tag > Economics

-

Put clean energy at the heart of stimulus plans to counter the coronavirus crisis (IEA)

The impact of the coronavirus around the world and the resulting turmoil in global markets are dominating global attention. As governments respond to these interlinked crises, they must not lose sight of a major challenge of our time: clean energy transitions.

-

China Intensifies Pursuit of 'De-Dollarization' With Digital Currency (2020, Newsmax)

Earlier this week, we covered the Federal Reserve's pursuit of a central bank digital currency (CBDC), based on the blockchain and dubbed "Fedcoin." It turns out that China is also pursuing its own version of a CBDC, and while the consequences of such a move for Americans would be very different than those of a Fedcoin, they have the potential to be even more dire. What's more, Beijing could be even closer to implementation than the Fed is.

Kung Hei Fat Choi: The Story of China’s Digital Yuan Project (2020, Medium)

It was on Thursday, July 11th 2019 that the former Peoples Bank of China governor Zhou Xiaochuan told an event in Beijing that Facebook’s Libra project was a ‘new risk’ that should motivate the government to ‘make good preparations and make the Chinese yuan a stronger currency’. This ‘new risk’ of Facebook’s Libra cryptocurrency appears to have acted as validation to the ongoing tinkering of a Chinese organisation tasked to investigate digital currencies.

-

Fear of Chinese takeover (Manager Magazine, DE only)

The profit sags, the low market value in the crisis invites to takeover. The Chinese major shareholders are already securing further share packages. Daimler CEO Ola Källenius has to fight for the independence of the German top brand.

-

World’s Richest Spend $1 Billion on ‘Bargains of a Lifetime’ (Bloomberg)

Some of the world’s wealthiest people spent more than $1 billion combined to boost their stakes in companies as markets around the world tumbled. Activist investor Carl Icahn increased his holdings in Hertz Global Holdings Inc. and Newell Brands Inc., according to regulatory filings. Warren Buffett’s holding company added shares of Delta Air Lines Inc., while the heirs of the Tetra Laval fortune plowed $317 million into International Flavors & Fragrances Inc. stock.

-

China locked in hybrid war with US - by Pepe Escobar (asiatimes)

Fallout from Covid-19 outbreak puts Beijing and Washington on a collision course. Additionally, along the hard slog down the road, with immense, inbuilt human and economic sacrifice, with or without a reboot of the world-system, a more pressing question remains: will imperial elites still choose to keep waging full-spectrum-dominance hybrid war against China?

US keeps public in dark over COVID-19 - by Yang Sheng and Cao Siqi (Global Time)

"US irresponsible, opaque, selfish, disorganized: analysts" - "Low transparency" - "Anarchy in the US" - "The world should be worried about the situation in the US."

Bolsonaro’s son enrages Beijing by blaming China for coronavirus crisis (theguardian)

“It’s China’s fault,” Bolsonaro claimed on Twitter, retweeting a message that said: “The blame for the global coronavirus pandemic has a name and surname: the Chinese Communist party.” Yang Wanming, Beijing’s top diplomat in Brazil, demanded an immediate retraction and apology for the “evil insult”, while his embassy accused Eduardo Bolsonaro of contracting “a mental virus” during a recent trip to the United States.

-

Climate change: The rich are to blame, international study finds (BBC)

The rich are primarily to blame for the global climate crisis, a study by the University of Leeds of 86 countries claims. The wealthiest tenth of people consume about 20 times more energy overall than the bottom ten, wherever they live. The gulf is greatest in transport, where the top tenth gobble 187 times more fuel than the poorest tenth, the research says. That’s because people on the lowest incomes can rarely afford to drive. The researchers found that the richer people became, the more energy they typically use. And it was replicated across all countries. And they warn that, unless there's a significant policy change, household energy consumption could double from 2011 levels by 2050. That's even if energy efficiency improves.

-

Employee At BIS' Basel Headquarters Infected With Coronavirus, Nine Others Exposed (FT)

The Bank for International Settlements has said a member of staff working at its headquarters in Basel, Switzerland, has tested positive for Covid-19. This afternoon the organisation reported that the individual had received medical treatment and was currently recovering at home. A further nine staff members who had been working in close proximity to the infected employees had been told to to work from home temporarily.

Italian army chief tested positive for coronavirus

Italian Chief of Army Staff Salvatore Farina has tested positive for the coronavirus and will remain quarantined in his home, with a replacement taking on his official duties. Farina announced he is self-isolating after not feeling well and then testing positive for the disease. He will be replaced in his role as chief of staff by General Federico Bonato, reported foreign media on Sunday.

-

Spanish king turns off the money tap to his father (alt)

Treasure of the Ancient Aztecs - Cortes and his Conquistadors plunder old Mexico

Felipe VI. ends the standing order to his father and predecessor Juan Carlos – and later renounces his legacy. The split is about Saudi millions and a dubious foundation.

Spanish king named on offshore fund linked to €65m Saudi 'gift' (telegraph)

-

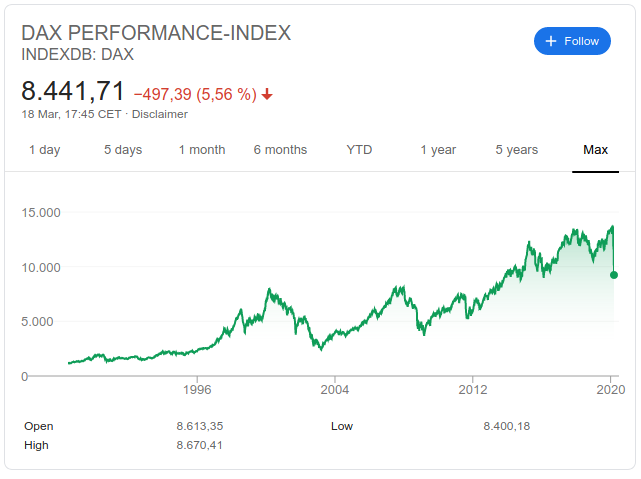

World’s Richest Nearing $1 Trillion Wipeout in 2020 Rout (bloomberg)

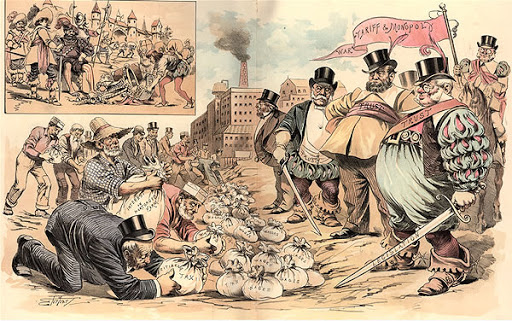

Illustration of 19 century Robber baron The world's 500 richest people lost a collective $331 billion on Thursday, according to Bloomberg. This is the biggest one day drop in the eight year history of Bloomberg's Billionaire's Index. The rich have lost 16% of their collective net worth since the beginning of the year. The slowdown has affected every industry from every geography.

Amazon CEO Jeff Bezos saw a $8.1 billion net worth drop in one day.

Fed to Inject $1.5 Trillion in Bid to Prevent ‘Unusual Disruptions’ in Markets (Wallstreet)

The Federal Reserve said it would make vast sums of short-term loans available on Wall Street and purchase Treasury securities in a coronavirus-related response aimed at preventing ominous trading conditions from creating a sharper economic contraction.

Putin Unleashes Strategic Hell on the U.S - by Tom Luongo (strategic culture)

"And with natural gas prices in Europe already in the gutter from oversupply and a mild winter, there isn’t much time or money lost in the end. Better to take the world oil price down well below U.S. production costs which ensure that Trump’s prized LNG stays off the European market as the myth of U.S. energy self-sufficiency vanishes in a puff of financial derivative smoke. Now Trump is facing a market meltdown well beyond his capacity to fathom or respond to. While Russia is in the unique position to drive costs down for so many of the people while riding out the shock to the global system with its savings."

-

How’s the economy? Fed increasingly turns to private data (AP)

#Comment: Predictably, computational economics is take centre stage, even in the brain-dead US public discourse. It is a key component towards turnkey "Computational Totalitarianism" - a concept which elites around the global are embracing as a new governance system.

-

London’s Trees Are Saving the City Billions (citylab)

#Comment: Why is the "saving money" perspective used so frequently when talking about nature ("nature based services" etc.)? Do these foolish people really not comprehended, that the notion that "Nature = Money" is at the very core of the problem they pretend to address?

#Regenerative #Urban #Infrastructure #Economics #ClimateChange

-

UK accounting regulator urges break up of Big Four firms KPMG, Deloitte, PwC, EY (The Guardian, 2018. Alt: The Irishtimes, 2019)

The UK audit regulator has outlined the plan to breakup the Big Four accounting firms in letters sent to the leaders of Deloitte, EY, KPMG and PwC. In what would amount to a far-reaching shake-up of the accounting industry, the Financial Reporting Council (FRC) issued guidelines for the big four to separate their audit and consulting operations in Britain.

-

Trend Forecaster Li Edelkoort: Coronavirus Offers Planet Chance For Restart

A security guard standing in an empty shopping mall in Beijing during the current coronavirus epidemic (Source: Kevin Frayer / Getty Images) The coronavirus outbreak, now declared a global pandemic, will eventually enable humanity to reset its values for the benefit of the planet, said top trend forecaster Li Edelkoort. In an interview with Dezeen, Edelkoort said that the coronavirus is now causing a “quarantine of consumption” that will usher in a “better system” for the environment and people. Her views are echoed by climate activists, who are saying that much of the response to the coronavirus has been quick, decisive and drastic, proving that world governments can and do have the capacity to bring about the necessary changes to fight the similarly urgent issue of the climate emergency.

-

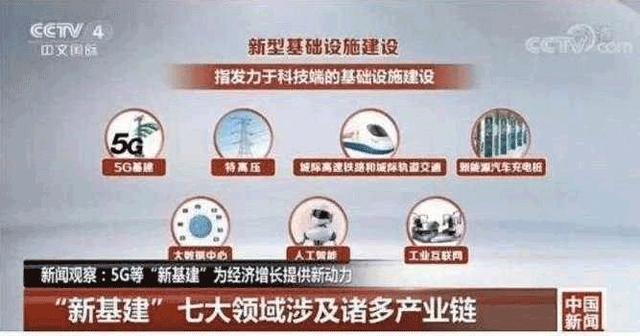

China, post-virus, will invest 34 trn yuan (equivalent to 34% of 2019 GDP) on "new infra" - 5G, UHV, intercity high-speed railway, new energy vehicles, big data centers, AI (via)

As of March 1, 13 provinces and municipalities have released a list of investment plans for key projects in 2020. The investment list includes a total of 10,326 projects, totaling 33.83 trillion yuan; another 8 provinces announced annual investment, totaling about 2.79 trillion yuan.

-

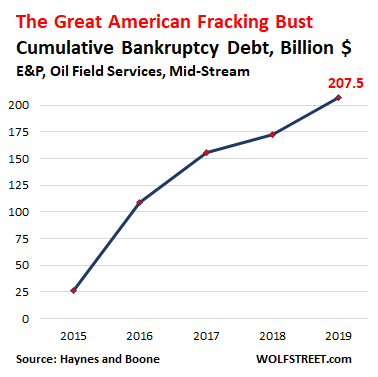

Is The U.S. Shale Boom Over? Four Major Threats To The Fracking Revolution (investors.com)

The U.S. is awash in cheap shale oil and gas. After decades of declining U.S. oil output, the fracking revolution unlocked vast oil and gas deposits and made America the world's No. 1 oil producer. Yet just as Americans have begun to take cheap energy for granted, the U.S. shale boom's next act looks uncertain. Political, financial, technological and geological pressures are closing in.

-

Airlines are burning thousands of gallons of fuel flying empty ‚ghost‘ planes so they can keep their flight slots during the coronavirus outbreak (Business Insider)

Global commercial airlines revenue per year: 754 billion U.S. dollars

Airlines are running empty ‚ghost‘ flights during the coronavirus due to European rules forcing operators to run their allocated flights or lose their slots. The rules are leading some airlines to waste thousands of gallons of jet fuel flying empty planes in and out of Europe. Demand for flights is collapsing worldwide with airline industry groups warning that the coronavirus crisis could wipe up to $113 billion off the value of the industry.

-

Thinking Like A Forest: A Design Agenda for Bioregions - talk by John Thackara (2015)

Regenerative City - talk by John Thackara at Tongji University (2018)

-

Studies Show Fracking Ban Would Wreak Havoc On US Economy

A new study from the American Petroleum Institute (API), with modeling data provided by the consulting firm OnLocation, details how a nationwide ban on hydraulic fracturing (colloquially known as “fracking”) could trigger a recession, would seriously damage U.S. economic and industrial output, considerably increase household energy costs, and make life much harder and costlier for American farmers. API argues that a fracking ban would lead to a cumulative loss in gross domestic product (GDP) of $7.1 trillion by 2030, including $1.2 trillion in 2022 alone.

-

The Rich Are Preparing for Coronavirus Differently (NYTimes) - "Concierge doctors, yachts, chartered planes and germ-free hideaways."