread carefully to avoid financial stability dangers if it creates a digital equivalent to its existing banknotes, Governor Mark Carney said on Thursday.

Mark Carney concerned about financial stability risks of introducing digital currency (thelogic)

The outgoing Bank of England governor said a government-backed digital coin would to be "very carefully designed" if it is introduced.

What China’s Cyber-Cash Advantage Means for the Global Economy (insead)

The rise of cryptocurrency could threaten the dominance of the US dollar and cost the United States trillions in increased debt financing charges.

China's central bank is one step closer to issuing its digital currency - report (The Block)

The People’s Bank of China is said to have moved one step closer to issuing digital yuan. A Global Times report on Tuesday, citing “industry insiders,” said the central bank appears to have completed the development of digital currency’s basic function. The PBoC is now reportedly drafting relevant laws to circulate its digital currency

Central Bank Digital Currency ‘Incredibly Rich Area’ Says IMF (bitcoinist)

Tao Zhang, Deputy Managing Director of the International Monetary Fund (IMF) has made a strong argument for the development of Central Bank Digital Currency (CBDCs). He asserts that as a new asset class they hold tremendous promise, notably for the developing world.

IMF Weighs the Pros and Cons of a Central Bank Digital Currency (cointelegraph)

In a recent keynote speech to the London School of Economics, International Monetary Fund (IMF) Deputy Managing Director, Tao Zhang, briefed the positives and negatives of a central bank digital currency (CBDC). Zhang pointed toward greater efficiency and lower costs associated with a CBDC. “In some countries, the cost of managing cash can be very high on account of geography, and access to the payments system may not be available to the unbanked, rural, or poorer population,” he said in the Feb. 28 speech, which hit the web on March 19.

Deputy Managing Director Tao Zhang’s Keynote Address on Central Bank Digital Currency (IMF)

This afternoon, we’re going to take up a topic that everybody seems to be talking about these days – namely, central bank digital currency (or “CBDC” for short). This is a “widely accessible, digital form of fiat money that can be legal tender,” and a recent BIS survey of central banks shows that 80 percent were exploring CBDC.

G7 Working Group on Stablecoins - Investigating the impact of global stablecoins (BIS)

Stablecoins have many of the features of cryptoassets but seek to stabilise the price of the “coin” by linking its value to that of a pool of assets. Therefore, stablecoins might be more capable of serving as a means of payment and store of value, and they could potentially contribute to the development of global payment arrangements that are faster, cheaper and more inclusive than present arrangements. That said, stablecoins are just one of many initiatives that seek to address existing challenges in the payment system and, being a nascent technology, they are largely untested.

4 Reasons Central Banks Should Launch Retail Digital Currencies (Coindesk)

Financial stability is about preventing the financial system from becoming unstable and thus causing financial distress for consumers. Unlike cash and reserves, a retail CBDC will allow a central bank to become the lender of last resort for households and small businesses rather than for billionaires and banks. In a financial crisis, this will allow the central bank to bail out consumers instead of corporations, which in turn will reduce the incentives for mega corporations to borrow too much. That, in turn, will reduce aggregate national debt and improve financial stability.

A central bank will issue a consumer-ready digital currency within five years (omfif)

73% of central bank survey respondents would require retail CBDCs to be available under all circumstances and for all types of payments where cash is currently used.

Coronavirus: SF businesses decline cash, fearing it could spread the virus (sfchronicle)

More and more businesses are turning away from cash, fearing that the virus could be sitting on banknotes and coins, as it changes hands from person to person in everyday transactions. “Looking at the situation with COVID-19 getting worse, we decided to switch,” said Eileen Rinaldo, owner of Ritual Coffee. “Cash is notoriously covered with germs, and it’s a matter of eliminating that point of contact.”

-

Softbank Looking to Cut Alibaba, Sprint Share Stakes (Variety)

Softbank, the giant Japanese investment group that has made huge bets on the sharing economy, is looking to cut its stake in Alibaba, according to reports. And possibly in Sprint too. On Monday, Masayoshi Son, founder and CEO of the heavily indebted Softbank, said that he would raise or monetize $41 billion of assets, in order to put the group on a sounder financial footing.

On Tuesday, Bloomberg reported that more than a third of the total would be raised by selling a $14 billion tranche of shares in Chinese e-commerce giant Alibaba. That would represent about 3% of Alibaba’s total equity capital, which is traded in New York in ADR form and, in a secondary listing, as shares in Hong Kong. Softbank has long been an ally of Alibaba and has made vast paper profits on its 25% Alibaba holding. But the dire performance of Softbank’s other investments has depressed Softbank’s share price so much that at one point recently its holding in Alibaba was more valued more highly than the entire Tokyo-traded Softbank group.

SoftBank’s Son Still Betting on Himself After Go-Private Talks (Bloomberg)

SoftBank Group Corp.’s Masayoshi Son is continuing to bet on himself, even after he reportedly considered and then abandoned the idea of taking his conglomerate private. Son discussed the idea with investors including Elliott Management and the Abu Dhabi sovereign-wealth fund Mubadala in the past week, the Financial Times reported, before moving ahead with a plan to sell assets instead.

-

Arab nations sound alarm over oil tanker moored off Yemen (thenational)

Six Arab countries are urging the UN Security Council to exercise “maximum efforts” to persuade Yemen’s Houthi rebels to allow the United Nations to inspect a tanker moored in the Red Sea while loaded with over a million barrels to prevent “widespread environmental damage, a humanitarian disaster and the disruption of maritime commerce”. In a letter to the council circulated on Thursday, they warned that in the event of an explosion or leak “the possibility of a spill of 181 million litres of oil in the Red Sea would be four times worse than the oil disaster of the Exxon Valdez Exxon, which took place in Alaska in 1989”.

-

Recent Corona News

- IBM, Amazon, Google and Microsoft partner with White House to provide compute resources for COVID-19 research (Techcrunch)

- Business unusual: Time for tech to move fast and fix things (aljazeera)

- China’s factories work 24/7 to build medical ventilators for Milan, New York amid spreading global Covid-19 pandemic (SCMP)

- Coronavirus Stimulus Offered By House Financial Services Committee Creates New Digital Dollar (Forbes)

- Am Telefon zur Corona-Virologie: Karin Mölling (KenFM, Excellent DE Only Interview)

- Corona virus COVID-19- hype and hysteria? Demystification of the nightmare! (Interview with Prof. Dr. med. Sucharit Bhakdi)

- Italian professor repeats warning coronavirus may have spread outside China last year (SCMP)

- Satellite images show resurgence of air pollution over China (ctvnews)

- Traffic and Pollution Plummet as U.S. Cities Shut Down for Coronavirus (NYTimes)

- Older people would rather die than let Covid-19 harm US economy – Texas official (Guardian)

- Warmer Weather May Slow, but Not Halt, Coronavirus (NYTimes)

- India to be under complete lockdown for 21 days starting midnight: Narendra Modi (econtimes)

- Why are the infection rates so high in Italy? (fefe)

- Canadian doctor who works in Gaza makes 3D-printed face shields for COVID-19 (cbc)

- German Government Corona Hackaton

- Coronavirus Treatment Developed by Gilead Sciences Granted “Rare Disease” Status, Potentially Limiting Affordability (intercept)

- The Coronavirus COVID-19 Pandemic: The Real Danger is “Agenda ID2020” (globalresearch)

- Welcome to the Virosphere (NYTimes)

- Afro-Jazz-Star Dibango ist tot: Makossa-König und Saxo-Genie (SZ)

- Last groups of Russian medical experts arrive in Italy (TASS)

- Russia sends aid to Italy to cope with COVID-19 and backs NATO dialogue (TASS)

- Russia helps Italy to fight coronavirus without any strings attached — Kremlin (TASS)

- Antibiotic resistance: the hidden threat lurking behind Covid-19 (Stat News)

- Statistikprobleme beim Coronavirus - Die große Meldelücke (Spiegel)

EU Shrugs Off US Sanctions, Gives Millions In Coronavirus Aid To Iran (ZeroHedge)

-

New Coronavirus Stimulus Bill Introduces Digital Dollar And Digital Dollar Wallets (Forbes)

As the markets continue to drop and the U.S. looks to Congress for agreement on a massive stimulus package to save the economy from impacts of the coronavirus pandemic, the newest offer by House Democrats includes a very forward-looking kind of stimulus: the creation of a ‘digital dollar’ and the establishment of ‘digital dollar wallets.’ In what will send shock waves through the cryptocurrency and blockchain industry, particularly for those following central bank digital currencies around the world, this signals the U.S. is serious in establishing infrastructure for a central bank digital currency.

-

Coronavirus Is Speeding Up the Amazonification of the Planet (onezero)

A woman works at a packing station at the 855,000-square-foot Amazon fulfillment center in Staten Island, New York City, on February 5, 2019. Photo: Johannes Eisele/AFP/Getty Images This Amazonification is already underway. The consumer shift to online retailers away from meatspace malls and boutique shops has been the subject of hand-wringing and prognostication for years, and, if anything, the evolution was moving slower than many feared. Walmart, after all, remained the world’s largest retailer long after fears of Amazon’s dominance had become mainstream. Warehouse automation, a key goal of Amazon, was advancing but not yet leaving humans out in the cold by any stretch of the imagination. Yet Amazon caught up in 2019, and if anything, this coronavirus-fueled surge may accelerate its supremacy over the retail market.

-

A debt jubilee is the only way to avoid a depression - Washington Post Opinion - by Michael Hudson, president of the Institute for the Study of Long-Term Economic Trends and distinguished research professor of economics at the University of Missouri at Kansas City.

Jesus & His Mission The word “Jubilee” comes from the Hebrew word for “trumpet” — yobel. In Mosaic Law, it was blown every 50 years to signal the Year of the Lord, in which personal debts were to be canceled. When Jesus delivered his first sermon, the Gospel of Luke describes him as unrolling the scroll of Isaiah and announcing that he had come to proclaim the Year of the Lord, the Jubilee Year.

The coronavirus outbreak is serving as a mind-expansion exercise, making hitherto unthinkable solutions thinkable. Debts that can’t be paid won’t be. A debt jubilee may be the best way out.

-

TSMC weighs new US plant to respond to Trump pressure (March 2020, Nikkei)

Taiwan Semiconductor Manufacturing Co. is stepping up its evaluation of whether to build an advanced chip facility in the U.S. in response to pressure from Washington, which wants the world's biggest contract chipmaker to produce on American soil over security concerns. TSMC, which makes chips for U.S. F-35 fighter jets and supplies almost all global chip developers, including Apple, Huawei, Qualcomm and Nvidia, is actively considering a U.S. plant, two sources briefed on the plan told the Nikkei Asian Review. A new plant would aim to be the world's most cutting-edge, producing semiconductors more advanced than the 5-nanometer node chips that Apple will adopt in its latest 5G iPhones this year, they said.

-

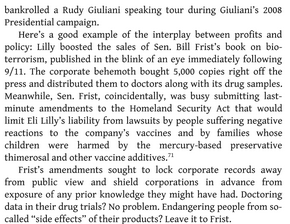

Who controls Gilead Sciences, the US pharmaceutical producing a COVID-19 treatment which was rapidly approved by NIH and praised by the WHO? Donald Rumsfeld was chair of the board and remains a top shareholder.

Recent Gilead News:

Might The Experimental Drug Remdesivir Work Against COVID-19? (NPR, 2020)

With a coronavirus vaccine at least a year away, some scientists are investigating existing medicines and compounds that might work as effective treatments. A drug called Remdesivir is now in the spotlight.

Why Is Everyone Talking About Gilead Sciences? (fool, 2020)

The big biotech has a drug that struck out on one super-contagious disease but could be the best option on the scene for treating another. Chinese health officials scrambled to begin two clinical studies evaluating remdesivir in treating patients with COVID-19, the disease caused by the novel coronavirus. Gilead provided the drug at no charge for these studies and gave input on how the studies should be designed and conducted. In late February 2020, the National Institutes for Health (NIH) began the first U.S. clinical trials of remdesivir in treating COVID-19. Gilead also initiated two late-stage clinical studies of its own in Asian countries and other countries with high numbers of COVID-19 cases in early March. World Health Organization assistant director-general Bruce Aylward even said that remdesivir is the "one drug right now that we think may have efficacy."

FDA chief highlights Gilead drug’s availability under compassionate use for Covid-19 (medcity, 2020)

In remarks at the daily Coronavirus Task Force press briefing, FDA Commissioner Stephen Hahn pointed out that the drug, remdesivir, is available under compassionate use in addition to the ongoing clinical trials being run by Gilead Sciences and the NIH.

Gilead Sciences Could Be the First to Beat the Coronavirus (Yahoo Finance, 2020)

Gilead Sciences Stock Price The coronavirus’ grip on the market continues. Since the beginning of February, the S&P 500 has shed 8.5% of its value, a reflection of the effect the outbreak is having on the global economy. Amidst the bloodbath, one specific group of stocks is holding up. These are the drug companies those infected, the public at large and investors are hoping can halt the virus from spreading any further. Gilead Sciences (GILD) is among those leading the search for a treatment and is currently being rewarded by the market. In contrast to the broader market, GILD stock is up 23% year-to-date.

Gilead puts emergency access to experimental coronavirus drug on hold amid surging demand (Retuers, 23.march.2010)

Gilead Sciences Inc said on Sunday it was temporarily putting new emergency access to its experimental coronavirus drug remdesivir on hold due to overwhelming demand and that it wanted most people receiving the drug to participate in a clinical trial to prove if it is safe and effective.

Enter the Donald:

Donald H. Rumsfeld Named Chairman of Gilead Sciences (Gilead, 1997)

Gilead Sciences Inc. (Nasdaq: GILD) today announced that board member Donald H. Rumsfeld will assume the position of Chairman, effective immediately. Mr. Rumsfeld succeeds Michael L. Riordan, M.D., who founded Gilead in 1987 and has served as Chairman since 1993. Dr. Riordan will continue to serve as a director on the board.

Gilead Sciences’s criminal drug testing: a cover for the Pentagon’s illegal arms testing? (voltairenet, 2018)

The company Gilead Sciences has deliberately carried on with testing Sovaldi (Sofosbuvir), its drug against Hepatitis C, in violation of international laws and without first obtaining its patients’ consent.

Donald_H._Rumsfeld and Gilead_Sciences (SourceWatch)

"Rummy was Chair of the Board of Directors at Gilead Sciences until named to the Bush cabinet and, like [Vice President Dick] Cheney, still has ties that bind to the 'old company.' Now isn't it an 'amazing coincidence' that the drug Tamiflu patented by Gilead Sciences is being pushed by the National Institutes of Allergies and Infectious Diseases as the NUMBER ONE choice for flu, which, wonder of wonders, is sweeping through in one epidemic after another," Free Market News related October 21, 2005, from a January 2004 web posting.

Donald Rumsfeld makes $5m killing on bird flu drug (independent, 2006)

Donald Rumsfeld has made a killing out of bird flu. The US Defence Secretary has made more than $5m (£2.9m) in capital gains from selling shares in the biotechnology firm that discovered and developed Tamiflu, the drug being bought in massive amounts by Governments to treat a possible human pandemic of the disease.

Donald Rumsfeld's controversial links to drug company behind Tamiflu (dailymail, 2009)

The drug company behind the swine flu medicine Tamiflu is at the centre of controversy over its links to former US Defence Secretary Donald Rumsfeld.

Rumsfeld's growing stake in Tamiflu (CNN, 2007)

Defense Secretary, ex-chairman of flu treatment rights holder, sees portfolio value growing.

Tamiflu and Donald Rumsfeld (Snoops)

Does Secretary of Defense Donald Rumsfeld own Tamiflu stock? Status: True.

Rumsfeld to Avoid Bird-Flu Drug Issues (NYTimes, 2006)

Defense Secretary Donald H. Rumsfeld has recused himself from government decisions concerning medications to prevent or treat avian flu, rather than sell his stock holdings in the company that patented the antiviral agent Tamiflu, according to a Pentagon memorandum issued Thursday. The memorandum, to Mr. Rumsfeld's staff from the Pentagon general counsel, said the defense secretary would not take part in decisions that may affect his financial interests in Gilead Sciences Inc. Before becoming defense secretary in January 2001, Mr. Rumsfeld was chairman of Gilead. On each of his annual financial disclosure statements, he has listed continued stock holdings in the company. Gilead holds the patent on Tamiflu, but contracts for it are signed with an American subsidiary of F. Hoffman-LaRoche Ltd., which holds marketing and manufacturing rights. Mr. Rumsfeld will remain involved in matters related to the Pentagon response to an outbreak, so long as none affect Gilead.

The Fight Against Monsanto's Roundup: The Politics of Pesticides (Book by Mitchel Cohen)

Gilead Science, Eugenics Mass Murder of the Poor (2014)

#Health #Biotech #Politics #Economics #Military #Cryptocracy

-

64% rise in rental properties across Dublin in midst of Covid_19 crisis according to property website @daftmedia as landlords start withdrawing their rentals from short-term listing sites like AirBnB and are offering them into the market instead.

-

Russia Will Ban the Issuing and Selling of Cryptocurrencies (forbes.com)

A senior Russian official says an upcoming digital assets bill will ban the issuing and selling of cryptocurrencies. Forbes reports: "We believe there are big risks of legalizing the operations with the cryptocurrencies, from the standpoint of financial stability, money laundering prevention and consumer protection," Russia's central bank head of legal, Alexey Guznov, told Russia news agency Interfax this week in comments translated to English via Google. "We are opposed to the fact that there are institutions that organize the release of cryptocurrency and facilitate its circulation," Guznov said, adding the coming bill "directly formulates a ban on the issue, as well as on the organization of circulation of cryptocurrency, and introduces liability for violation of this ban...."

. However, Guznov admitted that Russia would not be able to completely ban bitcoin and other cryptocurrencies. "Nobody is going to ban owning cryptocurrencies," Guznov said, adding people will not be punished for owning crypto "if they made their deal in a jurisdiction that does not prohibit that."

-

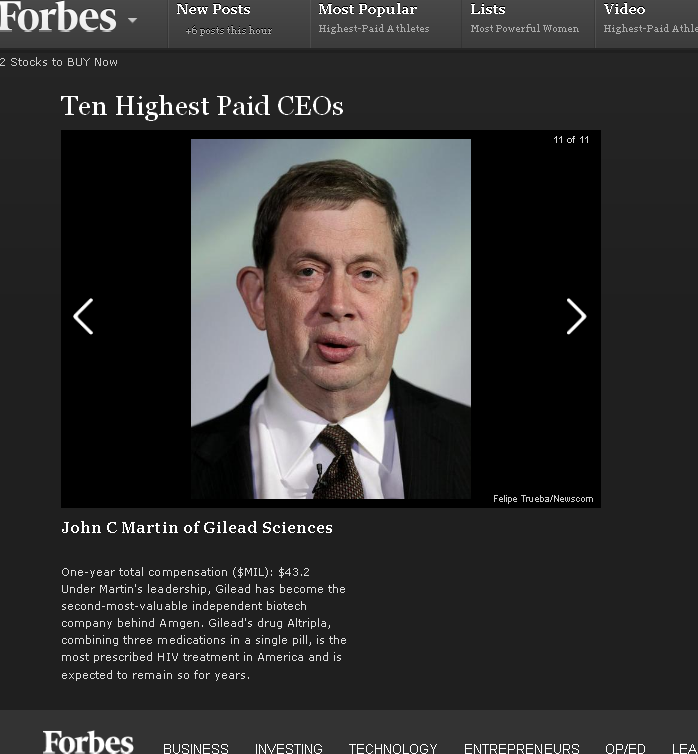

Operation Bernhard (wikipedia)

Operation Bernhard was an exercise by Nazi Germany to forge British bank notes. The initial plan was to drop the notes over Britain to bring about a collapse of the British economy during the Second World War.

-

Recent Corona News Rundown

- Slavoj Zizek: Biggest threat Covid-19 epidemic poses is not our regression to survivalist violence, but BARBARISM with human face (RT)

- Israeli Nobel Laureate: Coronavirus spread is slowing (jpost)

- Goldman Sachs gives CEO 20% raise as it forecasts crash for America (RT)

- Senators deny they’re corrupt after dumping stocks before coronavirus crash (NYPost)

- German "news" blaming Russian bots for any and all alternative narratives (Tagesspiegel)

- Italian Istituto superiore di sanità published detailed figures on pandemic victims for the first time. Result: average age 80.3 years; only 1.1% had no previous illnesses, 75% had 2 or more.

- 99% of Those Who Died From Virus Had Other Illness, Italy Says (Bloomberg)

- Life, the Universe and Everything look closer from italy lockdown (Stop at Zona M)

- Iranian physicians urge regional leaders to take action to destroy US biological labs (PressTV)

- Die Ruhe vor dem perfekten Sturm (zeitpunkt)

- 'The virus has mutated very well': What Russian doctors say about the new infection (rbth)

- Dino Melaye, former senator from Nigeria, says tackling the coronavirus pandemic requires adhering to the instruction of God. (thecable.ng)

- The Kushner Family Could Be Getting Very Rich Thanks to the Coronavirus (Mintpress)

- Big Tech Firms are Using Automation to Censor News About the Coronavirus (Mintpress)

- Palantir & Clearview AI are among tech firms now in discussion with the US government about implementing widespread surveillance tools in response to the coronavirus (WSJ)

- Cuba and coronavirus: how Cuban biotech came to combat COVID-19 (LSE)

- South Korea, China, Japan to discuss COVID-19 response (CNA)

- Coronavirus: Xi Jinping calls leaders of France, Spain, Germany and Serbia with offers of support (SCMP)

COVID-19 - Evidence Over Hysteria (Aaron Ginn)

Coronavirus: The Beijing Quarantine Diaries (ARTE Documentary)

- https://helpwithcovid.com/

- Slavoj Zizek: Biggest threat Covid-19 epidemic poses is not our regression to survivalist violence, but BARBARISM with human face (RT)