tag > Economics

-

Stanford research provides a snapshot of a new working-from-home economy

Stanford economist Nicholas Bloom discusses the societal impacts of a new “working-from-home economy” and the challenges posed by the massive transition to widespread remote work. "We see an incredible 42 percent of the U.S. labor force now working from home full-time."

-

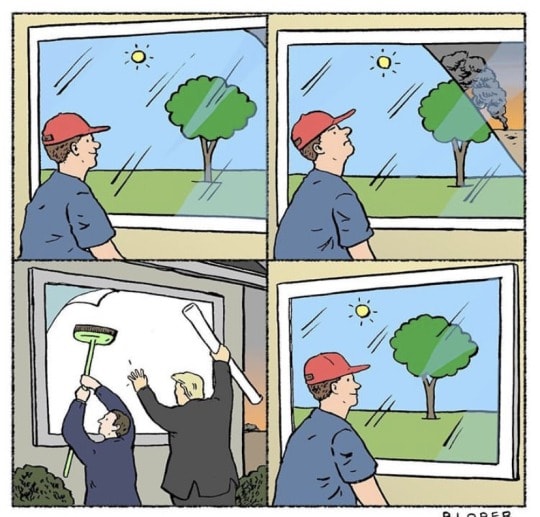

Dark Comedy: JPMorgan Drops Terms 'Master,' 'Slave' From Internal Tech Code and Materials

JPMorgan Chase is eliminating terms like "blacklist," "master" and "slave" from its internal technology materials and code as it seeks to address racism within the company, said two sources with knowledge of the move. Reuters reports:

#Comment: Just how many unaccounted trillions did the Bankers and their Spook & Billionaire friends extort in recent years? Luckily they can easily hide all - as public attention is for sale.

-

BUY or DIE! - the official slogan of humanity today.

-

China’s Digital Currency Could Challenge Bitcoin and Even the Dollar (Bloomberg)

Now the Chinese government has begun a pilot program for an official digital version of its currency—with the likelihood of a bigger test at the Beijing Winter Olympics in 2022. Some observers think the virtual yuan could bolster the government’s power over the country’s financial system and one day maybe even shift the global balance of economic influence.

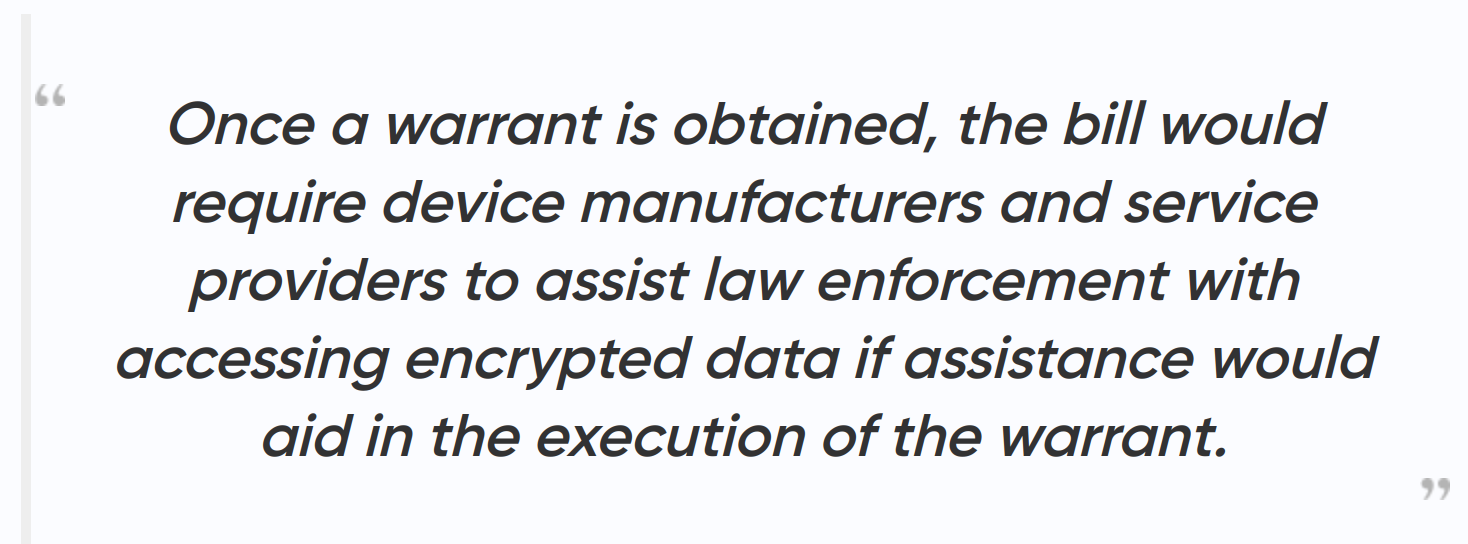

US Senators Introduce 'Lawful Access to Encrypted Data Act' — With Backdoor Mandate

US lawmakers have introduced the Lawful Access to Encrypted Data Act to ensure law enforcement can access encrypted information. This bill is “a full-frontal nuclear assault on encryption in the United States,” one expert says. It requires manufacturers of encrypted devices and operating systems to have the ability to decrypt data upon request, creating a backdoor requirement.

-

The Global Drug Meta-Group: Drugs, Managed Violence, and the Russian 9/11 - by Peter Dale Scott in Lobster Magazine

Narcotics are estimated to be worth between $500 billion and $1 trillion a year, an amount, according to UN Secretary General Kofi Annan in remarks to a United Nations General Assembly session in June 2003, that is greater than the global oil and gas industry, and twice as large as the overall automobile industry.

-

“Only the simplest & purest commodities are traded on markets, most value creation has nothing to do markets - it is largely generated by networks not markets. Thereby our value creation economy needs to be regulated to accelerate open networks not the illusion of markets.” (via)

-

Court in Switzerland: Companies must pay share of rent for employees working from home

Switzerland’s top court has ruled that employers are required to contribute to employees’ rent payments if they are expected to work from home.

-

China to account for 44% of global robotics market (including drones) by 2024

China is the largest robotics (including drones) market in the world. It is expected to account for 38% of the global total in 2020, with a total expenditure of US$47.38 billion according to IDC. By 2024, China will account for 44% of the global market. And, it will reach US$121.12 billion.

-

Germany’s shock court ruling against the ECB challenges the stability of the euro zone

The European Central Bank was quick to react, arguing that it follows decisions taken by the European Court of Justice — not national courts. However, the German ruling has sparked an unprecedented legal minefield and has led to new questions about the future of the euro zone.

Court rules that European Central Bank’s 2015 bond-buying program could be illegal.

...and what it means for the future of the EU

This is the most serious challenge to the EU's legal framework we have yet come across. In the UK, the courts operated under the assumption that conflicts between EU and UK law would always be settled on the basis that EU law is supreme.

German Judges Strike Back, Say ECB Isn't Master of Universe ...

-

Norway’s oil fund sells out of Glencore, Anglo American and RWE (FT)

Norway’s $1tn oil fund has sold out of some of the biggest names in commodities and utilities including Glencore, Anglo American and RWE after the world’s largest sovereign wealth fund decided they breached its guidelines on the use of coal. Exclusions by one of the world’s biggest shareholders — the fund owns on average almost 1.5 per cent of every listed company in the world — are often closely followed by other investors.

Norway sovereign wealth fund blacklists coal giants

In the short term, coal still supplies around a quarter of the world's primary energy and two-fifths of its electricity. However, the well-regarded fund’s decision is expected to have a more gradual effect on investor sentiment in the long-term.

Why Norway fund’s divestment from the oilsands could trigger a bigger fund exodus

'Pulling investments from the oil sands and claiming it's for climate change reasons is more about publicity than fact' — Cenovus Energy CEO

-

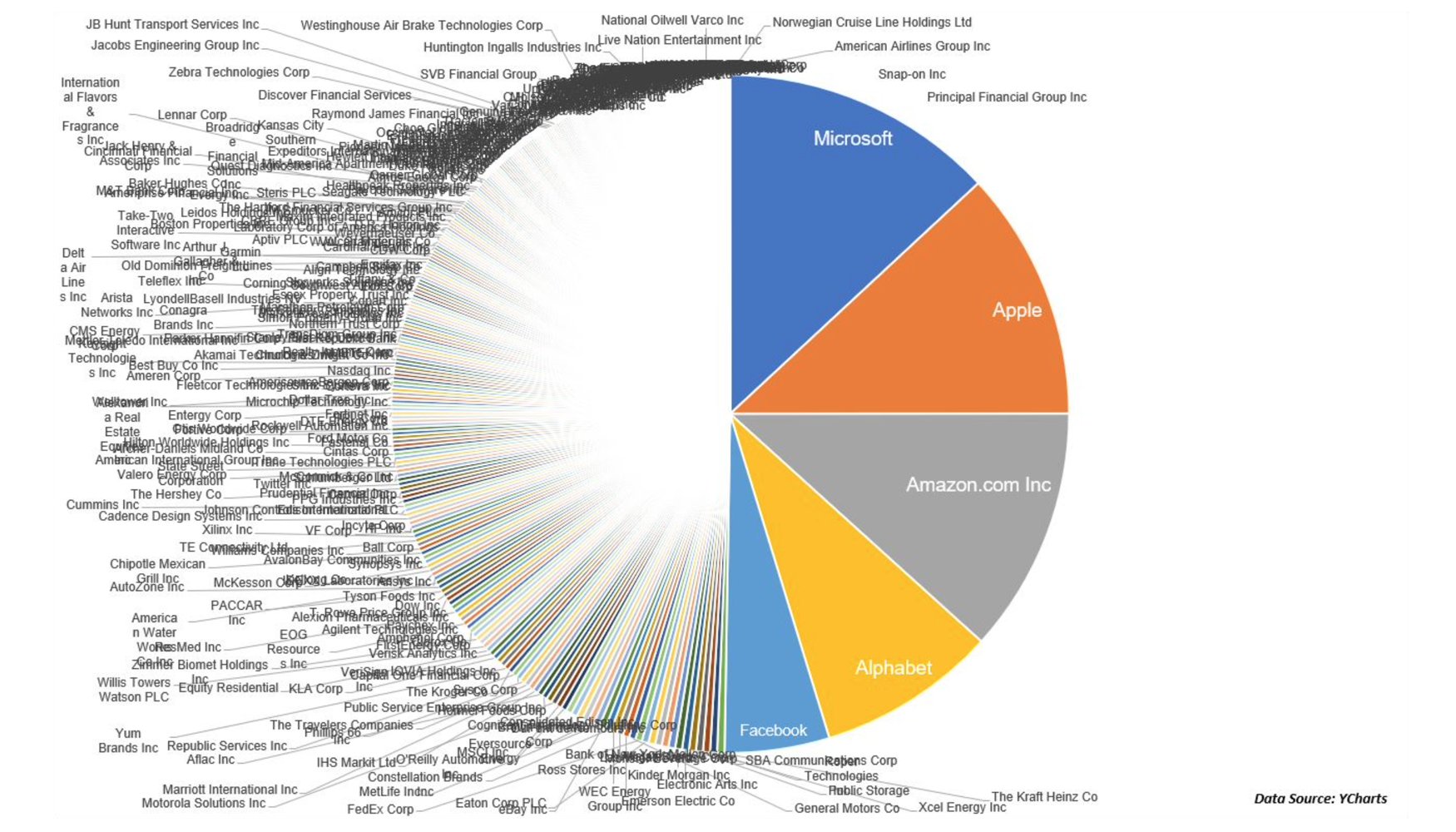

The market capitalization of these 5 companies are as large as the bottom 350 S&P 500 stocks combined, and almost as much as the entire rest of the developed market around the world.

-

Oil prices dip below zero as producers forced to pay to dispose of excess (Guardian)

US crude fell to negative value for first time in history as stockpiles overwhelmed storage facilities, before rebounding to just over $1 on Tuesday

When oil became waste: a week of turmoil for crude, and more pain to come (Reuters)

The magnitude of how damaged the energy industry is came into full view on April 20 when the benchmark price of U.S. oil futures, which had never dropped below $10 a barrel in its nearly 40-year history, plunged to a previously unthinkable minus $38 a barrel.

As US Shale Oil Plunges, Trump Admin Takes Aim at Venezuela (Mintpress)

A confluence of factors suggests that such a Panama-style invasion of Venezuela is not only a possibility, but increasingly likely.

US crude prices tumble as world’s largest oil ETF backs out (FT)

West Texas Intermediate drops more than 27% one week after sub-zero dive

Russia Steals Chinese Oil Market Share From Saudi Arabia (oilprice.com)

China imported 31 percent more oil from Russia last month while its intake of Saudi crude slipped by 1.8 percent compared to March 2019, Reuters reported, citing calculations based on official customs data. Overall crude oil imports rose by 4.5% on the year to 9.68 million bpd.

How much is a barrel of oil worth? (resilient.org)

If you were an oil futures trader wanting to unload a May 1 contract on Monday, April 20, a barrel of oil was worth $-37. That’s right, traders were, in effect, willing to pay someone—anyone—to take ownership of a commodity that powers modern industrial society, and has suddenly become too abundant.

The Next Chapter of the Oil Crisis: The Industry Shuts Down (Yahoo Finance)

Negative oil prices, ships dawdling at sea with unwanted cargoes, and traders getting creative about where to stash oil. The next chapter in the oil crisis is now inevitable: great swathes of the petroleum industry are about to start shutting down.

Oil Slides After Crude ETFs Move Into Later-Dated Contracts (Yahoo Finance)

Oil fell after the biggest oil ETF said it would sell out of its June WTI futures position as physical oil storage levels continue to balloon.

-

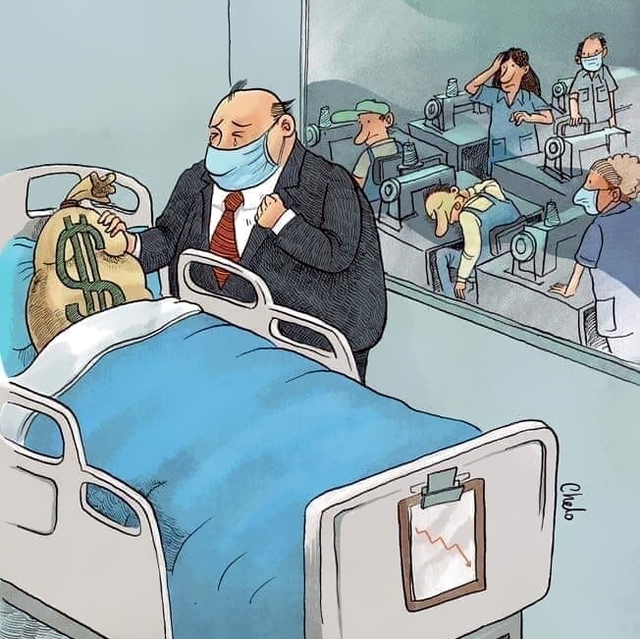

Europe’s new jobless urged to pick fruit amid huge farm labour shortage (eco-business)

Farmers fear crops could be left to rot as coronavirus lockdown leaves them short of hundreds of thousands of seasonal labourers.

World Food Programme warns at least 30 million people could die of starvation during pandemic (theglobeandmail)

The head of the World Food Programme, who recently recovered from COVID-19, says at least 30 million people could die of starvation if the UN agency doesn’t receive critical funding needed to feed the world’s most vulnerable during the global pandemic.

Russia Halts Wheat Exports, Deepening Fears of Global Food Shortages (Time)

For the first time in a decade, the world risks being cut off from Russian wheat at a time when some key buyers are rushing to import it.

Coronavirus pandemic 'will cause famine of biblical proportions' (The Guardian)

Governments must act now to stop 265 million starving, warns World Food Programme boss

Coronavirus threatens to trigger new round of global food crisis: China official (wkzo)

The global coronavirus pandemic threatens to cause a huge shock to international food trade and trigger a new food crisis, a top agriculture official in China said on Monday. "The fast spreading global epidemic has brought huge uncertainty on international agriculture trade and markets," said Yu Kangzhen, China's deputy agriculture minister.

Pandemic alters – and threatens – supply chain for end users (resource-recycling)

As the coronavirus impacts continue throughout the U.S., manufacturers are highlighting the importance of curbside recycling as a feedstock supply channel. Meanwhile, processors are seeing changes in demand for their material as consumer spending shifts.

-

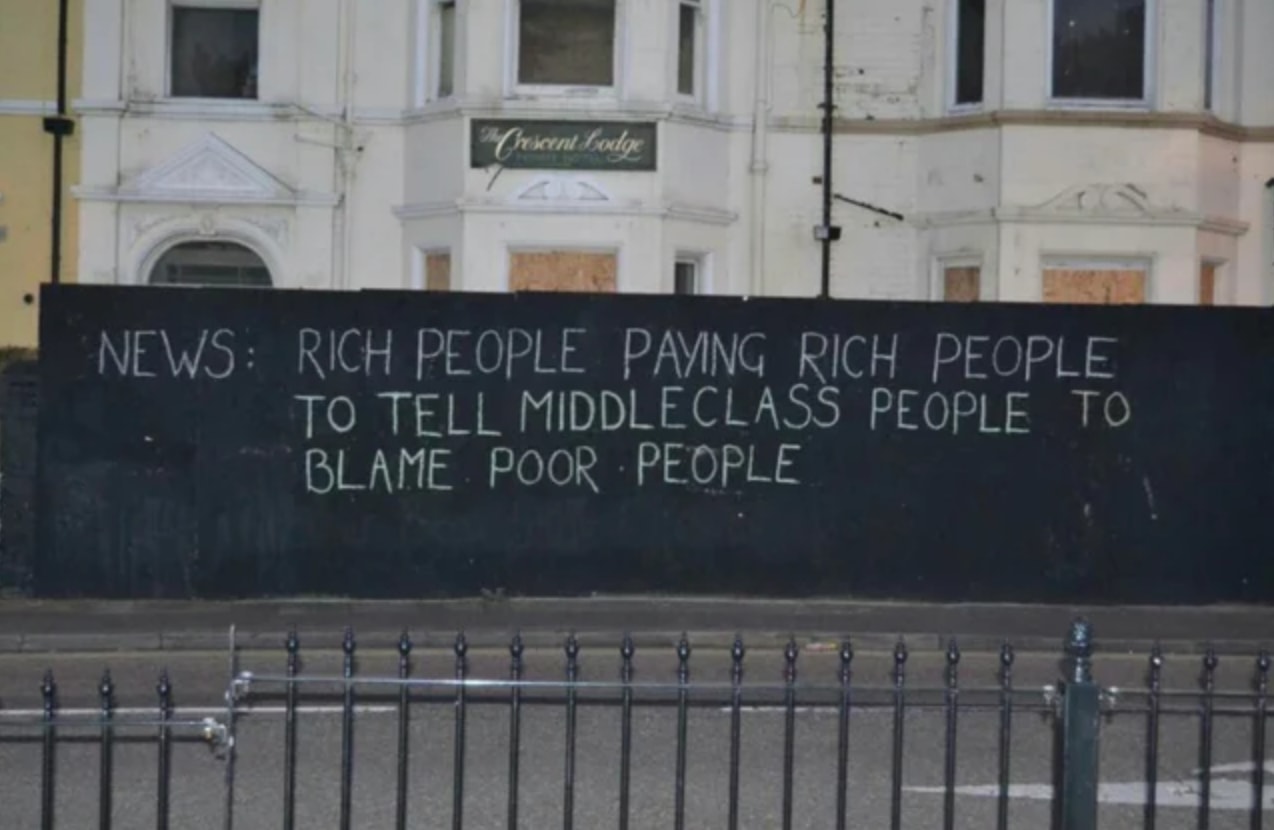

Climate change: The rich are to blame, international study finds (BBC)

The rich are primarily to blame for the global climate crisis, a study by the University of Leeds of 86 countries claims. The wealthiest tenth of people consume about 20 times more energy overall than the bottom ten, wherever they live. The gulf is greatest in transport, where the top tenth gobble 187 times more fuel than the poorest tenth, the research says. That’s because people on the lowest incomes can rarely afford to drive. The researchers found that the richer people became, the more energy they typically use. And it was replicated across all countries. And they warn that, unless there's a significant policy change, household energy consumption could double from 2011 levels by 2050. That's even if energy efficiency improves.